Question: Dear expert. If you can know the answer , then take the question, do not waste my question. do not copy paste from chegg, as

Dear expert. If you can know the answer , then take the question, do not waste my question. do not copy paste from chegg, as answer is already given in chegg. that is wrong, Need Perfect answer. Thanks.

Kings Biscuits Berhad: Crafting the Next Move?

Kings Biscuits Berhad (KBB) was founded in 1979 as a home grown confectionery manufacturing company at the northern part of Malaysia and later was acquired by Cheng family in 1992. At this point of time the turnover for the company was merely Ringgit Malaysia (RM) 500,000.00 (exchange rate RM2.75 to USD1.00 in 1993). With the right management and right strategy, the company sales increased by 50 times to RM25 million by 2000. Thanks to the youngest son of the Cheng family who came on board to the company in the same year upon graduating from a UK premier university with an MBA in 1994. Under his stewardship KBB has been able to grow not just in terms of sales and profitability but also product variety.

The main product line from KBB is cakes which do not need to be stored in refrigerated condition with long shelf life of six months. This unique characteristic of the product suits developing market such as Malaysia where the supply chain is still not fully refrigerated. Armed with this recipe of success, KBB has broken the bottleneck in the issue of logistics where cakes could not be mass produced due to storage problem in a developing country like Malaysia. This also helps KBB to export the cakes to other countries with similar logistics condition such as China, Indonesia Thailand, Vietnam and Middle East. Export sales is now accounted for 40% of KBBs turnover and growing fast at 15% annually in the last three years.

Malaysia, with a population of about 28 million, the economy was developing rapidly in the 1990s with per capita income of USD2,400 in 1990 and increased to USD4,700 in 1997. Due to the 1997/98 Asian financial crisis, the ringgit was depreciated drastically from RM2.50 to RM4.50 to a dollar and later it was pegged by the Malaysian government in 1998 at RM3.80. In 2005 the Malaysian government following the footstep of China floating the Yuan, decided to adopt a managed-float system for the ringgit. Due to the weakness in dollars, the ringgit has since slowly creeping up to around RM3.20 by mid 2010. The Malaysias economy has been developing steadily since 1997/98 crisis and the GDP per capita income is now estimated to be at USD7,000 in 2009 putting Malaysia in the middle income level of economic development.

As Malaysia is not a wheat producer and flour is a major ingredient for KBBs products, the company has been facing the cost pressure greatly since the 1997/98 financial crisis in Asia due to the weak ringgit. Other ingredients such as corn, potatoes and sugar are also strongly affected by the fluctuation of currencies due to the openness of Malaysian economy. In order to tackle the cost pressure from the main ingredients which are factors of input industry wide, KBB embark on cost reduction programmes through reducing waste, improving manpower and machinery efficiency. At the same time, KBB also managed to pass some costs down to the consumers through increasing price by 8 percent in 1999 and 7 percent in 2000.

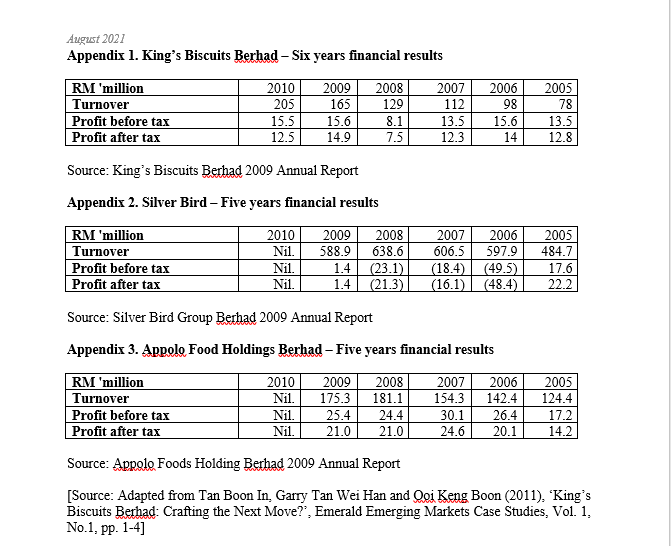

Despite the challenging economic environment, KBB was able to grow its business steadily from 2005 to 2010 (See Appendix 1 for 6 years results) to RM205m in 2010 with profit before tax of RM15.5m.According to the companys official home page, KBB strategy for growth was anchored on the following strengths:

- KKB brought in the manufacturing technology through acquiring machinery and knowhow from Japan and Taiwan.

- KBB researched the market well and launched some popular products and market them well.

- The distribution system for KBB was well developed and efficient with more than 300 wholesalers and distributors through out Malaysia. KBBs products are found in all marketing channels from traditional retail shops to modern supermarkets and hypermarkets.

- Good quality control. Consistency in taste and obtained certifications from ISO9000 and HACCP to meet international standards for export markets. .

In addition to cakes, KBB also manufactures a range of assorted chocolate confectionery including chocolate-coated peanuts and biscuits, pancake cookies, jelly and puddings, wafer sticks, cup sticks and snack noodles. All these products come in variety of shapes and box sizes. These products are marketed under the different brand names such as Kingsco, Ratu, Aldinos, Vegas, Zulen and Rino. Although these added brands and products brought in more revenue and income for the company, they also post some challenges. With the company ever expanding in size each year the company is facing more challenges in its operations and marketing due to complication in terms of product mixes and SKUs (stock keeping unit). More resources are needed to manage the added product lines such as different production formula and different batches of scheduling. Sales personnel also find it more challenging now as there are more brands and SKUs to handle. It is a great challenge to convince the retailers to stock up more SKUs especially the traditional outlets where space is limited. At many times, the sales personnel have to play the role of deciding on behalf of the company which product or SKU the retailer should carry. Inevitably will create the internal conflicts where which brand and product need more support and focus from both the sales personnel and the retailers. Therefore, it is getting even more important the process of control from the marketing department and the head office to monitor closely of the sales of each product and brand in order to have the best optimum level of product mix from marketing, production and financial points of view. Meanwhile each of these products and brands does carry some uniqueness in their own ways:

Kingsco A rich chocolate snacks which contain high energy suitable for active life style for the youngsters.

Ratu A fruity (strawberry, watermelon, banana) flavours of chocolate candy specifically targeted at young girls for relaxation.

Aldinos A mixture of peanuts and cashew nuts in the less sweetened chocolate bars which serves as pre-meal or after meal snacks.

Vegas Is a fusion between pancake and cookies come in small bite sizes with various natural colours that attracts children.

Zulen A flavoured jelly in a small tub that can be consumed cold from the fridge or at ambient temperature to quench the thirst in a hot weather.

Rino The latest product launched from Kings. A new biscuit product line which comes in three variants (oat, chocolate, corn) currently targeting at the young adults for a quick, nutritious and convenient breakfast or afternoon tea.

For examples, in the competitive front, KBB needs to face two major competitors in Malaysia, first and foremost is Apollo Foods Holding Berhad where it is situated at the southern part of Malaysia with almost similar cake product line and similar in size with turnover of RM175m and profit after tax of RM21m. Worse, Apollo markets its product under the single family brand of Apollo alone which helps to reduce the complexity in its operations and marketing. The product range from Apollo was priced slightly lower than the cakes from KBB since it is very clearly targeting at children where it is consumed as healthy snacks especially in between meals or in school. This family brand strategy is adopted by Apollo as opposed to KBB which carries many unique brand names.

Secondly, there was another major competitor, Silver Bird Group Berhad which is even bigger in terms of size with reported turnover of RM590m in 2009 but less profitable at only RM1.4m. Silver Bird was originally a frozen cake company and later acquired the second largest bread making company in Malaysia with the brand called High-5. High-5 is believed to be one of the top two bread brands in Malaysia. Whereas Silver Bird brand is used for the cake products for the group. Silver Bird not only manufactures cakes and bread but at the same time it is using its wide distribution channels of 5,000 retail outlets throughout Malaysia to also distribute fixed and mobile phone cards to capture on the increasingly affluent consumer market in Malaysia. This product diversification strategy by capitalizing on the distribution strengths has contributed significantly to the turnaround of the financial results for Silver Bird for 2009 compared to 2006 to 2008.

Even though the standard of living in Malaysia is improving and consumers are getting more affluent, Silver Bird still finds that with frozen cakes alone is not enough to capture the total market of the ready-to-eat cake market. Furthermore the logistics of cold supply chain involved for frozen cakes pushes up the product distribution costs. The frozen cakes are usually marketed with the size of 280g 300g which need more people to consume together as opposed to the KBB and Apollo ready-to-eat cake size of 18g-20g per pack which could be consumed individually as snacks and does not need to be refrigerated. Therefore, Silver Bird also has jumped into the foray by launching their own non-refrigerated ready-to-eat cakes through capitalizing on its wide distribution of more than 5,000 retail outlets to compete directly with KBB and Apollo.

Other than the challenges posed by the two major competitors mentioned above, other smaller competitors are competing in price and locality with KBB. Worse still due to the open nature of Malaysian economy and trade policy, some players in the industry also import frozen cakes that are selling at the premium price level which is triple the price of KBBs cakes. Furthermore the traditional hot foods that served by the many economical eating outlets like any other developing countries in Asia also provide easy and convenience in terms of availability and good taste for the consumers in Malaysia. The consumers in Malaysia are just spoilt for choice.

KBB has reported the latest annual result for 30th June 2010, even though the revenue increased by 24% to RM205m, its profit attributable to shareholders has decreased by RM2.4m to RMRM12.5m. (See Appendix 1) The management of KBB from Cheng family is now carrying out a marketing environment scanning and contemplating the next course of actions to further take up the challenges that company is facing. Mr. Cheng is confident that all these challenges will be overcome just like before.

Question:

You are employed as a Marketing Manager for KBB. You are about to launch a new in-house brand of a new non-refrigerated ready-to-eat cakes. Explain TWO (2) reasons why 'matrix structure' is ideally suitable for this new product launch.( 1000-1200 word needed)

keep in mind the word limits

August 2021 Appendix 1. King's Biscuits Berhad - Six years financial results RM 'million 2010 2009 2008 2007 Turnover 205 129 112 Profit before tax 15.5 15.6 8.1 Profit after tax 12.5 14.9 7.5 12.3 165 2006 98 15.6 14 2005 78 13.5 12.8 13.5 Source: King's Biscuits Berhad 2009 Annual Report Appendix 2. Silver Bird Five years financial results RM 'million Turnover Profit before tax Profit after tax 2010 Nil. Nil. Nil. 2009 588.9 1.4 1.4 2008 638.6 (23.1) (21.3) 2007 2006 606.5 597.9 (18.4) (49.5) (16.1)| (48.4) 2005 484.7 17.6 22.2 Source: Silver Bird Group Berhad 2009 Annual Report Appendix 3. Appolo Food Holdings Berhad - Five years financial results RM 'million Turnover Profit before tax Profit after tax 2010 Nil. Nil. Nil. 2009 175.3 25.4 21.0 2008 181.1 24.4 21.0 2007 154.3 30.1 24.6 2006 142.4 26.4 20.1 2005 124.4 17.2 14.2 Source: Appolo Foods Holding Berhad 2009 Annual Report [Source: Adapted from Tan Boon In. Garry Tan Wei Han and Ooi Keng Boon (2011), 'King's Biscuits Berhad: Crafting the Next Move?'. Emerald Emerging Markets Case Studies, Vol. 1. No.1, pp. 1-4]Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts