Question: Days On Hand Analysis - Executive Summary Assignment Background: Days on Hand or Days in Inventory provides a metric for comparing supply chain operations within

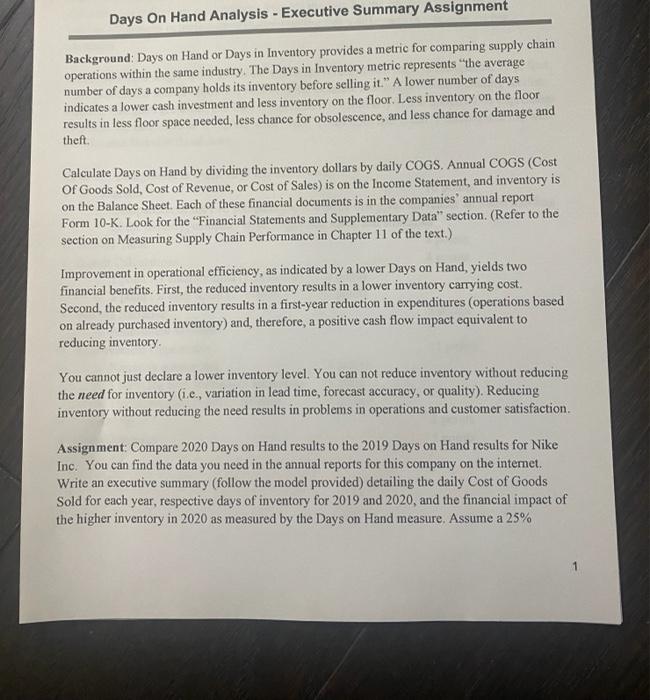

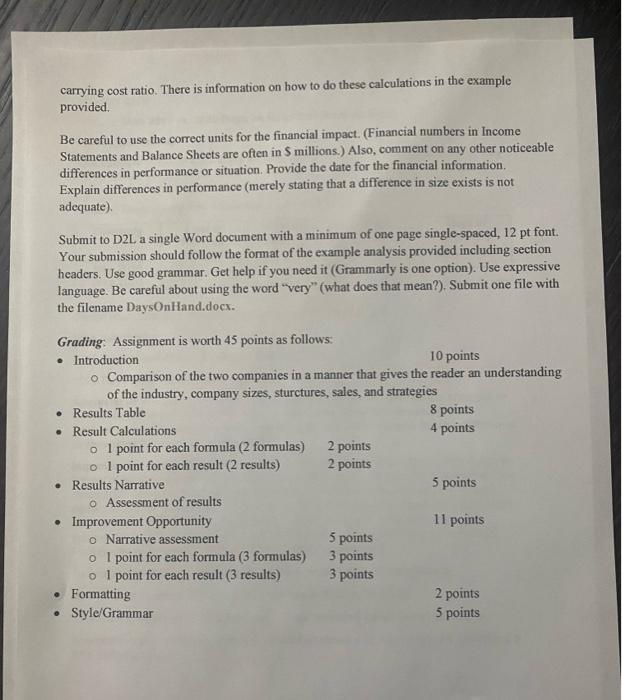

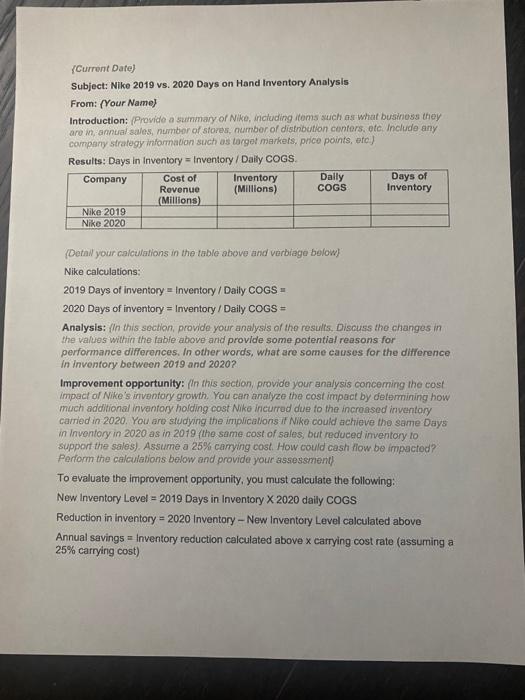

Days On Hand Analysis - Executive Summary Assignment Background: Days on Hand or Days in Inventory provides a metric for comparing supply chain operations within the same industry. The Days in Inventory metric represents the average number of days a company holds its inventory before selling it." A lower number of days indicates a lower cash investment and less inventory on the floor. Less inventory on the floor results in less floor space needed, less chance for obsolescence, and less chance for damage and theft Calculate Days on Hand by dividing the inventory dollars by daily COGS. Annual COGS (Cost Of Goods Sold, Cost of Revenue, or Cost of Sales) is on the Income Statement, and inventory is on the Balance Sheet. Each of these financial documents is in the companies' annual report Form 10-K. Look for the "Financial Statements and Supplementary Data" section. (Refer to the section on Measuring Supply Chain Performance in Chapter 11 of the text.) Improvement in operational efficiency, as indicated by a lower Days on Hand, yields two financial benefits. First, the reduced inventory results in a lower inventory carrying cost. Second, the reduced inventory results in a first-year reduction in expenditures (operations based on already purchased inventory) and therefore, a positive cash flow impact equivalent to reducing inventory You cannot just declare a lower inventory level. You can not reduce inventory without reducing the need for inventory (i.c., variation in lead time, forecast accuracy, or quality). Reducing inventory without reducing the need results in problems in operations and customer satisfaction. Assignment: Compare 2020 Days on Hand results to the 2019 Days on Hand results for Nike Inc. You can find the data you need in the annual reports for this company on the internet. Write an executive summary (follow the model provided) detailing the daily Cost of Goods Sold for each year, respective days of inventory for 2019 and 2020, and the financial impact of the higher inventory in 2020 as measured by the Days on Hand measure. Assume a 25% 1 carrying cost ratio. There is information on how to do these calculations in the example provided Be careful to use the correct units for the financial impact. (Financial numbers in Income Statements and Balance Sheets are often in S millions.) Also, comment on any other noticeable differences in performance or situation. Provide the date for the financial information Explain differences in performance (merely stating that a difference in size exists is not adequate) Submit to D2L a single Word document with a minimum of one page single-spaced, 12 pt font. Your submission should follow the format of the example analysis provided including section headers. Use good grammar. Get help if you need it (Grammarly is one option). Use expressive language. Be careful about using the word "very" (what does that mean?). Submit one file with the filename DaysOnHand.docx. Grading: Assignment is worth 45 points as follows: Introduction 10 points o Comparison of the two companies in a manner that gives the reader an understanding of the industry, company sizes, sturctures, sales, and strategies Results Table 8 points Result Calculations 4 points o 1 point for each formula (2 formulas) 2 points o 1 point for each result (2 results) 2 points Results Narrative 5 points O Assessment of results Improvement Opportunity 11 points o Narrative assessment 5 points o I point for each formula (3 formulas) 3 points o I point for each result (3 results) 3 points Formatting 2 points Style/Grammar 5 points (Current Date) Subject: Nike 2019 vs. 2020 Days on Hand Inventory Analysis From: (Your Name) Introduction: Provide a summary of Nike, including items such as what business they are in annual sales, number of stores, number of distnbution centers, etc. Include any company strategy information such as target markets, price points, etc) Results: Days in Inventory - Inventory / Daily COGS Company Cost of Inventory Dally Days of Revenue (Millions) COGS Inventory (Millions) Nike 2019 Nike 2020 (Detail your calculations in the table above and verbiage below Nike calculations: 2019 Days of inventory = Inventory/Daily COGS 2020 Days of inventory = Inventory/ Daily COGS = Analysis: In this section, provide your analysis of the results. Discuss the changes in the values within the table above and provide some potential reasons for performance differences. In other words, what are some causes for the difference In Inventory between 2019 and 2020? Improvement opportunity: (in this section, provide your analysis concerning the cost impact of Nike's inventory growth. You can analyze the cost impact by determining how much additional inventory holding cost Niko incurred due to the increased inventory carried in 2020. You are studying the implications if Nike could achieve the same Days in Inventory in 2020 as in 2019 (the same cost of sales, but reduced inventory to support the sales) Assume a 25% carrying cost. How could cash flow be impacted? Perform the calculations below and provide your assessment To evaluate the improvement opportunity, you must calculate the following: New Inventory Level = 2019 Days in Inventory X 2020 daily COGS Reduction in Inventory = 2020 Inventory - New Inventory Level calculated above Annual savings = Inventory reduction calculated above x carrying cost rate (assuming a 25% carrying cost) Days On Hand Analysis - Executive Summary Assignment Background: Days on Hand or Days in Inventory provides a metric for comparing supply chain operations within the same industry. The Days in Inventory metric represents the average number of days a company holds its inventory before selling it." A lower number of days indicates a lower cash investment and less inventory on the floor. Less inventory on the floor results in less floor space needed, less chance for obsolescence, and less chance for damage and theft Calculate Days on Hand by dividing the inventory dollars by daily COGS. Annual COGS (Cost Of Goods Sold, Cost of Revenue, or Cost of Sales) is on the Income Statement, and inventory is on the Balance Sheet. Each of these financial documents is in the companies' annual report Form 10-K. Look for the "Financial Statements and Supplementary Data" section. (Refer to the section on Measuring Supply Chain Performance in Chapter 11 of the text.) Improvement in operational efficiency, as indicated by a lower Days on Hand, yields two financial benefits. First, the reduced inventory results in a lower inventory carrying cost. Second, the reduced inventory results in a first-year reduction in expenditures (operations based on already purchased inventory) and therefore, a positive cash flow impact equivalent to reducing inventory You cannot just declare a lower inventory level. You can not reduce inventory without reducing the need for inventory (i.c., variation in lead time, forecast accuracy, or quality). Reducing inventory without reducing the need results in problems in operations and customer satisfaction. Assignment: Compare 2020 Days on Hand results to the 2019 Days on Hand results for Nike Inc. You can find the data you need in the annual reports for this company on the internet. Write an executive summary (follow the model provided) detailing the daily Cost of Goods Sold for each year, respective days of inventory for 2019 and 2020, and the financial impact of the higher inventory in 2020 as measured by the Days on Hand measure. Assume a 25% 1 carrying cost ratio. There is information on how to do these calculations in the example provided Be careful to use the correct units for the financial impact. (Financial numbers in Income Statements and Balance Sheets are often in S millions.) Also, comment on any other noticeable differences in performance or situation. Provide the date for the financial information Explain differences in performance (merely stating that a difference in size exists is not adequate) Submit to D2L a single Word document with a minimum of one page single-spaced, 12 pt font. Your submission should follow the format of the example analysis provided including section headers. Use good grammar. Get help if you need it (Grammarly is one option). Use expressive language. Be careful about using the word "very" (what does that mean?). Submit one file with the filename DaysOnHand.docx. Grading: Assignment is worth 45 points as follows: Introduction 10 points o Comparison of the two companies in a manner that gives the reader an understanding of the industry, company sizes, sturctures, sales, and strategies Results Table 8 points Result Calculations 4 points o 1 point for each formula (2 formulas) 2 points o 1 point for each result (2 results) 2 points Results Narrative 5 points O Assessment of results Improvement Opportunity 11 points o Narrative assessment 5 points o I point for each formula (3 formulas) 3 points o I point for each result (3 results) 3 points Formatting 2 points Style/Grammar 5 points (Current Date) Subject: Nike 2019 vs. 2020 Days on Hand Inventory Analysis From: (Your Name) Introduction: Provide a summary of Nike, including items such as what business they are in annual sales, number of stores, number of distnbution centers, etc. Include any company strategy information such as target markets, price points, etc) Results: Days in Inventory - Inventory / Daily COGS Company Cost of Inventory Dally Days of Revenue (Millions) COGS Inventory (Millions) Nike 2019 Nike 2020 (Detail your calculations in the table above and verbiage below Nike calculations: 2019 Days of inventory = Inventory/Daily COGS 2020 Days of inventory = Inventory/ Daily COGS = Analysis: In this section, provide your analysis of the results. Discuss the changes in the values within the table above and provide some potential reasons for performance differences. In other words, what are some causes for the difference In Inventory between 2019 and 2020? Improvement opportunity: (in this section, provide your analysis concerning the cost impact of Nike's inventory growth. You can analyze the cost impact by determining how much additional inventory holding cost Niko incurred due to the increased inventory carried in 2020. You are studying the implications if Nike could achieve the same Days in Inventory in 2020 as in 2019 (the same cost of sales, but reduced inventory to support the sales) Assume a 25% carrying cost. How could cash flow be impacted? Perform the calculations below and provide your assessment To evaluate the improvement opportunity, you must calculate the following: New Inventory Level = 2019 Days in Inventory X 2020 daily COGS Reduction in Inventory = 2020 Inventory - New Inventory Level calculated above Annual savings = Inventory reduction calculated above x carrying cost rate (assuming a 25% carrying cost)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts