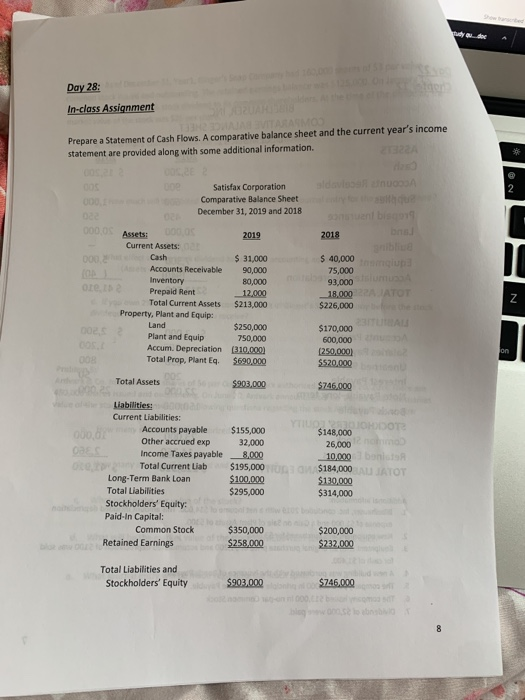

Question: Day 28: In-class Assignment Prepare a Statement of Cash Flows. A comparative balance sheet and the current year's income statement are provided along with some

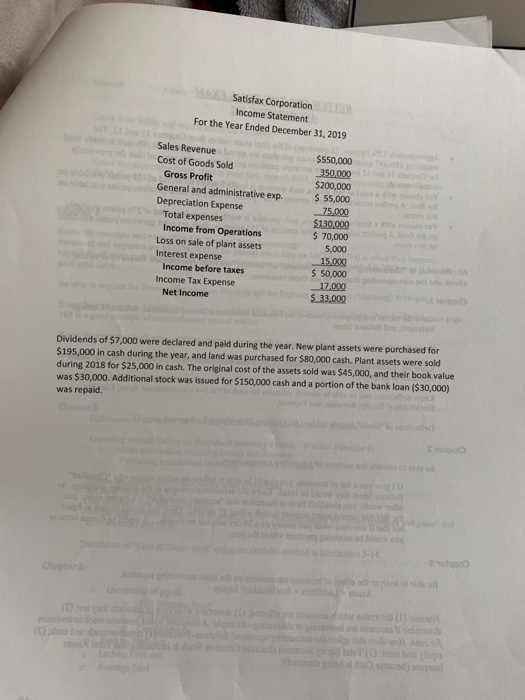

Day 28: In-class Assignment Prepare a Statement of Cash Flows. A comparative balance sheet and the current year's income statement are provided along with some additional information. slova ODA 000 Satisfax Corporation Comparative Balance Sheet December 31, 2019 and 2018 0000 Assets: 2019 2018 000 a Current Assets Cast Accounts Receivable Inventory ore te Prepaid Rent Total Current Assets Property, Plant and Equip: Land 002, Plant and Equip Accum. Depreciation Total Prop, Plant Eq. $ 31,000 90,000 80,000 12,000 $213,000 $ 40,000 75,000 93,000 18.000 $226,000 BITUAL $250,000 750,000 (310.000) $690.000 $170,000 600,000 250,000) $520,000 Total Assets $903,000 $746,000 Liabilities: Current Liabilities: Accounts payable Other accrued exp OBES Income Taxes payable Total Current Liab Long-Term Bank Loan Total Liabilities Stockholders' Equity: Paid-in Capital: Common Stock Retained Earnings $155,000 32,000 8.000 $195,000 $100,000 $295,000 OHDOT $148,000 26,000 10,000 bonis $184,000 AUTOT $130,000 $314,000 $350,000 $258,000 $200,000 $232,000 Total Liabilities and Stockholders' Equity $903.000 $746,000 Blogwomselon Satisfax Corporation Satisfax Corne Income Statement For the Year Ended December 31, 2019 $550.000 350.000 $200,000 $ 55,000 75.000 Sales Revenue Cost of Goods Sold Gross Profit General and administrative exp. Depreciation Expense Total expenses Income from Operations Loss on sale of plant assets Interest expense Income before taxes Income Tax Expense Net Income $ 70,000 5,000 15.000 $ 50,000 17.000 $ 33.000 Dividends of $7,000 were declared and paid during the year. New plant assets were purchased for $195,000 in cash during the year, and land was purchased for $80,000 cash. Plant assets were sold during 2018 for $25,000 in cash. The original cost of the assets sold was $45,000, and their book value was $30,000. Additional stock was issued for $150,000 cash and a portion of the bank loan ($30,000) was repaid. SO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts