Question: Date: Course: Intermediate Accounting I-Spring 2016 Assi (Revised) l pledge that will not use any text, or other reference materials during this assignment I pledge

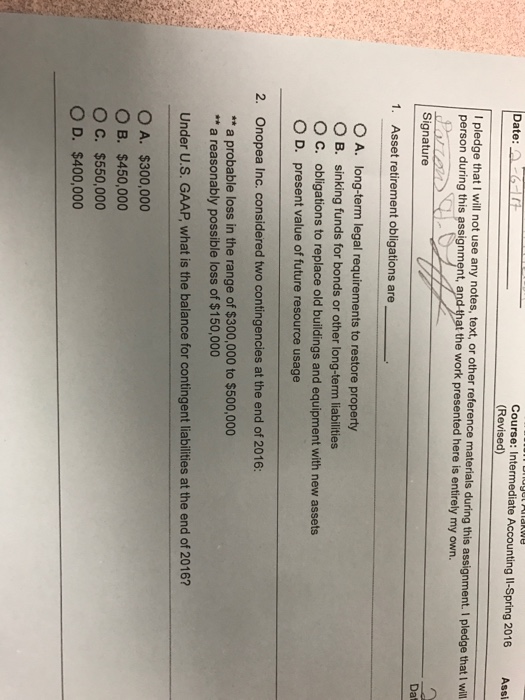

Date: Course: Intermediate Accounting I-Spring 2016 Assi (Revised) l pledge that will not use any text, or other reference materials during this assignment I pledge that I person during this assignment, a that the work presented here is entirely my own. Signature Dat 1. Asset retirement obligations are O A. ong-term legal requirements to restore property O B. sinking funds for bonds or other long-term liabilities O C. obligations to replace old buildings and equipment with new assets O D. present value of future resource usage 2. Onopea Inc. considered two contingencies at the end of 2016 a probable loss in the range of $300,000 to $500,000 a reasonably possible loss of $150,000 Under U.S. GAAP, what is the balance for contingent liabilities at the end of 2016? O A. $300,000 O B. $450,000 O C. $550,000 O D. $400,000

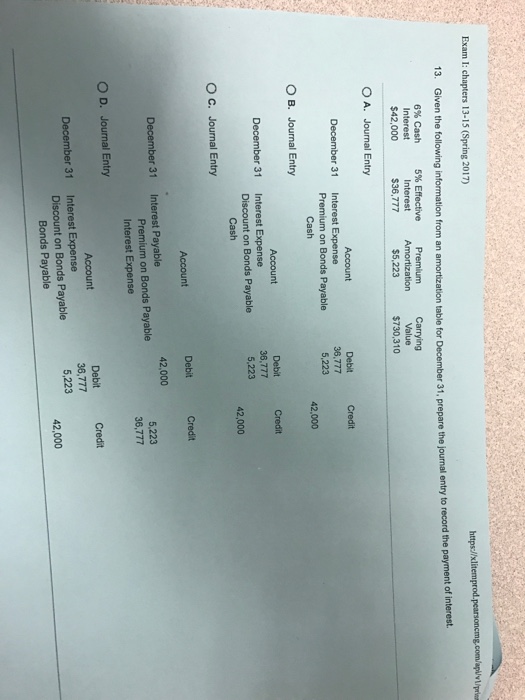

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts