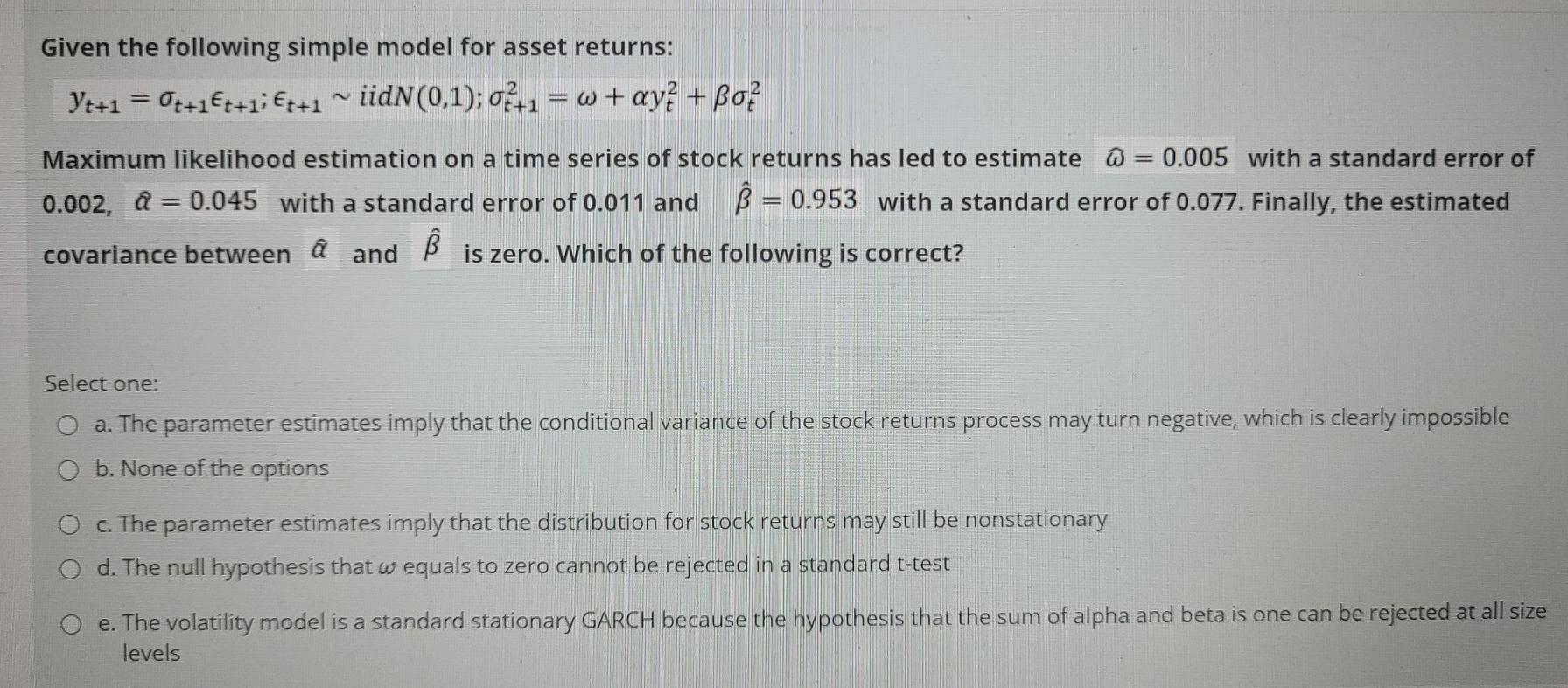

Question: Given the following simple model for asset returns: Yt+1 = 0++1t+1; +1 ~ iidN(0,1); 04+1 = w+ ay + Box Maximum likelihood estimation on a

Given the following simple model for asset returns: Yt+1 = 0++1t+1; +1 ~ iidN(0,1); 04+1 = w+ ay + Box Maximum likelihood estimation on a time series of stock returns has led to estimate @= 0.005 with a standard error of 0.002, a = 0.045 with a standard error of 0.011 and = 0.953 with a standard error of 0.077. Finally, the estimated covariance between a B and is zero. Which of the following is correct? Select one: O a. The parameter estimates imply that the conditional variance of the stock returns process may turn negative, which is clearly impossible O b. None of the options c. The parameter estimates imply that the distribution for stock returns may still be nonstationary O d. The null hypothesis that w equals to zero cannot be rejected in a standard t-test O e. The volatility model is a standard stationary GARCH because the hypothesis that the sum of alpha and beta is one can be rejected at all size levels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts