Question: Data Window Help cel File Edit View Insert Format Tools AutoSave OFF BES U- Insert Draw Page Layout Formulas Data Arial v 10 AA E

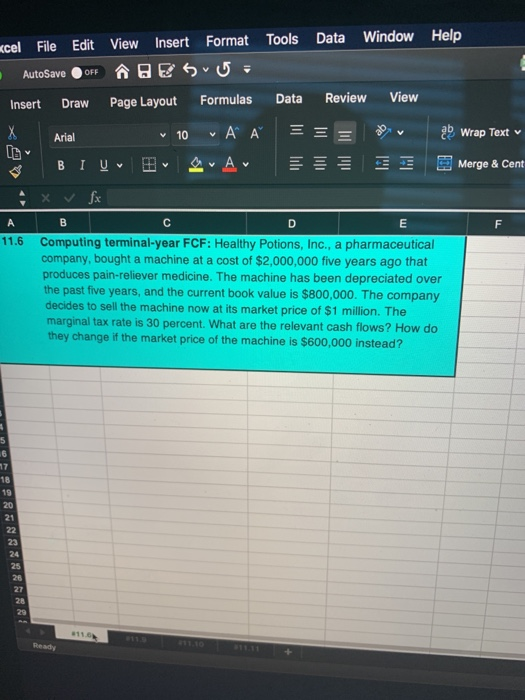

Data Window Help cel File Edit View Insert Format Tools AutoSave OFF BES U- Insert Draw Page Layout Formulas Data Arial v 10 AA E BIUR A Review View X E ab Wrap Texty Merge & Cent 11.6 Computing terminal-year FCF: Healthy Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2,000,000 five years ago that prouuces pain-reliever medicine. The machine has been depreciated over the past five years, and the current book value is $800,000. The company decides to sell the machine now at its market price of $1 million. The marginal tax rate is 30 percent. What are the relevant cash flows? How do they change if the market price of the machine is $600,000 instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts