Question: dB =W 1. (20 points) (A simple portfolio optimization problem) Consider the Black-Scholes model where dB, =rBidt, ds, rus, dt+oSdW. Consider a constant-weighted portfolio. That

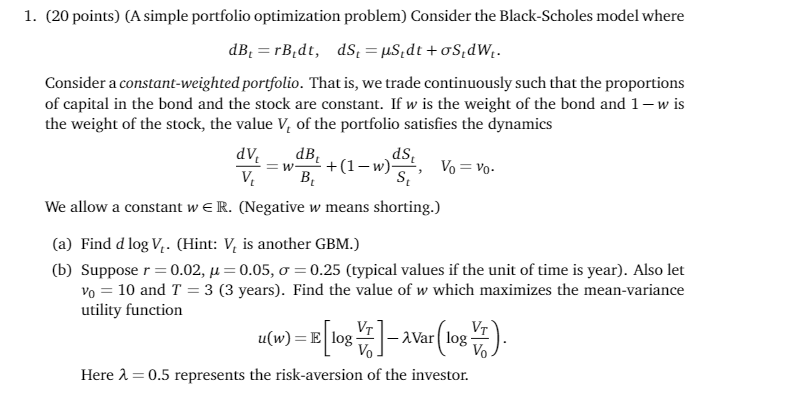

dB =W 1. (20 points) (A simple portfolio optimization problem) Consider the Black-Scholes model where dB, =rBidt, ds, rus, dt+oSdW. Consider a constant-weighted portfolio. That is, we trade continuously such that the proportions of capital in the bond and the stock are constant. If w is the weight of the bond and 1- w is the weight of the stock, the value V, of the portfolio satisfies the dynamics dV. ds +(1-w) V = Vo. V B S We allow a constant w R. (Negative w means shorting.) (a) Find d log V. (Hint: V, is another GBM.) (b) Suppose r =0.02, u=0.05, o =0.25 (typical values if the unit of time is year). Also let Vo = 10 and T = 3 (3 years). Find the value of w which maximizes the mean-variance utility function VI VI - 2 Var log VO Here 2 = 0.5 represents the risk-aversion of the investor. dB =W 1. (20 points) (A simple portfolio optimization problem) Consider the Black-Scholes model where dB, =rBidt, ds, rus, dt+oSdW. Consider a constant-weighted portfolio. That is, we trade continuously such that the proportions of capital in the bond and the stock are constant. If w is the weight of the bond and 1- w is the weight of the stock, the value V, of the portfolio satisfies the dynamics dV. ds +(1-w) V = Vo. V B S We allow a constant w R. (Negative w means shorting.) (a) Find d log V. (Hint: V, is another GBM.) (b) Suppose r =0.02, u=0.05, o =0.25 (typical values if the unit of time is year). Also let Vo = 10 and T = 3 (3 years). Find the value of w which maximizes the mean-variance utility function VI VI - 2 Var log VO Here 2 = 0.5 represents the risk-aversion of the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts