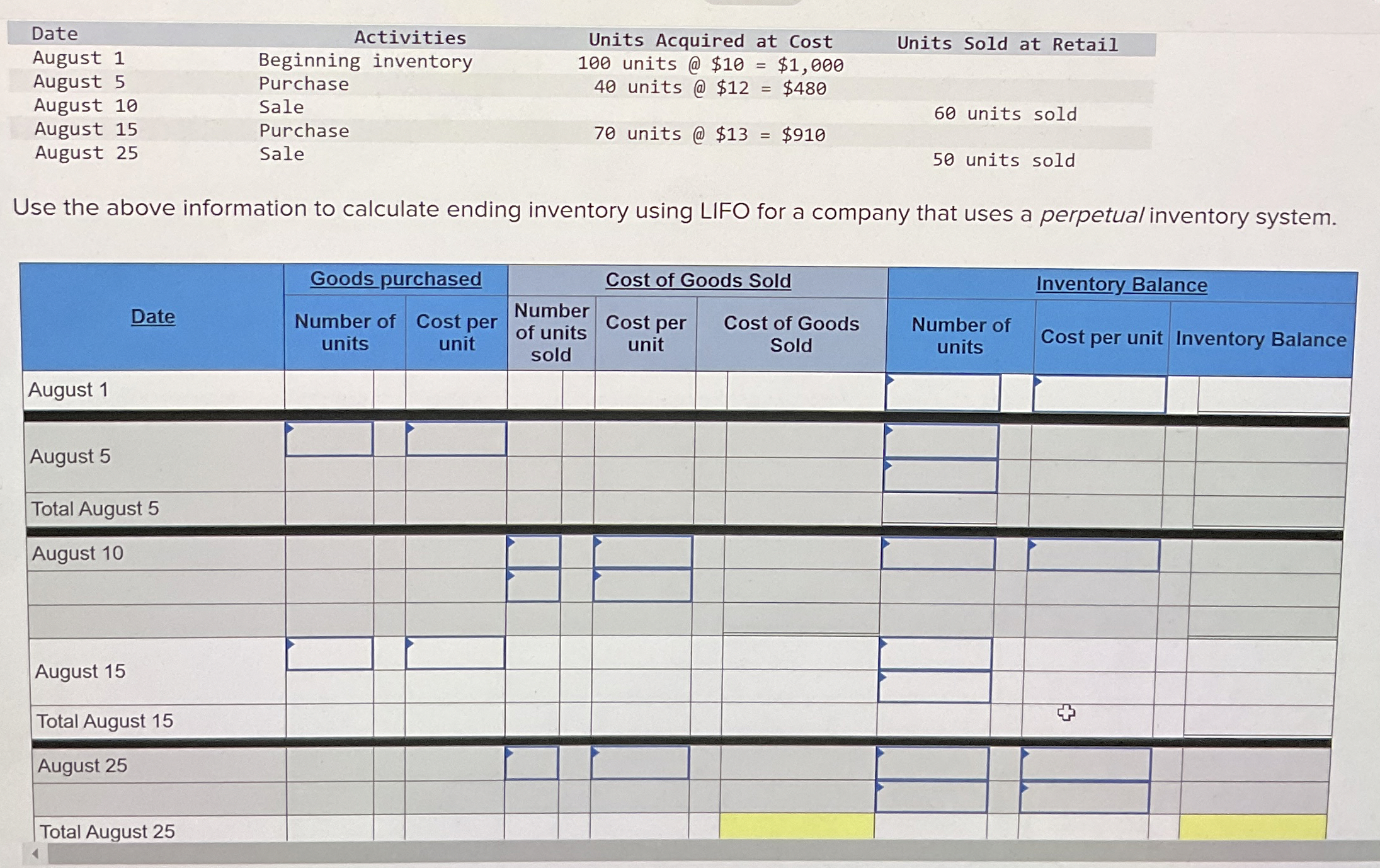

Question: Date August 1 August 5 August 1 0 August 1 5 August 2 5 Activities Beginning inventory Purchase Sale Purchase Sale Units Acquired at Cost

Date

August

August

August

August

August

Activities

Beginning inventory

Purchase

Sale

Purchase

Sale

Units Acquired at Cost

units @ $ $

units @ $ $

units @ $ $

Units Sold at Retail

units sold

units sold

Use the above information to calculate ending inventory using LIFO for a company that uses a perpetual inventory system.

tableGoods purchased,Cost of Goods Sold,Inventory BalanceDateNumber of units,Cost per unit,Number of units sold,Cost per unit,Cost of Goods Sold,Number of units,Cost per unit,Inventory BalanceAugust AuguAuguTotal August August August Total August August Total August

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock