Question: Name: Date: Cells highlighted in green contain a drop-down list; select the appropriate account/response from the When the calculation for Net cash provided (used) by

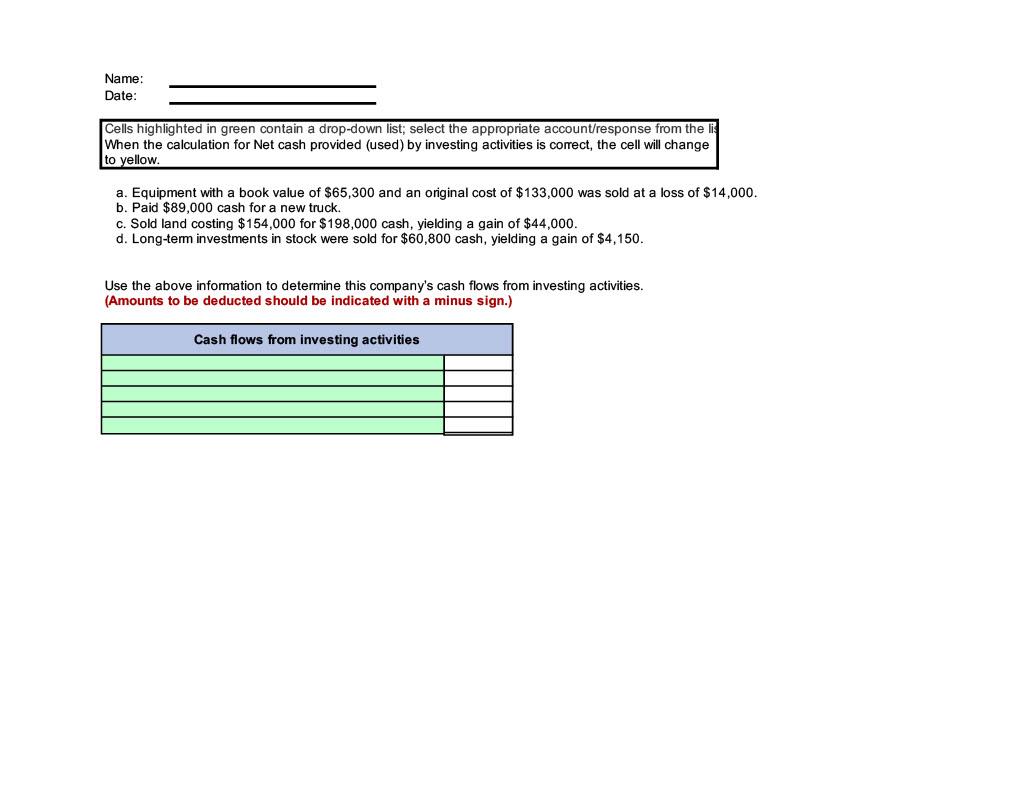

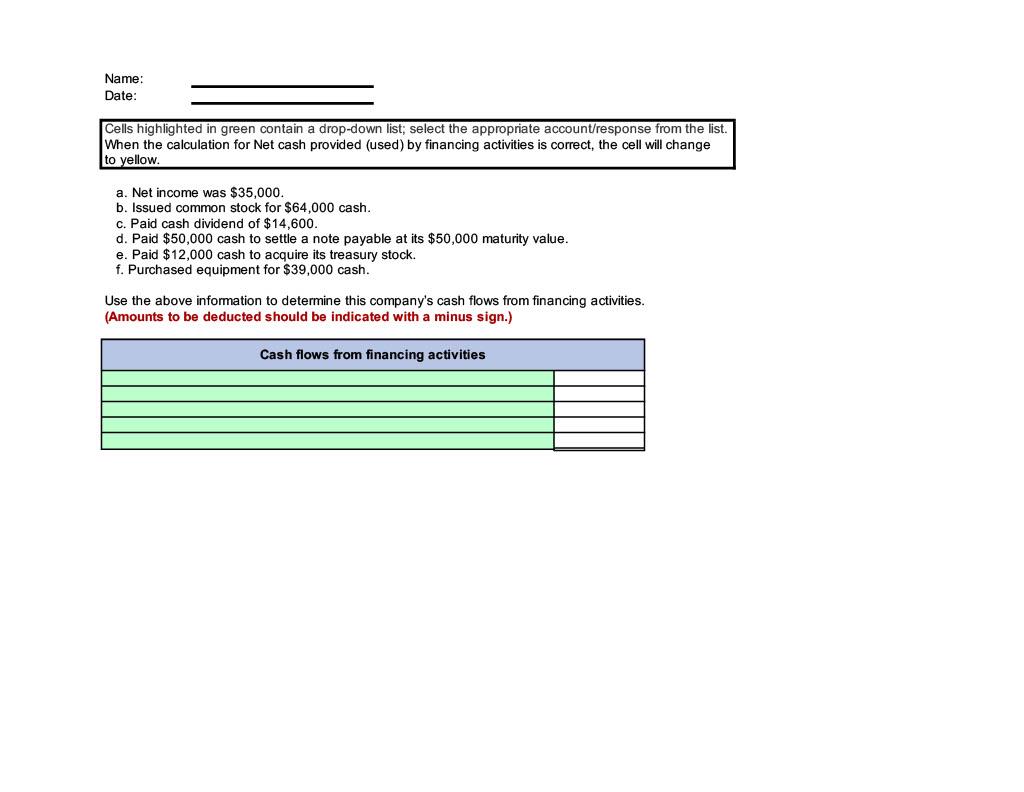

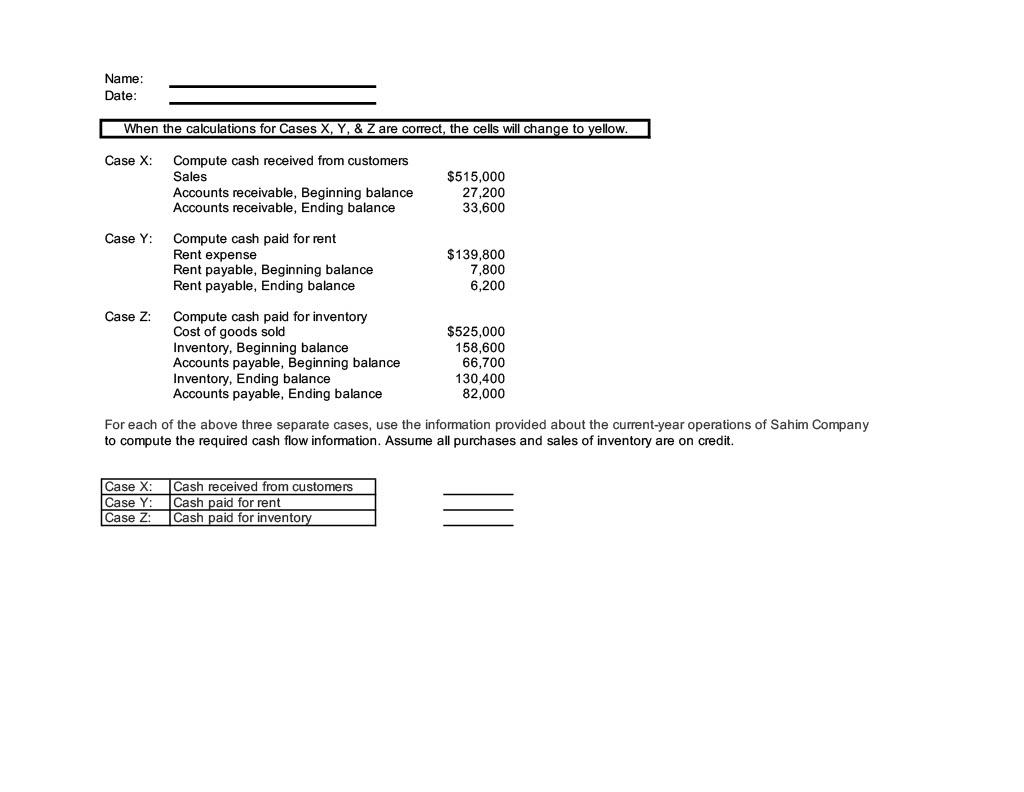

Name: Date: Cells highlighted in green contain a drop-down list; select the appropriate account/response from the When the calculation for Net cash provided (used) by investing activities is correct, the cell will change to yellow a. Equipment with a book value of $65,300 and an original cost of $133,000 was sold at a loss of $14,000. b. Paid $89,000 cash for a new truck. c. Sold land costing $154,000 for $198,000 cash, yielding a gain of $44,000. d. Long-term investments in stock were sold for $60,800 cash, yielding a gain of $4,150. Use the above information to determine this company's cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from investing activities Name: Date: Cells highlighted in green contain a drop-down list; select the appropriate account/response from the list. When the calculation for Net cash provided (used) by financing activities is correct, the cell will change to yellow a. Net income was $35,000. b. Issued common stock for $64,000 cash. c. Paid cash dividend of $14,600. d. Paid $50,000 cash to settle note payable at its $50,000 maturity value. e. Paid $12,000 cash to acquire its treasury stock. f. Purchased equipment for $39,000 cash. Use the above information to determine this company's cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from financing activities Name: Date: When the calculations for Cases X, Y, & Z are correct, the cells will change to yellow Case X: Compute cash received from customers Sales Accounts receivable, Beginning balance Accounts receivable, Ending balance $515,000 27,200 33,600 Case Y: Compute cash paid for rent Rent expense Rent payable, Beginning balance Rent payable, Ending balance $139,800 7,800 6,200 Case Z: Compute cash paid for inventory Cost of goods sold Inventory, Beginning balance Accounts payable, Beginning balance Inventory, Ending balance Accounts payable, Ending balance $525,000 158,600 66,700 130,400 82,000 For each of the above three separate cases, use the information provided about the current-year operations of Sahim Company to compute the required cash flow information. Assume all purchases and sales of inventory are on credit. Case X: Case Y: Case z Cash received from customers Cash paid for rent Cash paid for inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts