Question: Date: Cells highlighted in green contain a drop-down list; select the appropriate response fror h the calculation for combined total net income (loss) is correct,

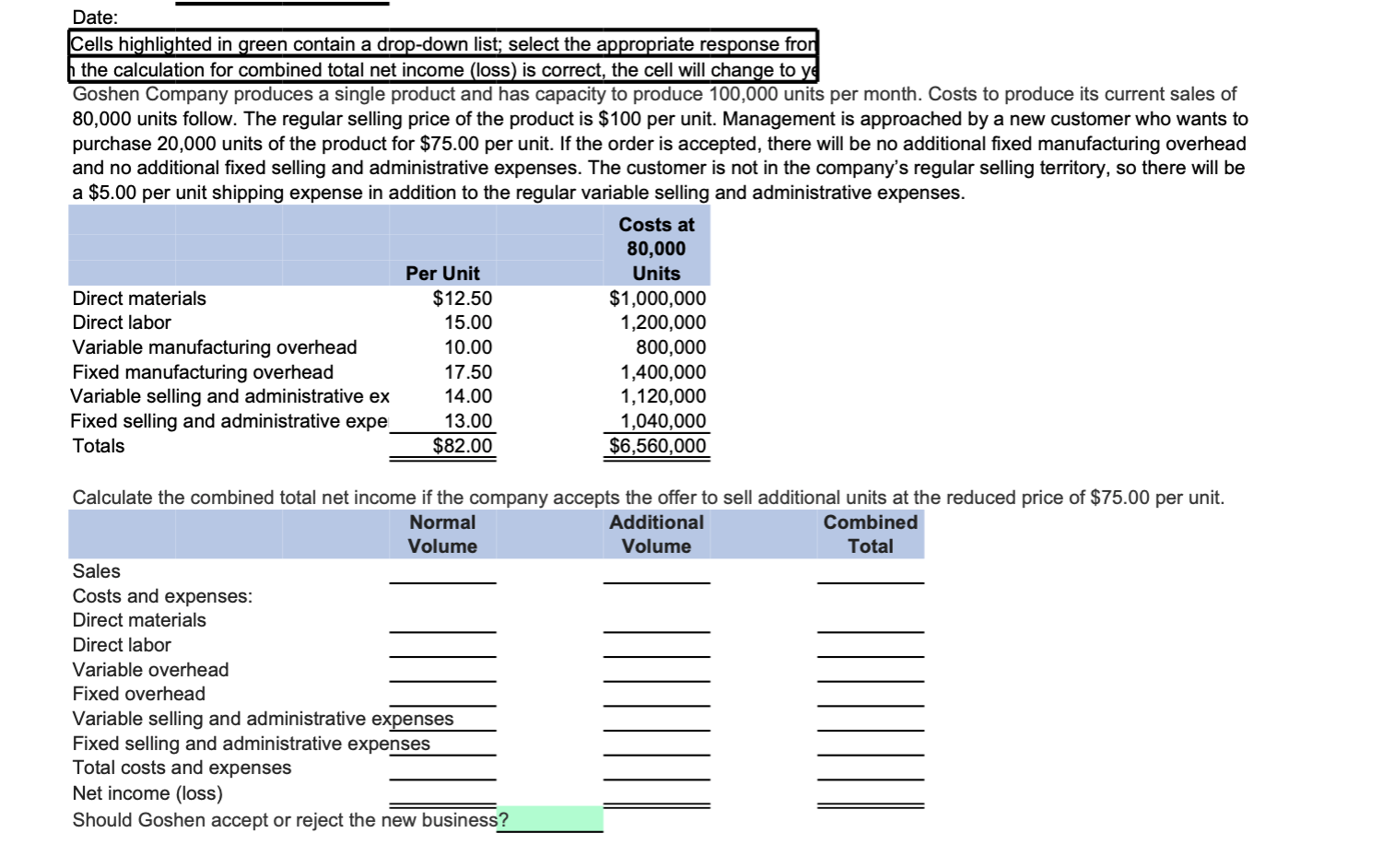

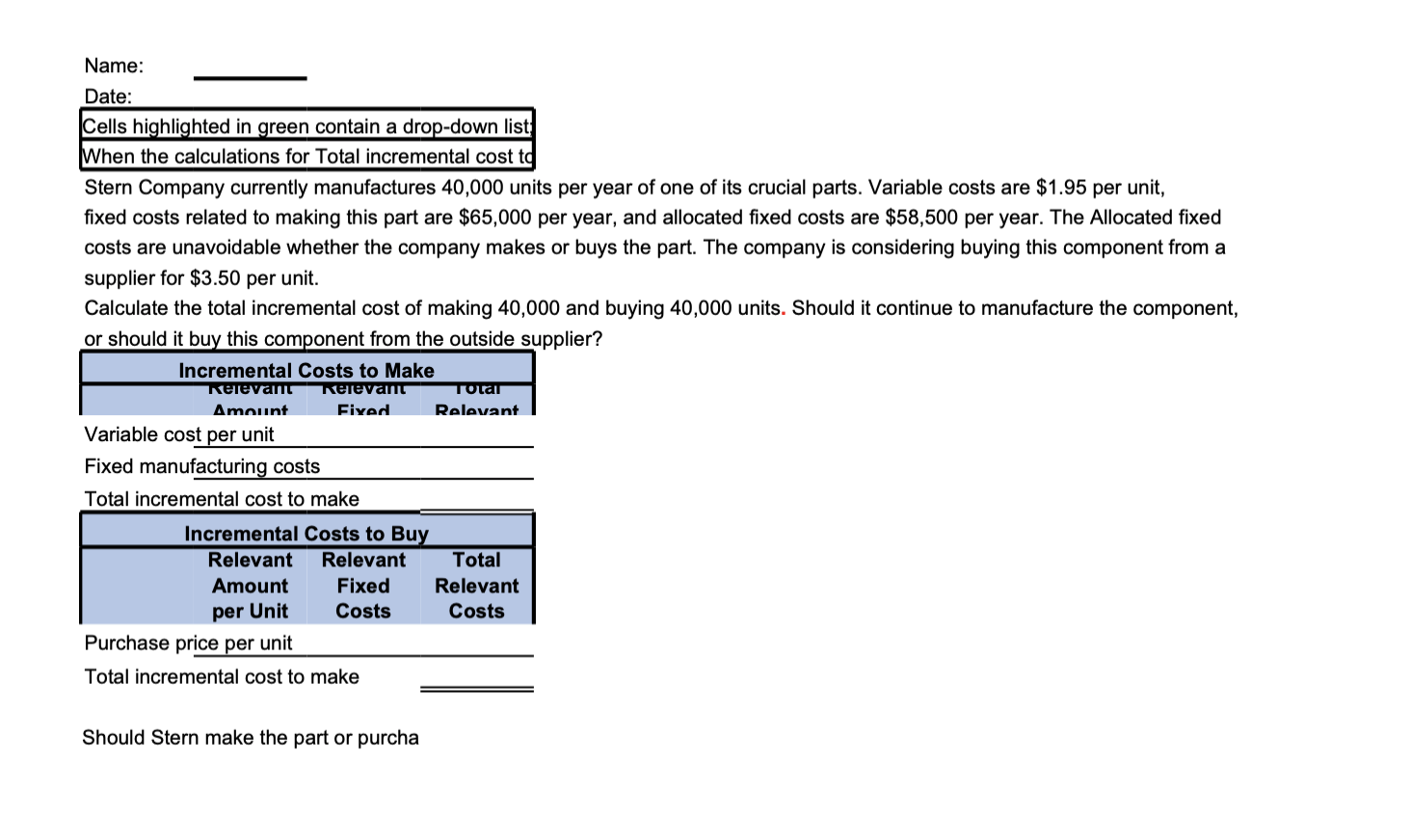

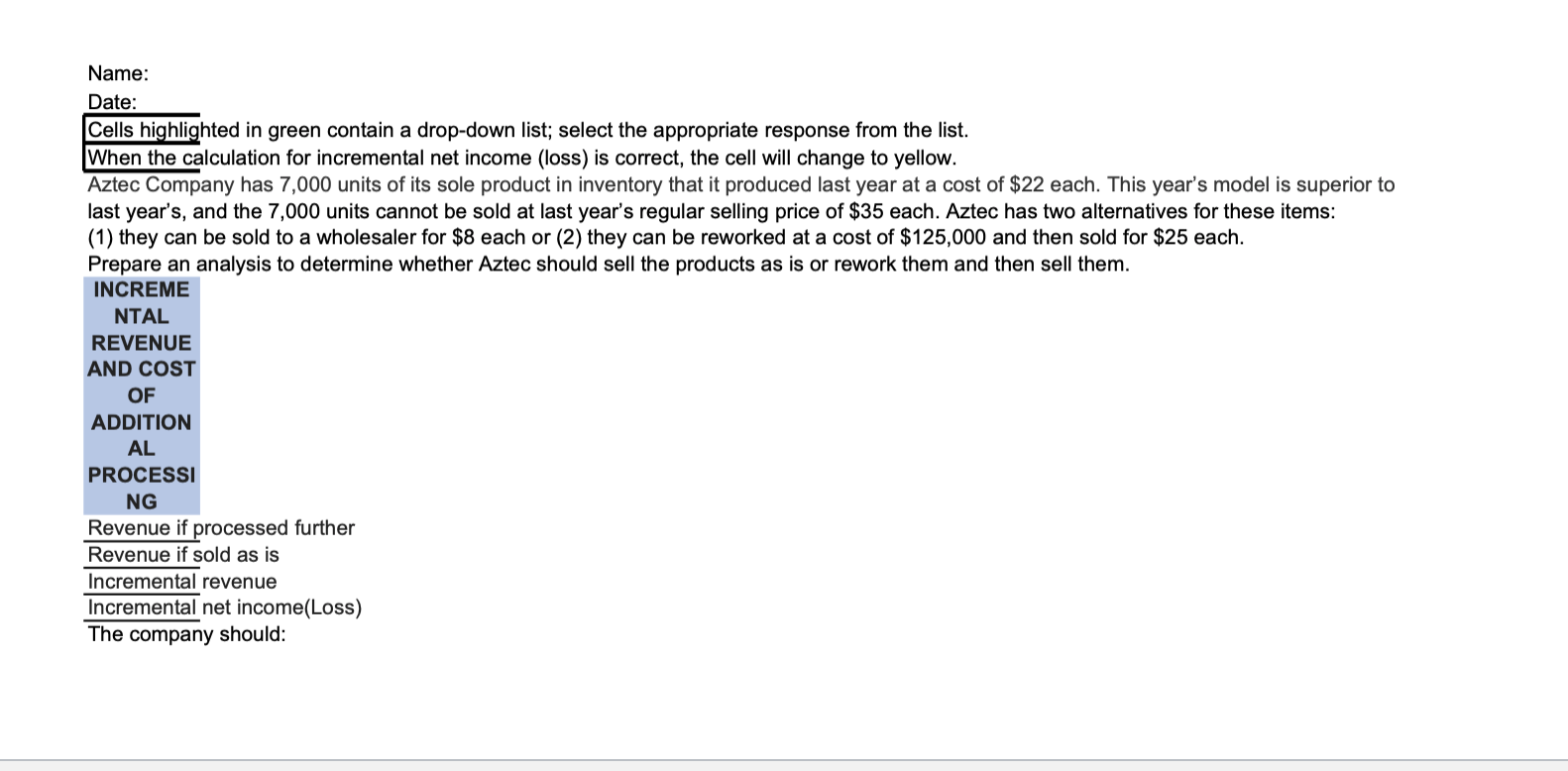

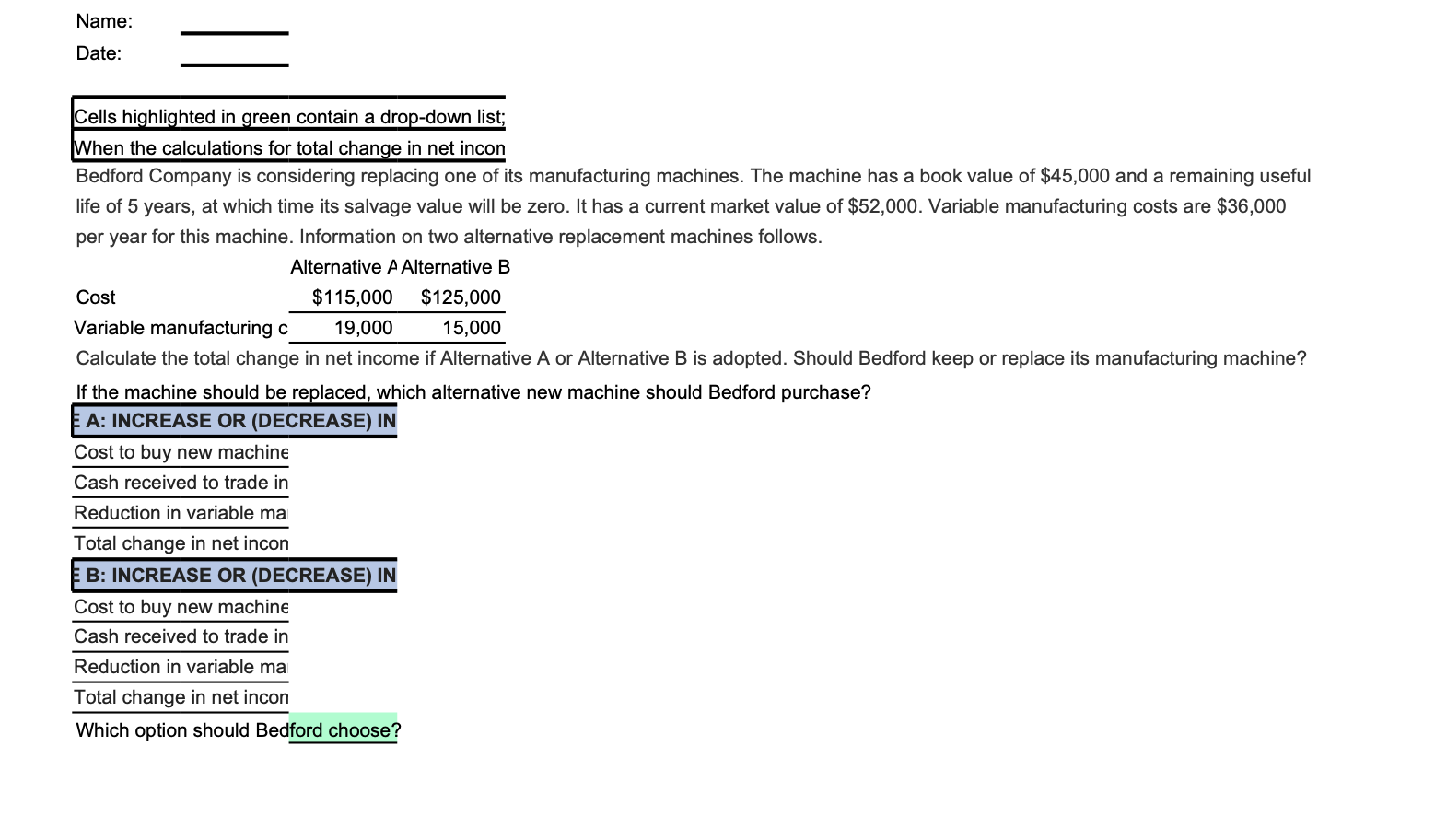

Date: Cells highlighted in green contain a drop-down list; select the appropriate response fror h the calculation for combined total net income (loss) is correct, the cell will change to ye Goshen Company produces a single product and has capacity to produce 100,000 units per month. Costs to produce its current sales of 80,000 units follow. The regular selling price of the product is $100 per unit. Management is approached by a new customer who wants to purchase 20,000 units of the product for $75.00 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and administrative expenses. The customer is not in the company's regular selling territory, so there will be a $5.00 per unit shipping expense in addition to the regular variable selling and administrative expenses. Costs at 80,000 Per Unit Units Direct materials $12.50 $1,000,000 Direct labor 15.00 1,200,000 Variable manufacturing overhead 10.00 800,000 Fixed manufacturing overhead 17.50 1,400,000 Variable selling and administrative ex 14.00 1,120,000 Fixed selling and administrative expe 13.00 1,040,000 Totals $82.00 $6,560,000 Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $75.00 per unit. Normal Additional Combined Volume Volume Total Sales Costs and expenses: Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Total costs and expenses Net income (loss) Should Goshen accept or reject the new business? Name: Date: Cells highlighted in green contain a drop-down list When the calculations for Total incremental cost to Stern Company currently manufactures 40,000 units per year of one of its crucial parts. Variable costs are $1.95 per unit, fixed costs related to making this part are $65,000 per year, and allocated fixed costs are $58,500 per year. The Allocated fixed costs are unavoidable whether the company makes or buys the part. The company is considering buying this component from a supplier for $3.50 per unit. Calculate the total incremental cost of making 40,000 and buying 40,000 units. Should it continue to manufacture the component, or should it buy this component from the outside supplier? Incremental Costs to Make Inelevant relevant Total Amount Fived Relevant Variable cost per unit Fixed manufacturing costs Total incremental cost to make Incremental Costs to Buy Relevant Relevant Total Amount Fixed Relevant Costs Costs Purchase price per unit Total incremental cost to make per Unit Should Stern make the part or purcha Name: Date: Cells highlighted in green contain a drop-down list; select the appropriate response from the list. When the calculation for incremental net income (loss) is correct, the cell will change to yellow. Aztec Company has 7,000 units of its sole product in inventory that it produced last year at a cost of $22 each. This year's model is superior to last year's, and the 7,000 units cannot be sold at last year's regular selling price of $35 each. Aztec has two alternatives for these items: (1) they can be sold to a wholesaler for $8 each or (2) they can be reworked at a cost of $125,000 and then sold for $25 each. Prepare an analysis to determine whether Aztec should sell the products as is or rework them and then sell them. INCREME NTAL REVENUE AND COST OF ADDITION AL PROCESSI NG Revenue if processed further Revenue if sold as is Incremental revenue Incremental net income(Loss) The company should: Name: Date: Cells highlighted in green contain a drop-down list; When the calculations for total change in net incon Bedford Company is considering replacing one of its manufacturing machines. The machine has a book value of $45,000 and a remaining useful life of 5 years, at which time its salvage value will be zero. It has a current market value of $52,000. Variable manufacturing costs are $36,000 per year for this machine. Information on two alternative replacement machines follows. Alternative A Alternative B Cost $115,000 $125,000 Variable manufacturing c 19,000 15,000 Calculate the total change in net income if Alternative A or Alternative B is adopted. Should Bedford keep or replace its manufacturing machine? If the machine should be replaced, which alternative new machine should Bedford purchase? A: INCREASE OR (DECREASE) IN Cost to buy new machine Cash received to trade in Reduction in variable ma Total change in net incon EB: INCREASE OR (DECREASE) IN Cost to buy new machine Cash received to trade in Reduction in variable ma Total change in net incon Which option should Bedford choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts