Question: David Floyd died in the current year. His will created an irrevocable trust funded with $2.6 million, which grants a lifetime income interest to his

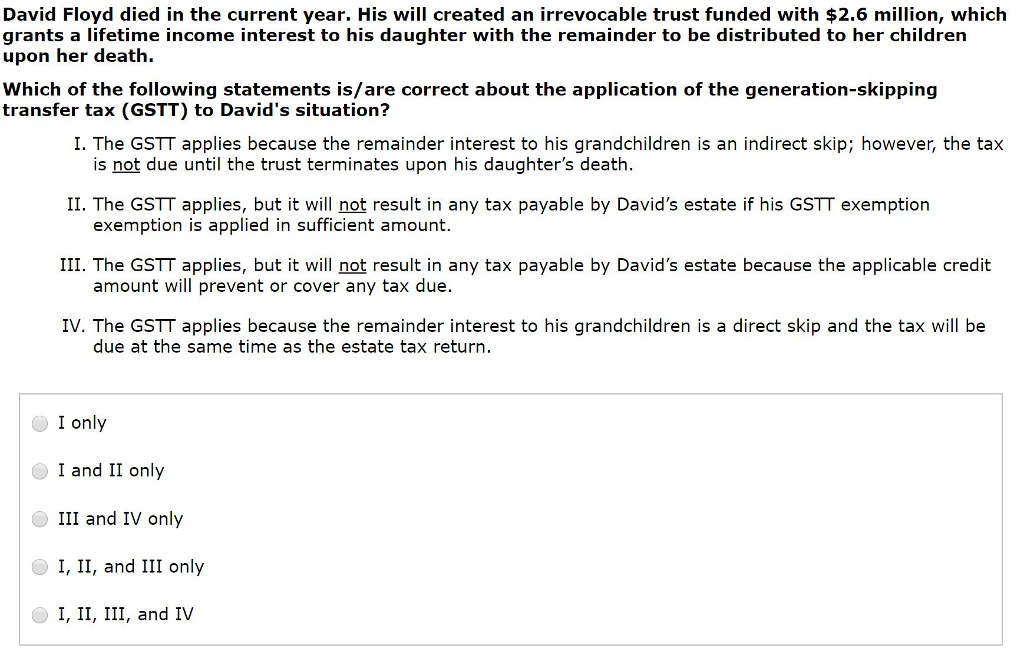

David Floyd died in the current year. His will created an irrevocable trust funded with $2.6 million, which grants a lifetime income interest to his daughter with the remainder to be distributed to her children upon her death. Which of the following statements is/are correct about the application of the generation-skipping transfer tax (GSTT) to David's situation? I. The GSTT applies because the remainder interest to his grandchildren is an indirect skip; however, the tax II. The GSTT applies, but it will not result in any tax payable by David's estate if his GSTT exemption III. The GSTT applies, but it will not result in any tax payable by David's estate because the applicable credit IV. The GSTT applies because the remainder interest to his grandchildren is a direct skip and the tax will be is not due until the trust terminates upon his daughter's deatlh exemption is applied in sufficient amount. amount will prevent or cover any tax due. due at the same time as the estate tax return. I only I and II only III and IV only I, II, and III only I, II, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts