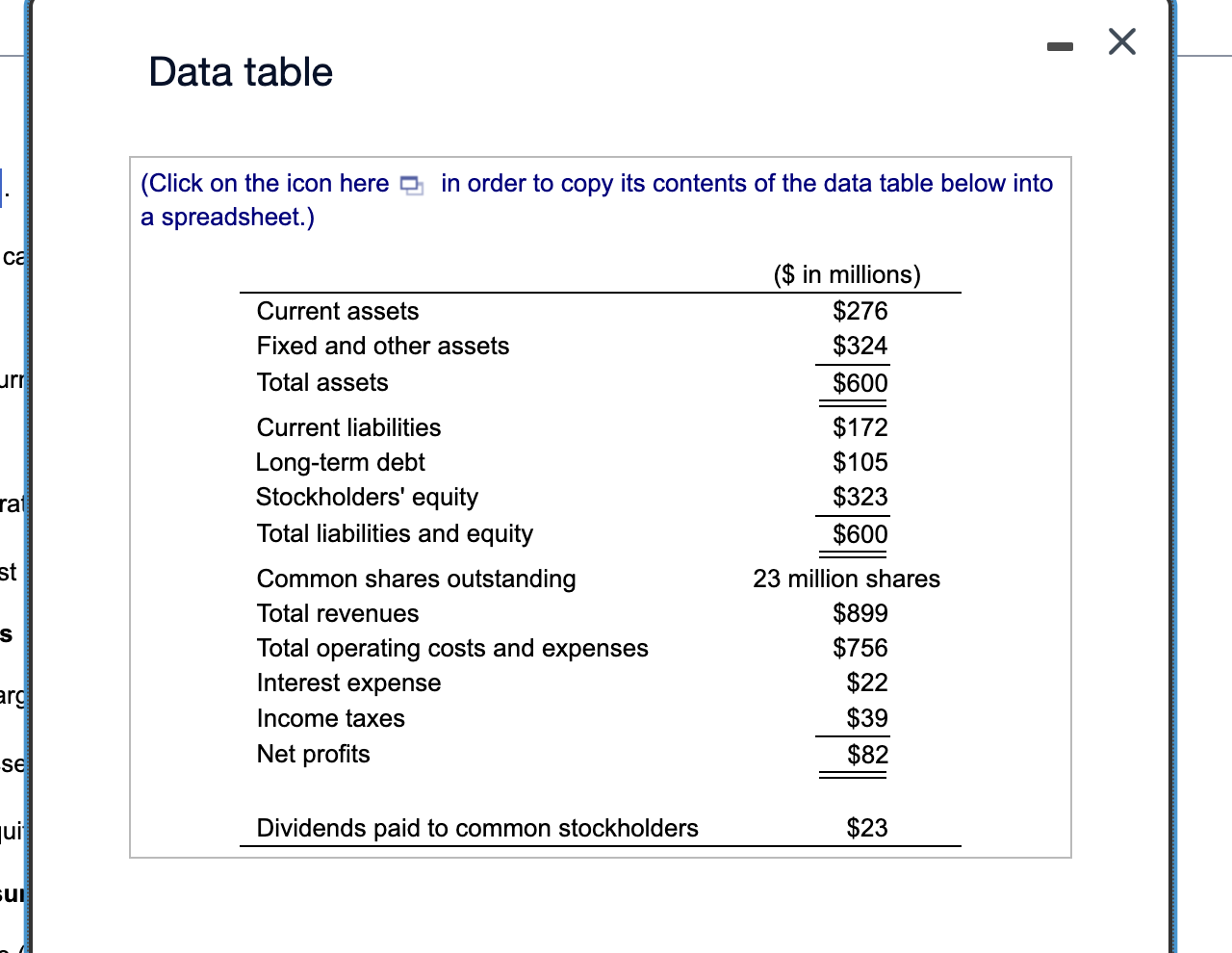

Question: Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) you can. (Note: Assume

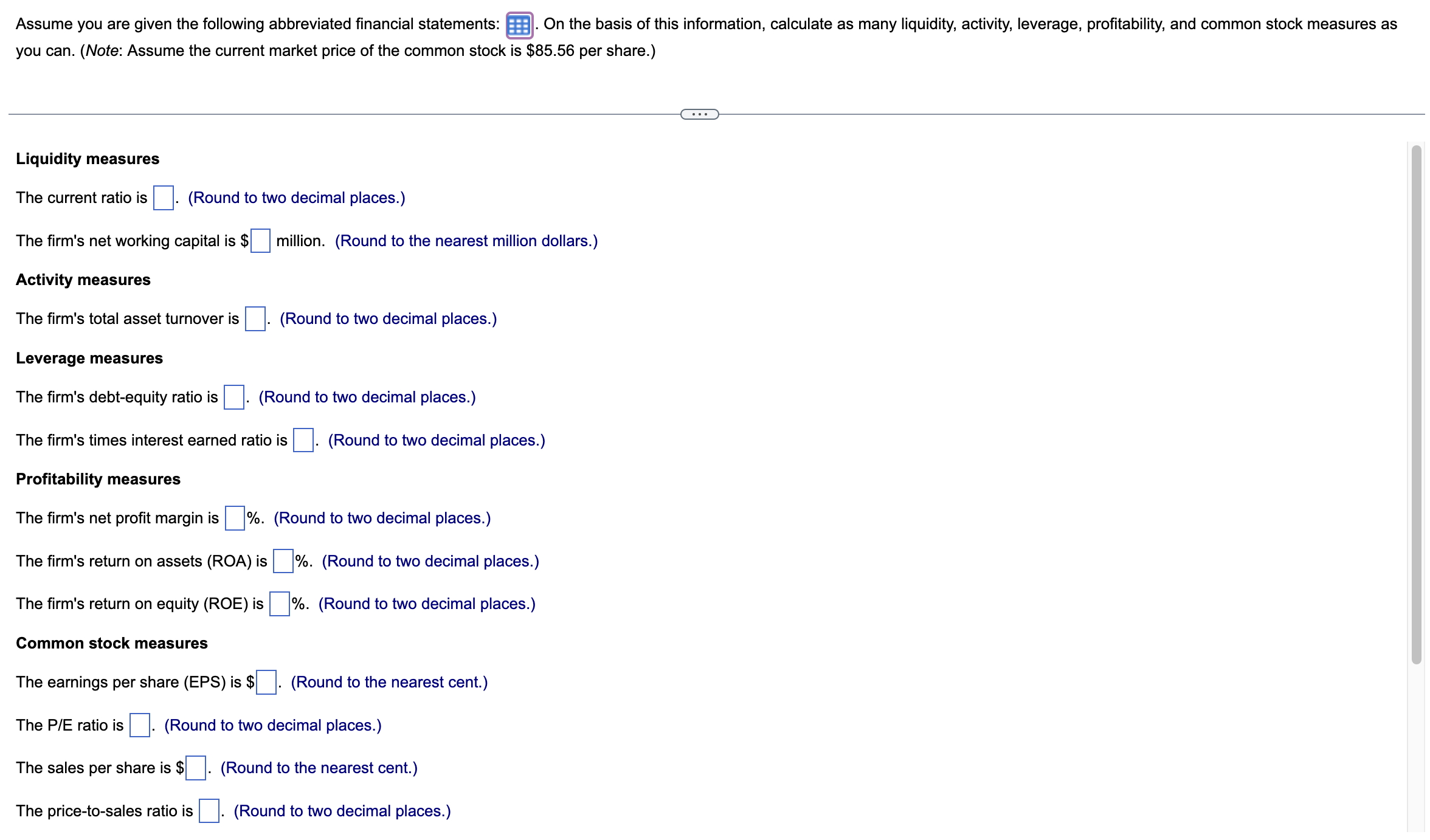

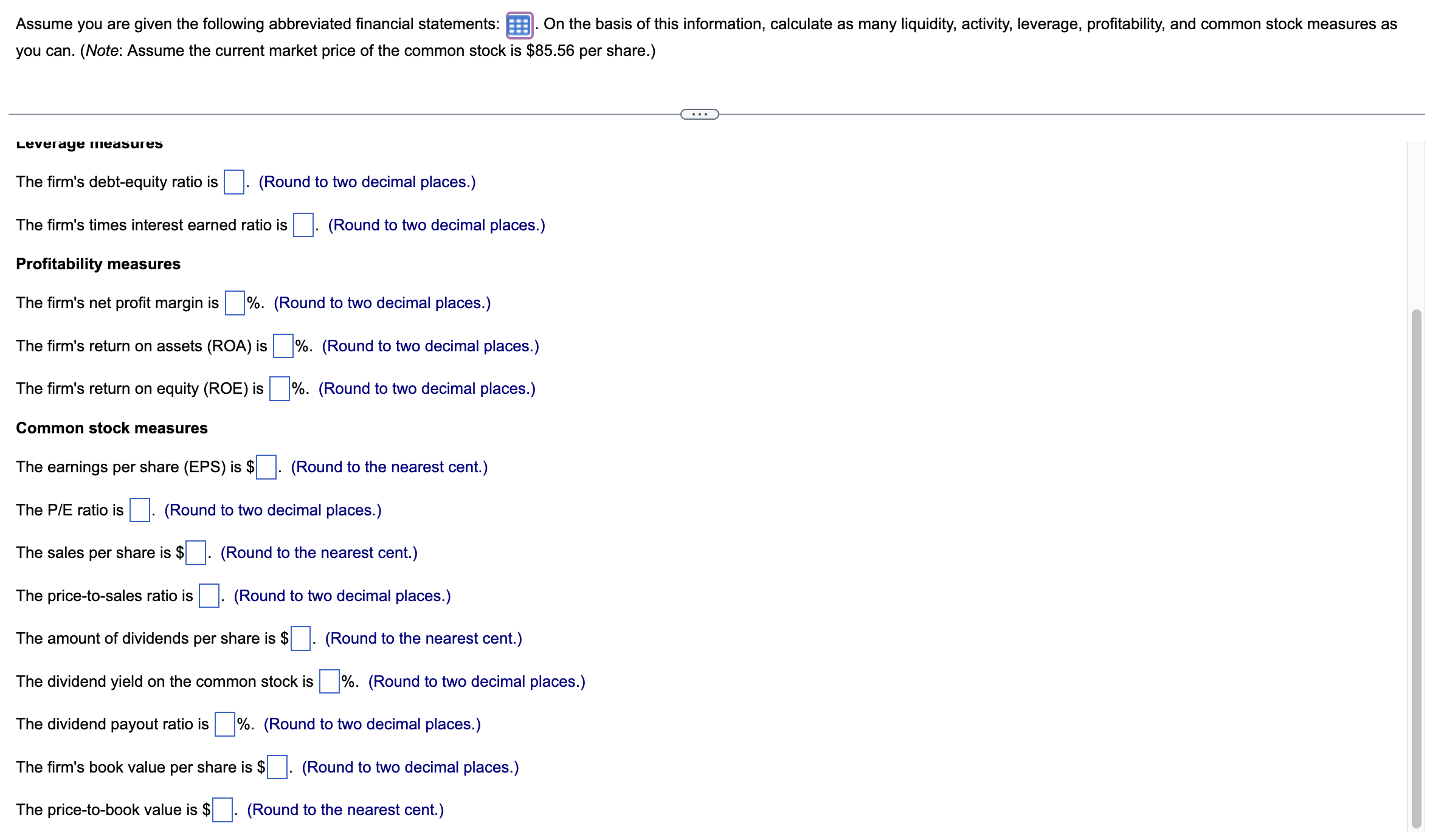

Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) you can. (Note: Assume the current market price of the common stock is $85.56 per share.) Liquidity measures The current ratio is . (Round to two decimal places.) The firm's net working capital is \$ million. (Round to the nearest million dollars.) Activity measures The firm's total asset turnover is (Round to two decimal places.) Leverage measures The firm's debt-equity ratio is . (Round to two decimal places.) The firm's times interest earned ratio is (Round to two decimal places.) Profitability measures The firm's net profit margin is \%. (Round to two decimal places.) The firm's return on assets (ROA) is \%. (Round to two decimal places.) The firm's return on equity (ROE) is \%. (Round to two decimal places.) Common stock measures The earnings per share (EPS) is $ (Round to the nearest cent.) The P/E ratio is (Round to two decimal places.) The sales per share is $ (Round to the nearest cent.) The price-to-sales ratio is (Round to two decimal places.) you can. (Note: Assume the current market price of the common stock is $85.56 per share.) Leverage mieasures The firm's debt-equity ratio is (Round to two decimal places.) The firm's times interest earned ratio is (Round to two decimal places.) Profitability measures The firm's net profit margin is \%. (Round to two decimal places.) The firm's return on assets (ROA) is \%. (Round to two decimal places.) The firm's return on equity (ROE) is \%. (Round to two decimal places.) Common stock measures The earnings per share (EPS) is $ (Round to the nearest cent.) The P/E ratio is (Round to two decimal places.) The sales per share is $ (Round to the nearest cent.) The price-to-sales ratio is (Round to two decimal places.) The amount of dividends per share is $. (Round to the nearest cent.) The dividend yield on the common stock is \%. (Round to two decimal places.) The dividend payout ratio is \%. (Round to two decimal places.) The firm's book value per share is $ (Round to two decimal places.) The price-to-book value is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts