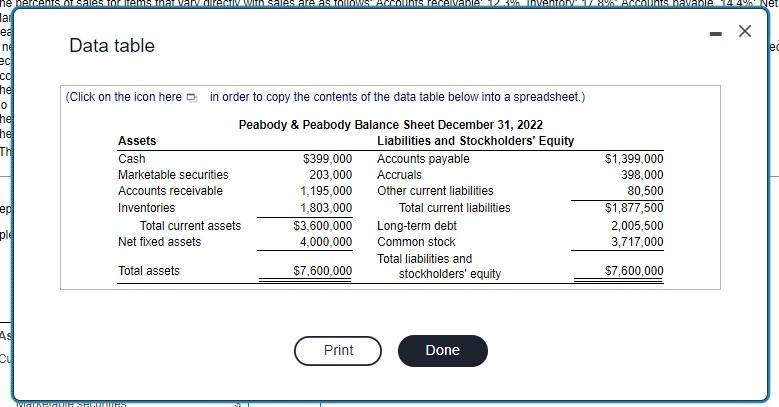

Question: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Pro forma balance sheet

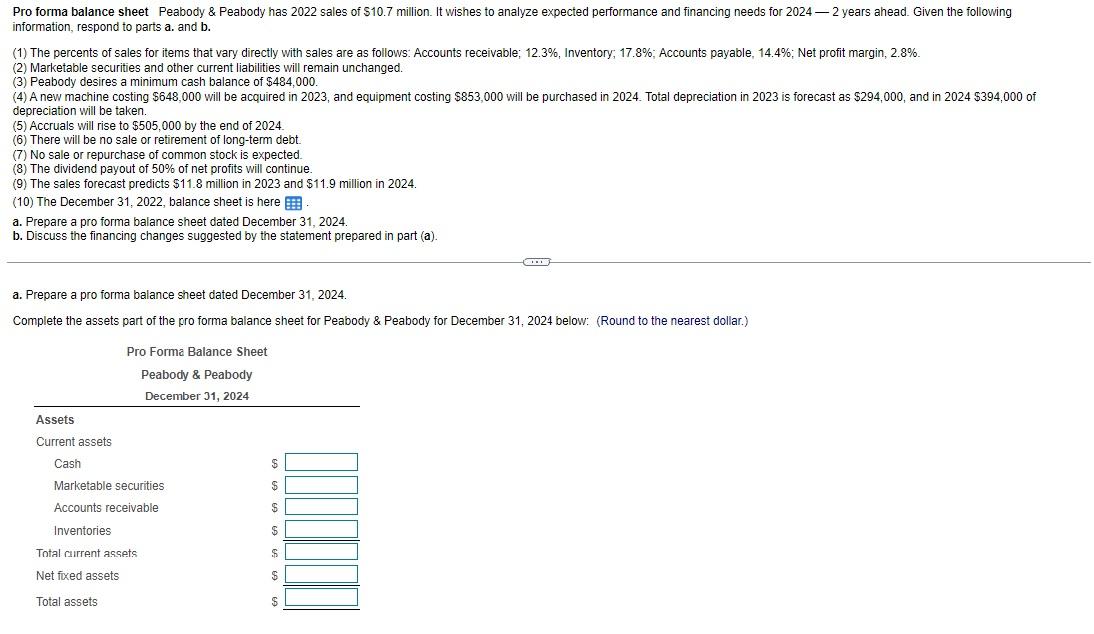

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Pro forma balance sheet Peabody \& Peabody has 2022 sales of $10.7 million. It wishes to analyze expected performance and financing needs for 2024 - 2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 12.3%, Inventory; 17.8%; Accounts payable, 14.4%; Net profit margin, 2.8%. (2) Marketable securities and other current liabilities will remain unchanged. (3) Peabody desires a minimum cash balance of $484,000. (4) A new machine costing $648,000 will be acquired in 2023 , and equipment costing $853,000 will be purchased in 2024 . Total depreciation in 2023 is forecast as $294,000, and in 2024$394,000 of depreciation will be taken. (5) Accruals will rise to $505,000 by the end of 2024. (6) There will be no sale or retirement of long-term debt. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits will continue. (9) The sales forecast predicts $11.8 million in 2023 and $11.9 million in 2024. (10) The December 31, 2022, balance sheet is here a. Prepare a pro forma balance sheet dated December 31,2024. b. Discuss the financing changes suggested by the statement prepared in part (a). a. Prepare a pro forma balance sheet dated December 31,2024. Complete the assets part of the pro forma balance sheet for Peabody \& Peabody for December 31,2024 below: (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts