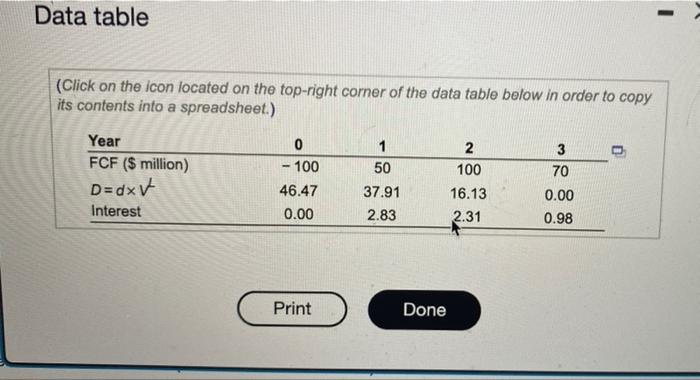

Question: Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.)

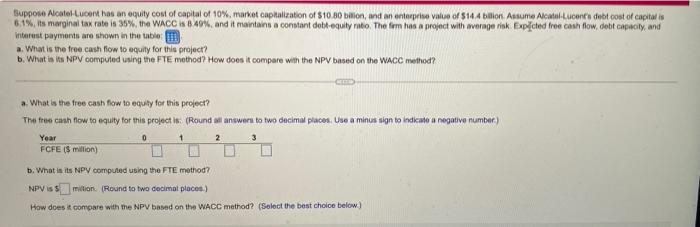

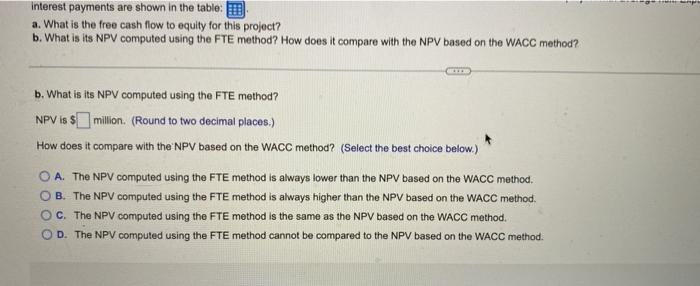

Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 0 -100 Year FCF (S million) D=dx V Interest 1 50 37.91 2.83 2 100 16.13 2.31 46.47 0.00 3 70 0.00 0.98 Print Done Suppose Alcatel-Lucer has an equity cost of capital of 10% market capitalization of $10.80 bilion, and an enterprise value of $144 bilion. Assume Alcatel-Lucent's debt cost of capitalis 6.1% its marginal tax rate in 35%, the WACC is 849%, and it maintains a constant dett-equity ratio The firm has a project with average risk Expected free cash flow, debt copoly, and interest payments are shown in the table a. What is the free cash flow to equity for this project? b. What is ta NPV computed using the FTE method? How does it compare with the NPV based on the WACC method? What is the free cash flow to equity for this project? Tha tres cash flow to equity for this project iw (Round all answer to two decimal places. Use a minus sign to Indikato a negative number) 0 1 2 3 Year FCFE (5 million) b. What is its NPV computed using the FTE method NPV is $ition (Round to two decimal places) How does it come with the NPV based on the WACC method? (Select the best choice below) interest payments are shown in the table: D a. What is the free cash flow to equity for this project? b. What is its NPV computed using the FTE method? How does it compare with the NPV based on the WACC method? b. What is its NPV computed using the FTE method? NPV is 5 million. (Round to two decimal places.) How does it compare with the NPV based on the WACC method? (Select the best choice below.) O A. The NPV computed using the FTE method is always lower than the NPV based on the WACC method. B. The NPV computed using the FTE method is always higher than the NPV based on the WACC method. OC. The NPV computed using the FTE method is the same as the NPV based on the WACC method. D. The NPV computed using the FTE method cannot be compared to the NPV based on the WACC method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts