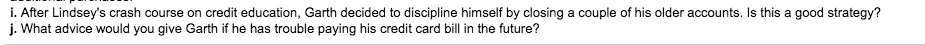

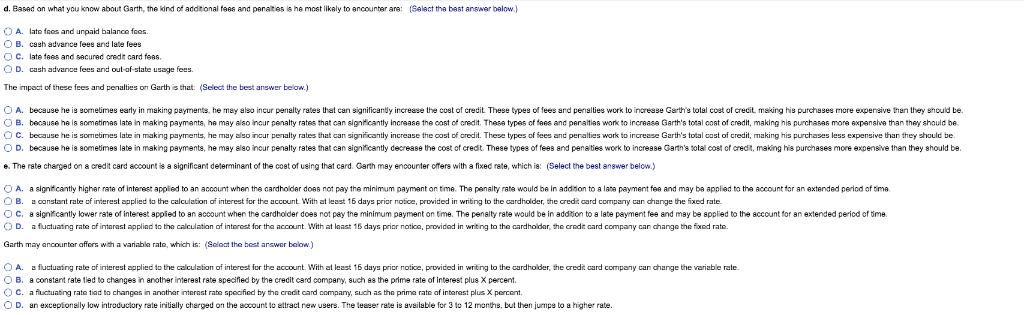

Question: Data Table Table 6.5 How Long It Can Take to Eliminate Credit Card Debt Each Month Pay This Percentage of the Initial Outstanding Balance 4%

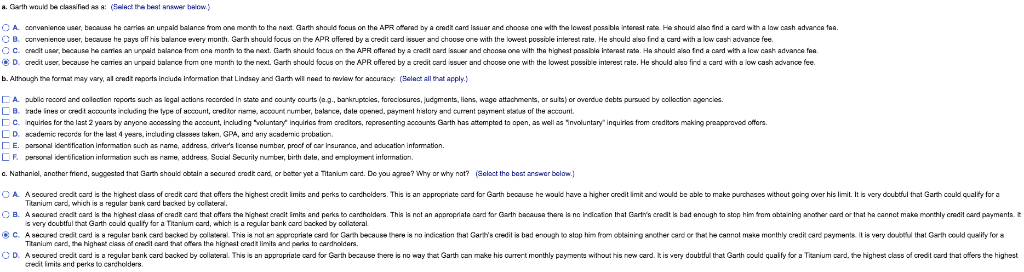

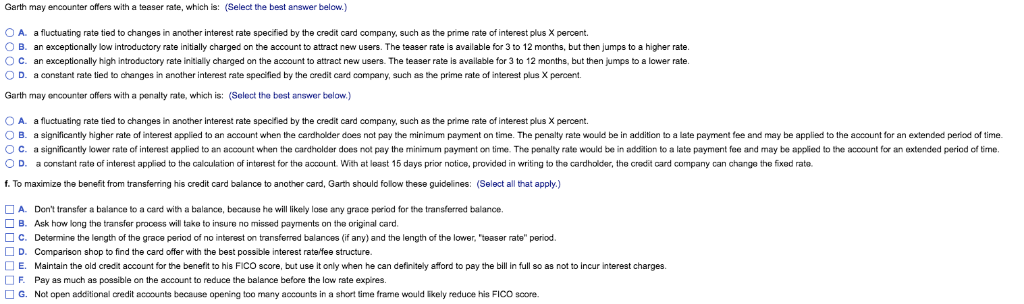

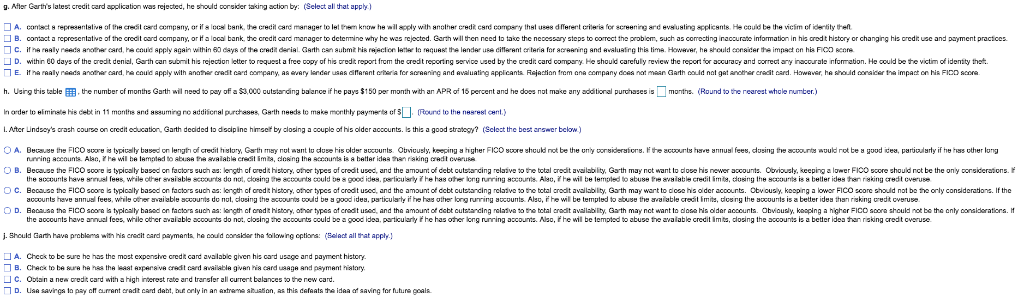

Data Table Table 6.5 How Long It Can Take to Eliminate Credit Card Debt Each Month Pay This Percentage of the Initial Outstanding Balance 4% 5% 10% 15% Annual Credit Card Interest Rate 9% 28 months 22 months 10 months 7 months 12% 29 months 22 months 11 months 7 months 30 months 23 months 11 months 7 months 18% 32 months 24 months 11 months 7 months Step 1: Find the row that corresponds to the percentage of your initial balance that you intend to pay off each month. If you have an initial outstanding balance of $5,000 and you intend to pay off $200 each month, you would be paying off $200/$5,000-4% each month. Thus, you should look in the 4% row Step 2: Find the column that corresponds to the annual percentage that you pay on your credit card. If your credit card charges 15%, look in the 15% column. Step 3: The intersection of the payments row and the credit card interest column shows how many months it would take to pay off your initial balance. If you pay off 4% of your initial balance each month and the card charges 15%, it would take 30 months to pay off your initial balance If you pay off only 2 percent of your initial balance per month, and the credit card interest rate is 15 percent, it would take 79 months or over 62 years before your credit card debt is paid. Keep in mind that this time frame assumes you don't charge anything more on your card. If you have a substantial balance and keep charging , you may never get out of debt. A aon arana usar, beausa ha nar as an unpaid balanse tam one mot ha naxt aan h shald focus on he APA B. conven ence user, because hu pay res u ance every month art, should ocus on the A R uffered by a credit o r erad by a cnadit cand uarand chaasa ona with thalo ast pasaba rterest rate He should also find a oard with a lov nash adv rca 1aa ssuer and choose ore with the o est posso e rie est rte. He should so rd card with low cas auvane fee. C. aa it Mr, because he carries up aid hal rca rem ona month ta ta next. Garth should acus a APR cffared by a cracit nar ss ar and chaa with tha h st paabla aras rata. should alsa fnd a da d th a low cash advan faa D. crecit user, because he cames ar rped balarce rom one mom to t e next art should focus o he APR c ered by a crecit card ss er and choose one with the lowest possibe ime es: ral. He should aiso ro a card with b. Althaugh tha format may vary, al cradt raparts incuda information that Lindsay and Gath w nead to vow for accuracy act all that apply) A p bi o record and colection reports such as legal actions recorded in state and oo n y oou s eq. bak ci s oreclosures udgments. lions, wage attach o ts, or suts or overdue debts pursued by ool ction o orcios o cash advance fee. C. C D E. L F nquines or the last 2 years by anyone accessi the account, ne d ng volunta in ines tom cr dtors, prosenting accouns Grth has a academic recur:8 for the lsst 4 years, maudrg classes tsker. GPA, ar,d emy 3der" c probation. personal dertification infommatan such as rame, address cm ers Icanse number, procr cor isuranca, and education infomation. pero ei e tification information such 5 ram" eddrees Soal security ber, birth daleand employ me t irrform ation m tod to open, as well as involuntary inqu rics from cred ors maki praap o od offers. c. Nathanial, another friend, suggested that Garth should obtain a secured credit card. cr boter yet a Titanum card. Do you agree? why or why not? cloct the best rswer below.] CA Aseoured credit card is the highest dass of aredit card that offers the highest crecit Imits and perks to carchclders. This is an appropriate card for Garth because he would have a higher credit imit and would be able to make purchases without goirg over his limit. It is wary doubtful that Garth could qualty for a Titarium card, which is a reguler bank card backed by cullatera. B. A saared aa t can s ta h hest da c radit cant that ffara tha highest c a t im its and par s to ca chcidam This s nat an aparopriata oard la arth bacauaa thana s nn n cason hat Garth's c a it s bad enough to step hin om a taning an tw o d or that ha aannat make month y cnadita d pa manta t s very doubtful that Garth could quaify 1ora Titanium card, which is regular bank card backed by Oollaaral A 8ec Thanium aard, Ngheat class of credit aard tat drers the highest (radt linita and peris tn ordnaldars. A secured aedt card s egular bank card backed by ool la crecit Emits and perks to carchclders C. d cre t cerd 8 eguler ber k card bec e by o tai i T 8 ol s a prop si , srd r art, be ause th 9 no dication that er s credit bad enou h to stop h fron ining a the care c hst he can ol ns monthly credit care payment* t is very ateful that a th could qualify fora aL This an appropnate a d erth because thre no way tot Garth can ma e his currert month y pay erns wit out his new a d tis very doubtful th Dould qua y or Titanium an e highest class o cre i car that ofers the highest r a d. Basad on what you know about Garth, the kind of addtional faes and panates is he most likaly to ancounbar are: (Salact tha best answer balow) O A. late faes and unpaid balance foos. O B. cagh advance fees and late fees C. late es and sacured oredt card feas. OD. cash advance fees and out-of-state usage fees. The impact of these fees and penalties on Garth isthat: Seledt the best answer below.) O A. because he is sometimes early in making payments, he may also incur penalty rates that can significandy increase the cost of credit These types of fees and penalties work to increase Garth's total cost of crecit, making his purchases more expensive than they should be. B. because he is sometimas late in making payments, he may elso inour penalty rates that can signficantly Increase the cost of cnedit. These types of saes and peraltias work to increase Garth's total cost of credit, making his purchases more expensive than they should be. C. because he is sometimes late in making payments,he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and peralties work to increase Garth's total cost of credit, making his purchases less expensive than they should be O D. because he is sometimes late in making payments, he msy also incur penslty ratee that can signiicantly decrease the cost of credt. These types of fees and penalties work to incresse Garth's total cost of credit, making his purchases more expensive than they should be e. The rste charged on a credit card account is a sigrificant determinant of the cost of using that card. Garth msy encounter offers with a fixed rate, which is: (Select the best answer below.) A. a sign cantly highar rate of interest appied to an account when the cardhoider doas not pay the minimum paymant on time. The penalty rate would be in addion to a lare payment fee and may ba applied to the account for an axtended period of time. B. oonstart rte of merest pied o he calculation o mt rest or the account with at leas 16 days pnor noice, pro nded in writing to the car holder, the credit card company can dar ge the fixed rate. C. a signicantly kower rate of interest appied to an account when the cardhoider does not pay the minimum payment on tme. The penalty rate would be in addition to a late payment fee and may be spplied to the sccount for an extended period of dme O D a ctuating rate of trast app iad the calculation o interest or the account With at laast 16 days pnor not oe pr idad in wrt g to the car holder he credit card company can danqa the fod rate. Garth may ancounter affers with a variabla rate, which is: (cloct the best arswer bolow.) OA. fluctuating rate of interest applied to the calculation of interest for the account. With at least 16 days prir notice, provided in writing to the cardholder, the credit card company can change the variable rate O B. a constant rate lied to changes in another interest rate specified by the credit card company, such 88 the prime rate of interest plus X percent. C. a fluctuating rate tiad to changes n anathar ntrast rate spea ed by tha creit card company, such as the prime rate af int arest plus X percent. O D. an excepsonally low introductory rate initially charged on the account to attract rew users. The teaser rate is availsble for 3 to 12 months, but then jumpe to a higher rate . After Garth's lates credit card application was rejected, he should orsider taking action by: (Select all that apphy A. contact 9 epresentst 8 of the creditcard com psny, arif * oc benk credit care manager to lei h credit ca c manager o determine why he wes e acted kno he ll a y w h 8nolher credi erd comp ry thst use8 dm rer t criteris fr screen ng arde susting appl 8nt8 He could be th , ic m c d tity then epresentative the cro c d company, o a loca bank a h w then need to tase the neces y steps o oor ec na problem, such as co ec ng naccura e m o mation in his aedt history or changrg his credit use and payment practce5. conac D. w hr 60 days o he credit denial arth can s nt his e econ i ter to request ree oopy of his edit re or from he redt reportng se oe used by the credr: card comp any He should carefuly eview the recon or accuracy nd Domec any nac rate n omation. He oould be e victim oident y the . Uairg this table E.the number of months Garth wil eod to pay off a $3,000 cutstanrding baiance if he pays $150 per manth with an APR of 15 percent and he dos nat make any aditional purchases is mantha. (Round to the rearest wthcle number. n order to elminate his cebt in 11 monte and assuming ro addiscnal purttases, Garth needs to make monthly paymerts ef 5 i. Ater Lindy's crah course on credit education, Garth dedided to dsipine himsef by closing a ccuple of his older acccunts. la this a good stratogy? (Eclect the bes: arswer below) ound to the negrest cant B. Becuse he FICO so e s typ.cal y basec on act s such as: er th c o dit history other pes o credt usec, and he amount of debt cu sar ng elaave to the total cre t av st V art may not want to ose his n wer a o r s nous y, keeping a lower F score should not be the ony ors eratons.f o the FIC soorotyp ca y based on factors such as ler gth c o edit history, oter t pcs o crodt use and he mount of dcbt cu sta ng Inve to the total crodit av lab 1 y Gath may wart to do e his oder accounts b ous y koa ong low or F O so e should not be the orly considera ons. If he D. Bea sa th FICO so ra t poly based on act s such as I h cf ondt his otor t pes of C dt use and the amount of debt cuts a lng n ate to the t tal aro t availab li Garth may nct want to dose N older ao cunts. Obviously ke p ng a h herFICO scora should not be the on y oor side at rs.H 0 ounts have nnus ees w le o er val ble scour s dc not. doar th. coor s oold bu good des, particular y if he has ther org rrr ng tocourts so, he wi be tempted to u se the rra atle crecit m its dvsng tre scou ts 15 better idea tar raking vedt cve use the accounts hav.mud ees, while other ava able accouts do not closing the accounts could De a good idea particula r he has oter long run ng accou ts. Also,f he wi be temo ed to abuse te avalable credit imts, dos ng the accoun s s a better idea an r king aedt cwe use j. Should Garth hava problema with Ma credit oard payments, he tould oorsider tha lalawing options: (Sal all that apply. : A. Check to be are he nas the most expensive credit card awalable given his card usage and paymert history. C. Ootan new redit card with a high merest rate ard trarsfer all curert balances he new card. D. usa savrga la pay m amant cradt card datt, but only in an antrame abatan,this dafaats idea atsaving for future goal Data Table Table 6.5 How Long It Can Take to Eliminate Credit Card Debt Each Month Pay This Percentage of the Initial Outstanding Balance 4% 5% 10% 15% Annual Credit Card Interest Rate 9% 28 months 22 months 10 months 7 months 12% 29 months 22 months 11 months 7 months 30 months 23 months 11 months 7 months 18% 32 months 24 months 11 months 7 months Step 1: Find the row that corresponds to the percentage of your initial balance that you intend to pay off each month. If you have an initial outstanding balance of $5,000 and you intend to pay off $200 each month, you would be paying off $200/$5,000-4% each month. Thus, you should look in the 4% row Step 2: Find the column that corresponds to the annual percentage that you pay on your credit card. If your credit card charges 15%, look in the 15% column. Step 3: The intersection of the payments row and the credit card interest column shows how many months it would take to pay off your initial balance. If you pay off 4% of your initial balance each month and the card charges 15%, it would take 30 months to pay off your initial balance If you pay off only 2 percent of your initial balance per month, and the credit card interest rate is 15 percent, it would take 79 months or over 62 years before your credit card debt is paid. Keep in mind that this time frame assumes you don't charge anything more on your card. If you have a substantial balance and keep charging , you may never get out of debt. A aon arana usar, beausa ha nar as an unpaid balanse tam one mot ha naxt aan h shald focus on he APA B. conven ence user, because hu pay res u ance every month art, should ocus on the A R uffered by a credit o r erad by a cnadit cand uarand chaasa ona with thalo ast pasaba rterest rate He should also find a oard with a lov nash adv rca 1aa ssuer and choose ore with the o est posso e rie est rte. He should so rd card with low cas auvane fee. C. aa it Mr, because he carries up aid hal rca rem ona month ta ta next. Garth should acus a APR cffared by a cracit nar ss ar and chaa with tha h st paabla aras rata. should alsa fnd a da d th a low cash advan faa D. crecit user, because he cames ar rped balarce rom one mom to t e next art should focus o he APR c ered by a crecit card ss er and choose one with the lowest possibe ime es: ral. He should aiso ro a card with b. Althaugh tha format may vary, al cradt raparts incuda information that Lindsay and Gath w nead to vow for accuracy act all that apply) A p bi o record and colection reports such as legal actions recorded in state and oo n y oou s eq. bak ci s oreclosures udgments. lions, wage attach o ts, or suts or overdue debts pursued by ool ction o orcios o cash advance fee. C. C D E. L F nquines or the last 2 years by anyone accessi the account, ne d ng volunta in ines tom cr dtors, prosenting accouns Grth has a academic recur:8 for the lsst 4 years, maudrg classes tsker. GPA, ar,d emy 3der" c probation. personal dertification infommatan such as rame, address cm ers Icanse number, procr cor isuranca, and education infomation. pero ei e tification information such 5 ram" eddrees Soal security ber, birth daleand employ me t irrform ation m tod to open, as well as involuntary inqu rics from cred ors maki praap o od offers. c. Nathanial, another friend, suggested that Garth should obtain a secured credit card. cr boter yet a Titanum card. Do you agree? why or why not? cloct the best rswer below.] CA Aseoured credit card is the highest dass of aredit card that offers the highest crecit Imits and perks to carchclders. This is an appropriate card for Garth because he would have a higher credit imit and would be able to make purchases without goirg over his limit. It is wary doubtful that Garth could qualty for a Titarium card, which is a reguler bank card backed by cullatera. B. A saared aa t can s ta h hest da c radit cant that ffara tha highest c a t im its and par s to ca chcidam This s nat an aparopriata oard la arth bacauaa thana s nn n cason hat Garth's c a it s bad enough to step hin om a taning an tw o d or that ha aannat make month y cnadita d pa manta t s very doubtful that Garth could quaify 1ora Titanium card, which is regular bank card backed by Oollaaral A 8ec Thanium aard, Ngheat class of credit aard tat drers the highest (radt linita and peris tn ordnaldars. A secured aedt card s egular bank card backed by ool la crecit Emits and perks to carchclders C. d cre t cerd 8 eguler ber k card bec e by o tai i T 8 ol s a prop si , srd r art, be ause th 9 no dication that er s credit bad enou h to stop h fron ining a the care c hst he can ol ns monthly credit care payment* t is very ateful that a th could qualify fora aL This an appropnate a d erth because thre no way tot Garth can ma e his currert month y pay erns wit out his new a d tis very doubtful th Dould qua y or Titanium an e highest class o cre i car that ofers the highest r a d. Basad on what you know about Garth, the kind of addtional faes and panates is he most likaly to ancounbar are: (Salact tha best answer balow) O A. late faes and unpaid balance foos. O B. cagh advance fees and late fees C. late es and sacured oredt card feas. OD. cash advance fees and out-of-state usage fees. The impact of these fees and penalties on Garth isthat: Seledt the best answer below.) O A. because he is sometimes early in making payments, he may also incur penalty rates that can significandy increase the cost of credit These types of fees and penalties work to increase Garth's total cost of crecit, making his purchases more expensive than they should be. B. because he is sometimas late in making payments, he may elso inour penalty rates that can signficantly Increase the cost of cnedit. These types of saes and peraltias work to increase Garth's total cost of credit, making his purchases more expensive than they should be. C. because he is sometimes late in making payments,he may also incur penalty rates that can significantly increase the cost of credit. These types of fees and peralties work to increase Garth's total cost of credit, making his purchases less expensive than they should be O D. because he is sometimes late in making payments, he msy also incur penslty ratee that can signiicantly decrease the cost of credt. These types of fees and penalties work to incresse Garth's total cost of credit, making his purchases more expensive than they should be e. The rste charged on a credit card account is a sigrificant determinant of the cost of using that card. Garth msy encounter offers with a fixed rate, which is: (Select the best answer below.) A. a sign cantly highar rate of interest appied to an account when the cardhoider doas not pay the minimum paymant on time. The penalty rate would be in addion to a lare payment fee and may ba applied to the account for an axtended period of time. B. oonstart rte of merest pied o he calculation o mt rest or the account with at leas 16 days pnor noice, pro nded in writing to the car holder, the credit card company can dar ge the fixed rate. C. a signicantly kower rate of interest appied to an account when the cardhoider does not pay the minimum payment on tme. The penalty rate would be in addition to a late payment fee and may be spplied to the sccount for an extended period of dme O D a ctuating rate of trast app iad the calculation o interest or the account With at laast 16 days pnor not oe pr idad in wrt g to the car holder he credit card company can danqa the fod rate. Garth may ancounter affers with a variabla rate, which is: (cloct the best arswer bolow.) OA. fluctuating rate of interest applied to the calculation of interest for the account. With at least 16 days prir notice, provided in writing to the cardholder, the credit card company can change the variable rate O B. a constant rate lied to changes in another interest rate specified by the credit card company, such 88 the prime rate of interest plus X percent. C. a fluctuating rate tiad to changes n anathar ntrast rate spea ed by tha creit card company, such as the prime rate af int arest plus X percent. O D. an excepsonally low introductory rate initially charged on the account to attract rew users. The teaser rate is availsble for 3 to 12 months, but then jumpe to a higher rate . After Garth's lates credit card application was rejected, he should orsider taking action by: (Select all that apphy A. contact 9 epresentst 8 of the creditcard com psny, arif * oc benk credit care manager to lei h credit ca c manager o determine why he wes e acted kno he ll a y w h 8nolher credi erd comp ry thst use8 dm rer t criteris fr screen ng arde susting appl 8nt8 He could be th , ic m c d tity then epresentative the cro c d company, o a loca bank a h w then need to tase the neces y steps o oor ec na problem, such as co ec ng naccura e m o mation in his aedt history or changrg his credit use and payment practce5. conac D. w hr 60 days o he credit denial arth can s nt his e econ i ter to request ree oopy of his edit re or from he redt reportng se oe used by the credr: card comp any He should carefuly eview the recon or accuracy nd Domec any nac rate n omation. He oould be e victim oident y the . Uairg this table E.the number of months Garth wil eod to pay off a $3,000 cutstanrding baiance if he pays $150 per manth with an APR of 15 percent and he dos nat make any aditional purchases is mantha. (Round to the rearest wthcle number. n order to elminate his cebt in 11 monte and assuming ro addiscnal purttases, Garth needs to make monthly paymerts ef 5 i. Ater Lindy's crah course on credit education, Garth dedided to dsipine himsef by closing a ccuple of his older acccunts. la this a good stratogy? (Eclect the bes: arswer below) ound to the negrest cant B. Becuse he FICO so e s typ.cal y basec on act s such as: er th c o dit history other pes o credt usec, and he amount of debt cu sar ng elaave to the total cre t av st V art may not want to ose his n wer a o r s nous y, keeping a lower F score should not be the ony ors eratons.f o the FIC soorotyp ca y based on factors such as ler gth c o edit history, oter t pcs o crodt use and he mount of dcbt cu sta ng Inve to the total crodit av lab 1 y Gath may wart to do e his oder accounts b ous y koa ong low or F O so e should not be the orly considera ons. If he D. Bea sa th FICO so ra t poly based on act s such as I h cf ondt his otor t pes of C dt use and the amount of debt cuts a lng n ate to the t tal aro t availab li Garth may nct want to dose N older ao cunts. Obviously ke p ng a h herFICO scora should not be the on y oor side at rs.H 0 ounts have nnus ees w le o er val ble scour s dc not. doar th. coor s oold bu good des, particular y if he has ther org rrr ng tocourts so, he wi be tempted to u se the rra atle crecit m its dvsng tre scou ts 15 better idea tar raking vedt cve use the accounts hav.mud ees, while other ava able accouts do not closing the accounts could De a good idea particula r he has oter long run ng accou ts. Also,f he wi be temo ed to abuse te avalable credit imts, dos ng the accoun s s a better idea an r king aedt cwe use j. Should Garth hava problema with Ma credit oard payments, he tould oorsider tha lalawing options: (Sal all that apply. : A. Check to be are he nas the most expensive credit card awalable given his card usage and paymert history. C. Ootan new redit card with a high merest rate ard trarsfer all curert balances he new card. D. usa savrga la pay m amant cradt card datt, but only in an antrame abatan,this dafaats idea atsaving for future goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts