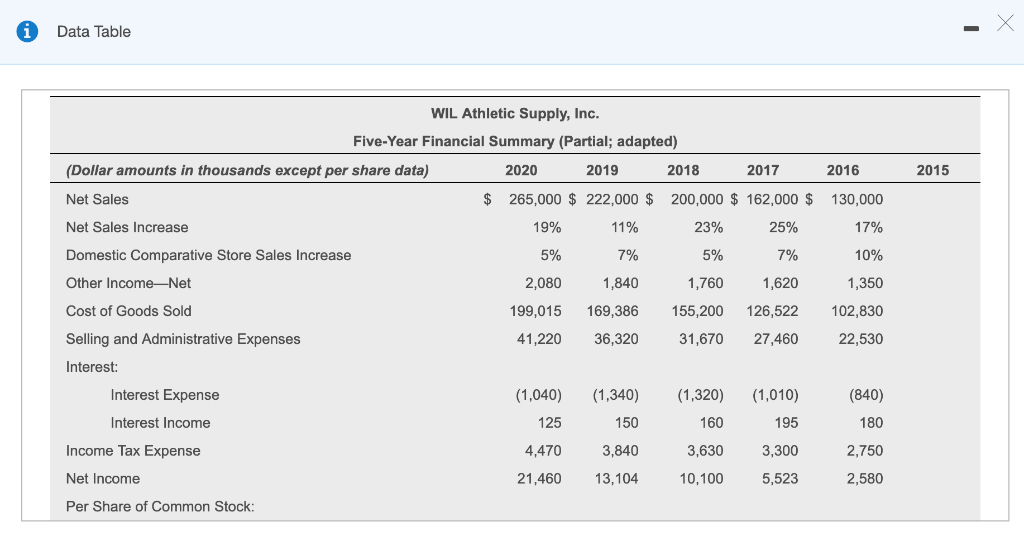

Question: Data Table WIL Athletic Supply, Inc Five-Year Financial Summary (Partial; adapted) 2020 2016 (Dollar amounts in thousands except per share data) Net Sales Net Sales

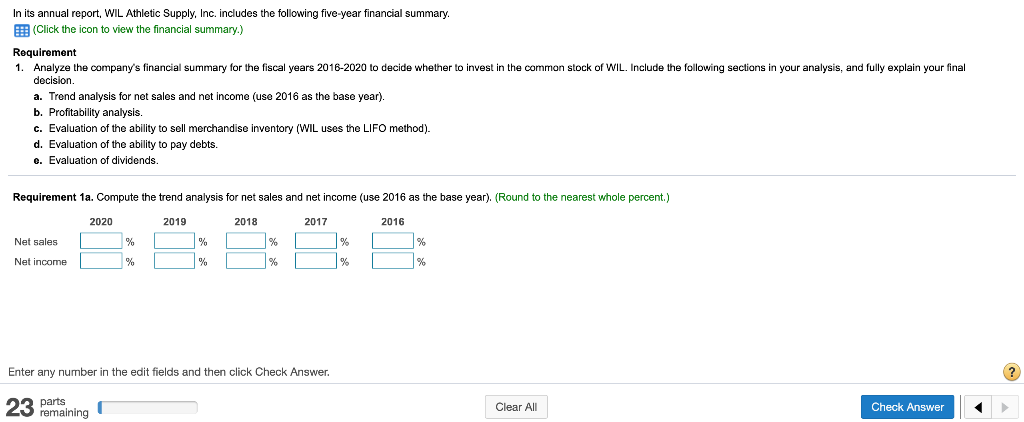

Data Table WIL Athletic Supply, Inc Five-Year Financial Summary (Partial; adapted) 2020 2016 (Dollar amounts in thousands except per share data) Net Sales Net Sales Increase Domestic Comparative Store Sales Increase Other Income-Net Cost of Goods Sold Selling and Administrative Expenses Interest: 2019 2018 2017 2015 $ 265,000 $ 222,000 $ 200,000 $ 162,000$ 130,000 17% 10% 1,350 99,015 169,386 155,200 126,522 102,830 22,530 19% 5% 2,080 11% 7% 1,840 25% 5% 1,760 25% 70h 1,620 41,220 36,320 31,670 27,460 (840) 180 2,750 2,580 Interest Expense (1,040) ,340 1,320) 1,010) 195 3,300 5,523 125 4,470 21,460 150 3,840 13,104 160 3,630 10,100 Interest Income Income Tax Expense Net Income Per Share of Common Stock In its annual report, WIL Athletic Supply, Inc. includes the following five-year financial summary (Click the icon to view the financial summary.) Requirement 1. Analyze the company's financial summary for the fiscal years 2016-2020 to decide whether to invest in the common stock of WIL. Include the following sections in your analysis, and fully explain your final decision. a. Trend analysis for net sales and net income (use 2016 as the base year) b. Profitability analysis. c. Evaluation of the ability to sell merchandise inventory (WIL uses the LIFO method) d. Evaluation of the ability to pay debts e. Evaluation of dividends. Requirement 1a. Compute the trend analysis for net sales and net income (use 2016 as the base year). Round to the nearest whole percent.) 2020 2019 2018 2017 2016 Net income | |% | % )% 1% Enter any number in the edit fields and then click Check Answer. parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts