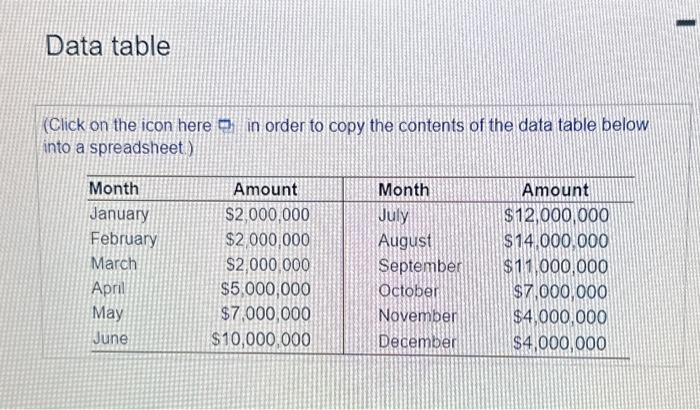

Question: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) a. Divide the firm's

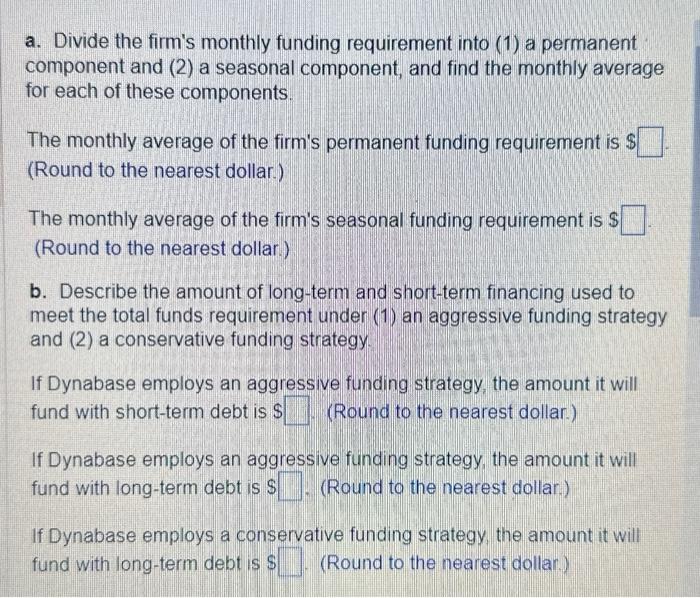

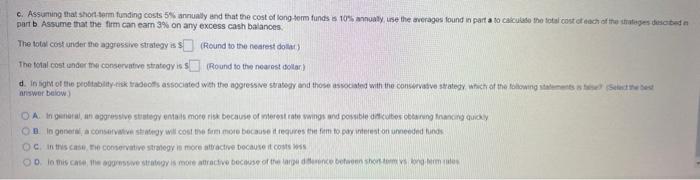

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) a. Divide the firm's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components. The monthly average of the firm's permanent funding requirement is $ (Round to the nearest dollar.) The monthly average of the firm's seasonal funding requirement is $ (Round to the nearest dollar.) b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative funding strategy. If Dynabase employs an aggressive funding strategy, the amount it will fund with short-term debt is $ (Round to the nearest dollar.) If Dynabase employs an aggressive funding strategy, the amount it will fund with long-term debt is $. (Round to the nearest dollar.) If Dynabase employs a conservative funding strategy, the amount it will fund with long-term debt is \$ (Round to the nearest dollar.) part b. Assume that the firm can earn 3% on any excess cash balances. The total costunder the aggressine strategy is ? (Round to the hearest dolat) The folal cost under the conservative strategy is s (Round to the nearest dollar) arswor beliow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts