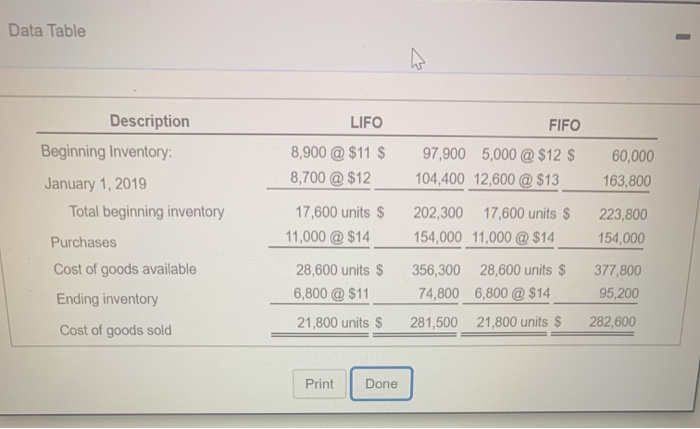

Question: Data Table LIFO 8,900 @ $11 $ 8,700 @ $12 FIFO 97,900 5,000 @ $12 $ 104,400 12,600 @ $13 60,000 163,800 Description Beginning Inventory:

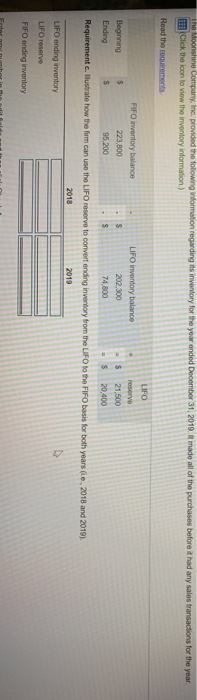

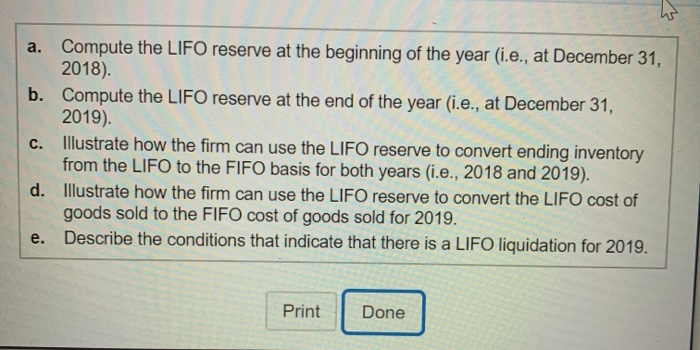

Data Table LIFO 8,900 @ $11 $ 8,700 @ $12 FIFO 97,900 5,000 @ $12 $ 104,400 12,600 @ $13 60,000 163,800 Description Beginning Inventory: January 1, 2019 Total beginning inventory Purchases Cost of goods available 17,600 units $ 11,000 @ $14 202,300 17,600 units $ 154,000 11,000 @ $14 223,800 154,000 Ending inventory 28,600 units $ 6,800 @$11 21,800 units $ 356,300 74,800 281,500 28,600 units $ 6,800 @$14 21,800 units $ 377,800 95,200 282,600 Cost of goods sold Print Done The Moonshine Company, Inc. provided the following information regarding its inventory for the year onded December 31, 2019. I made all of the purchases before it had any sales transactions for the year. 11. Click the icon to view the inventory information) Read the requirements LIFO Beginning Ending FIFO inventory balance 223,800 95,200 LIFO inventory balance 202,300 74,800 21,500 20,400 Requirement. Ilustrate how the firm can use the LIFO reserve to convertending inventory from the UFO to the FIFO basis for both years (ie, 2018 and 2019) LIFO ending inventory LIFO reserve FIFO ending inventory a. Compute the LIFO reserve at the beginning of the year (i.e., at December 31, 2018) b. Compute the LIFO reserve at the end of the year (i.e., at December 31, 2019). c. Illustrate how the firm can use the LIFO reserve to convert ending inventory from the LIFO to the FIFO basis for both years (i.e., 2018 and 2019). d. Illustrate how the firm can use the LIFO reserve to convert the LIFO cost of goods sold to the FIFO cost of goods sold for 2019. e. Describe the conditions that indicate that there is a LIFO liquidation for 2019. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts