Question: . Data to help with Calculations: Part A: Imputation Credits (IC) Pania Biddle owns 500 shares in Mainfreight Ltd (MFT), a company listed on the

.

.

Data to help with Calculations:

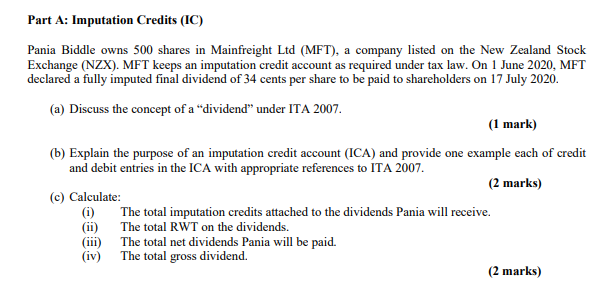

Part A: Imputation Credits (IC) Pania Biddle owns 500 shares in Mainfreight Ltd (MFT), a company listed on the New Zealand Stock Exchange (NZX). MFT keeps an imputation credit account as required under tax law. On 1 June 2020, MFT declared a fully imputed final dividend of 34 cents per share to be paid to shareholders on 17 July 2020. (a) Discuss the concept of a "dividend" under ITA 2007. (1 mark) (b) Explain the purpose of an imputation credit account (ICA) and provide one example each of credit and debit entries in the ICA with appropriate references to ITA 2007. (2 marks) (c) Calculate: (1) The total imputation credits attached to the dividends Pania will receive. (ii) The total RWT on the dividends. The total net dividends Pania will be paid. (iv) The total gross dividend. (2 marks) Pania Biddle owns 500 shares in Mainfreight Ltd (MFT), a company listed on the New Zealand Stock Exchange (NZX). MFT keeps an imputation credit account as required under tax law. On 1 June 2020, MFT declared a fully imputed final dividend of 34 cents per share to be paid to shareholders on 17 July 2020. Part A: Imputation Credits (IC) Pania Biddle owns 500 shares in Mainfreight Ltd (MFT), a company listed on the New Zealand Stock Exchange (NZX). MFT keeps an imputation credit account as required under tax law. On 1 June 2020, MFT declared a fully imputed final dividend of 34 cents per share to be paid to shareholders on 17 July 2020. (a) Discuss the concept of a "dividend" under ITA 2007. (1 mark) (b) Explain the purpose of an imputation credit account (ICA) and provide one example each of credit and debit entries in the ICA with appropriate references to ITA 2007. (2 marks) (c) Calculate: (1) The total imputation credits attached to the dividends Pania will receive. (ii) The total RWT on the dividends. The total net dividends Pania will be paid. (iv) The total gross dividend. (2 marks) Pania Biddle owns 500 shares in Mainfreight Ltd (MFT), a company listed on the New Zealand Stock Exchange (NZX). MFT keeps an imputation credit account as required under tax law. On 1 June 2020, MFT declared a fully imputed final dividend of 34 cents per share to be paid to shareholders on 17 July 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts