Question: Dear Chegg, I provided this question before, but only (1) was answered, but could kindly assist with all the resolution. from (1 to 4 )

Dear Chegg, I provided this question before, but only (1) was answered, but could kindly assist with all the resolution. from (1 to 4 )

QUESTION

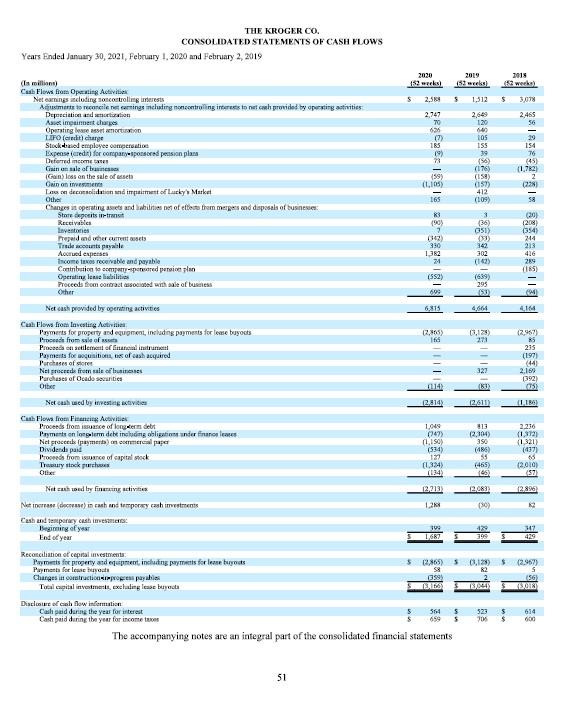

The below statement of cash flow for Kroger Co. for the three years ended January 31, 2021. Answer the following questions related to that statement. Make sure you clearly state if amounts are rounded to thousands or millions, and answer in complete sentences.

Show any calculations you do.

- How much did net cash provided by operating activities increase from fiscal 2019 to fiscal 2021 (which was 2018-2020)?

- How much was the difference between net income and operating cash flow for fiscal 2021 (which was 2020), and what was the biggest reconciling difference?

- What were the two largest investing cash flows in fiscal 2019 (2018) and how much was each? Make sure to state whether each is inflow or outflow.

- What was the largest financing cash flow in fiscal 2020 (2019) and how much was it? (And state whether it was an inflow or an outflow.)

THE KROGER CO. CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended January 30, 2021, February 1, 2020 and February 2, 2019 (In millions) Cash Flows from Operating Activities Net earnings including noncontrolling interests Auments to reconcile net earnings including noncontrolling interests to net cash provided by operating activities and wortization Depreciation and Aiempiment charges g lease asset amortization Operating LIFO (eredit) charge Stock-based employer compensation Expense (red) for company sponsored pension plans Deferred income ca Gain on sale of business (Gan) loss on the sale of assets Gain on investments Lass on deconsolidation and impairment of Lucky's Market Other Changes in operating assets and liabilities net of effects from mergers and disposals of businesses Stare deposits in-transit Receivables Inventories Prepaid and other current sets Trade accounts payable Accrued expenses Income taxes receivable and payable Contribution to company-sponsored pension plan Operating lease liabilities Proceeds from contract associated with sale of business Other Net cash provided by operating activities Cash Flows from Investing Activities Payments for property and equipment, including payments for lease buyouts Proceeds from sale of Proceeds on settlement of financial instrument Payments for acquisitions of cash acquired Purchases of storer Net proceeds from sale of businesses Purchases of Ocado securities Other Net cash used by investing activities Proceeds ds from issuance of long-term debt Payments on long-term debe including obligations under financs leases Net proceeds (payments) on commercial paper Dividends paid Proceeds from issuance of capital stock Treasury stock purchases Other Net cash used by financing activities Net terase (decease) in cash and temporary cash investments Cash and temporary cash investment Beginning of year End of year Reconciliation of capital investments Payments for property and equipment, including payments for lease buyouts Payments for lease buyouts Changes in contraction in progress payables Total capital investments, exchaling lease buyect Cash paid during the year for interest Cash paid during the year for income taxes Cash Flows from Financing Activities Disclosure of cash flow information 2020 2019 (52 weeks) (52 weeks) S 2,588 S 1,312 $ 3,078 2,747 70 625 (7) | 5 ********8*888***RE||1||| | ******** *88EX| | 2018012=888=1818 | N ***** (9) 73 (59) (1.105) 165 83 (90) (342) 330 (552) 699 6.815 (2,365) 165 (114) (2814) 1,049 (747) (1.150) (534) 127 (1,324) (134) (2,713) 1,28 399 1,687 (359) 564 S 659 $ The accompanying notes are an integral part of the consolidated financial statements 51 2,649 120 640 105 155 39 (56) (176) (158) (157) 412 (109) 3 (36) (351) (33) 342 302 (145) (639) 295 4,664 (3,128) 273 327 (2611) 2018 (52 werk) 813 (2,304) 350 (486) 55 (465) (45) (2,083) (30) (3,128) S 82 (3044) 2,465 56 323 S $ 306 29 154 76 (45) (1782) 2 (228) 58 (20) (208) (354) 244 213 416 289 (185) (M) 4,164 10 (2,967) 85 235 (197) (44) 2,169 (392) (75) (1,186) 2,236 (1,372) (1321) (437) 65 (2010) (57) (2.896) 347 429 (2,967) 5 (56) (3018) 614 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts