Question: Please answer C! 31. Thought - Objective 2 - deductible pension v. taxable investment Requested: (a) Consider the problem above. Was her decision to invest

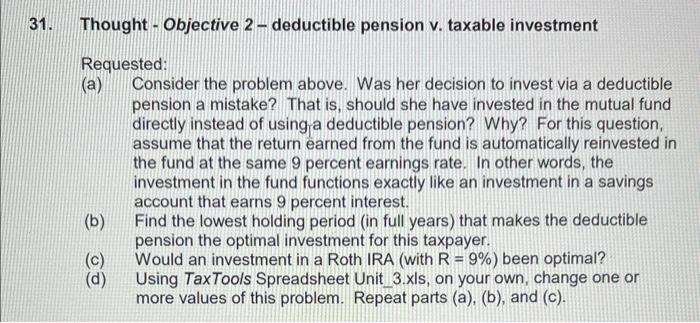

31. Thought - Objective 2 - deductible pension v. taxable investment Requested: (a) Consider the problem above. Was her decision to invest via a deductible pension a mistake? That is, should she have invested in the mutual fund directly instead of using a deductible pension? Why? For this question, assume that the return earned from the fund is automatically reinvested in the fund at the same 9 percent earnings rate. In other words, the investment in the fund functions exactly like an investment in a savings account that earns 9 percent interest. (b) Find the lowest holding period (in full years) that makes the deductible pension the optimal investment for this taxpayer. (c) Would an investment in a Roth IRA (with R=9% ) been optimal? (d) Using TaxTools Spreadsheet Unit_3.xls, on your own, change one or more values of this problem. Repeat parts (a), (b), and (c). 31. Thought - Objective 2 - deductible pension v. taxable investment Requested: (a) Consider the problem above. Was her decision to invest via a deductible pension a mistake? That is, should she have invested in the mutual fund directly instead of using a deductible pension? Why? For this question, assume that the return earned from the fund is automatically reinvested in the fund at the same 9 percent earnings rate. In other words, the investment in the fund functions exactly like an investment in a savings account that earns 9 percent interest. (b) Find the lowest holding period (in full years) that makes the deductible pension the optimal investment for this taxpayer. (c) Would an investment in a Roth IRA (with R=9% ) been optimal? (d) Using TaxTools Spreadsheet Unit_3.xls, on your own, change one or more values of this problem. Repeat parts (a), (b), and (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts