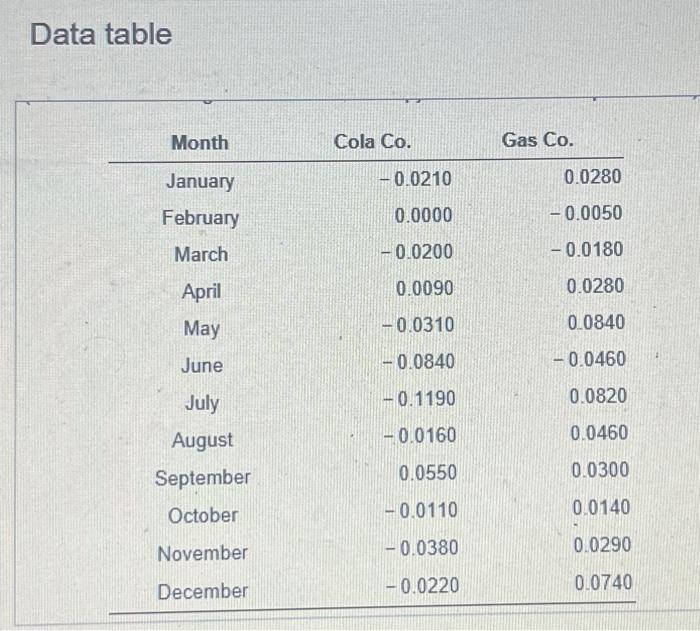

Question: Data table The following table contains monthly returns for Cola Co. and Gasi Co for 2013 (the returns are shown in decimal form, ie:0.035 is

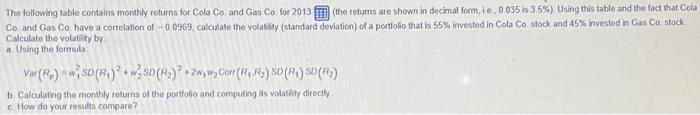

Data table The following table contains monthly returns for Cola Co. and Gasi Co for 2013 (the returns are shown in decimal form, ie:0.035 is 35% ) Using this table and the fact that Cola Co and Gas Co have a correlation of -00969 , colculate the volatifity (standard deviaticn) of a portfolio that is 55% invested in Cola Co stock and 45% invested in Gas Co stock Calculate the volatily by a. Using the formula: Var(R0)=w12SD(R1)2+w22SO(R2)2+2w1w2Cor(R1,R2)SO(R1)SD(R2) b. Calculating the monthly returns of the portfolio and computing as volatily directly c. How do your results compare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts