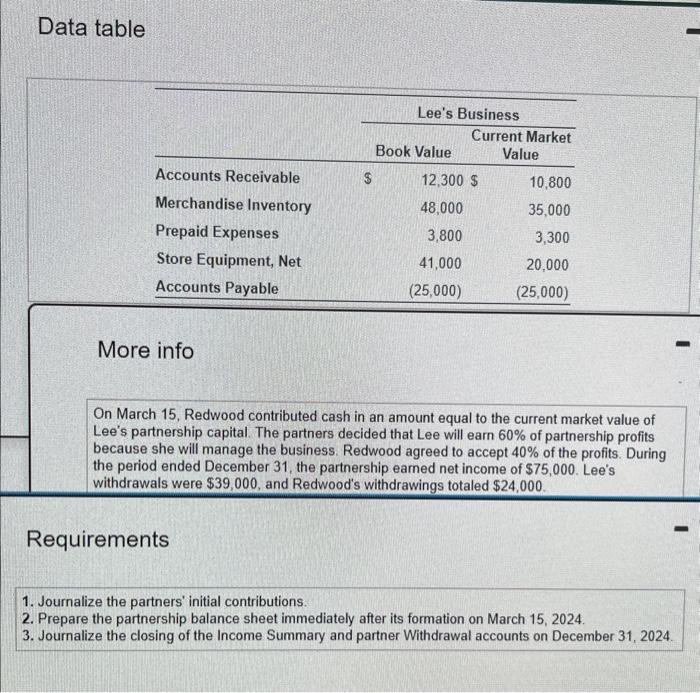

Question: Data table More info On March 15, Redwood contributed cash in an amount equal to the current market value of Lee's partnership capital. The partners

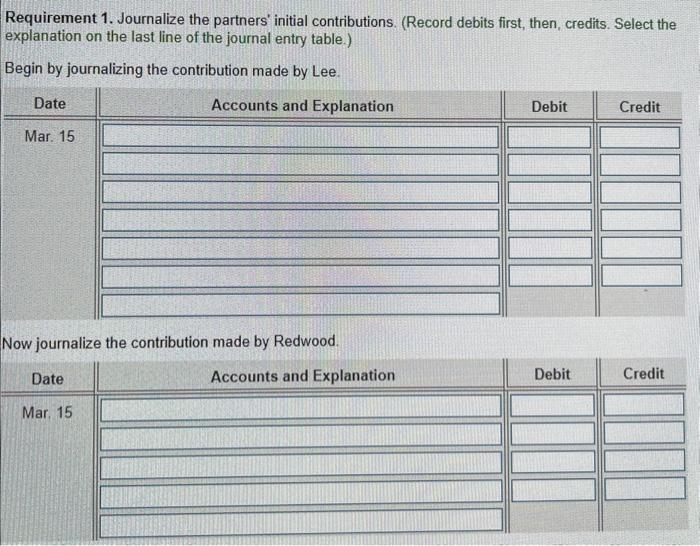

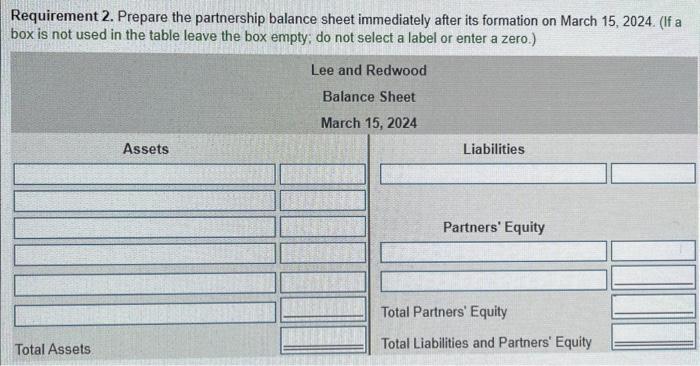

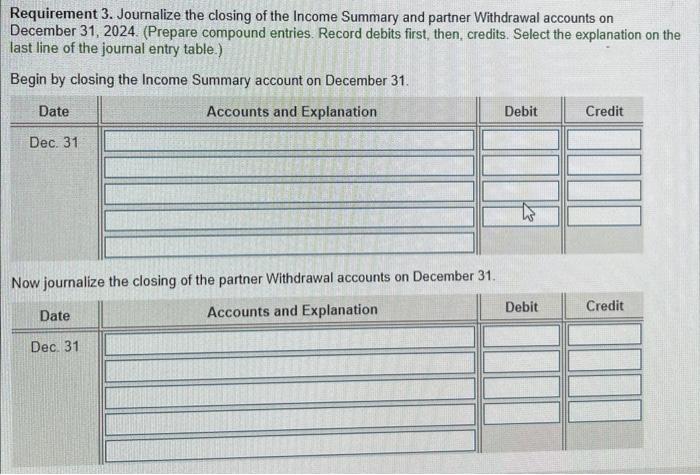

Data table More info On March 15, Redwood contributed cash in an amount equal to the current market value of Lee's partnership capital. The partners decided that Lee will earn 60% of partnership profits because she will manage the business. Redwood agreed to accept 40% of the profits. During the period ended December 31, the partnership earned net income of $75,000. Lee's withdrawals were $39,000, and Redwood's withdrawings totaled $24,000. Requirements 1. Journalize the partners' initial contributions. 2. Prepare the partnership balance sheet immediately after its formation on March 15, 2024. 3. Journalize the closing of the Income Summary and partner Withdrawal accounts on December 31, 2024. Requirement 1. Journalize the partners' initial contributions. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the contribution made by Lee. Now journalize the contribution made by Redwood. Requirement 2. Prepare the partnership balance sheet immediately after its formation on March 15, 2024. (If a box is not used in the table leave the box empty; do not select a label or enter a zero.) Requirement 3. Journalize the closing of the Income Summary and partner Withdrawal accounts on December 31, 2024. (Prepare compound entries. Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Begin by closing the Income Summary account on December 31. Now journalize the closing of the partner Withdrawal accounts on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts