Question: DEAR EXPERT, PLEASE GIVE A DETAILED ANSWER FOR THIS QUESTION. REGARDS, TEAM CHEGG Prepare the Statement of Cash Flows for Messi Plc for the year

DEAR EXPERT, PLEASE GIVE A DETAILED ANSWER FOR THIS QUESTION.

REGARDS, TEAM CHEGG

Prepare the Statement of Cash Flows for Messi Plc for the year ended 31st October 2015 in accordance with International Accounting Standards.

Please answer correct.

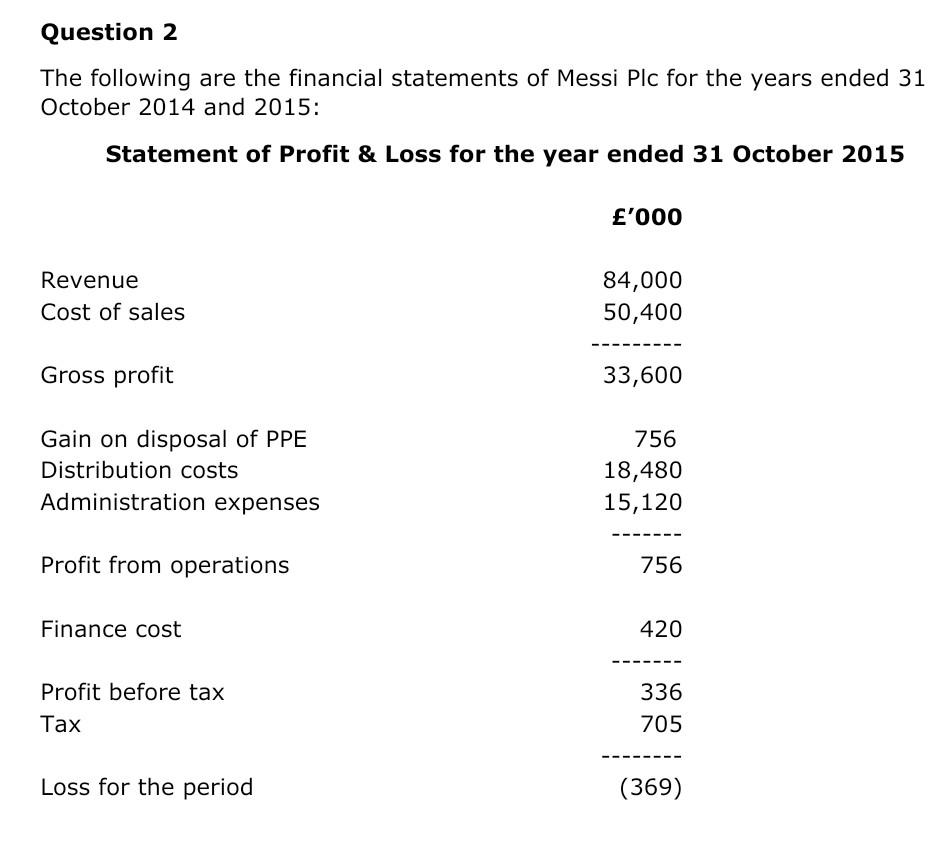

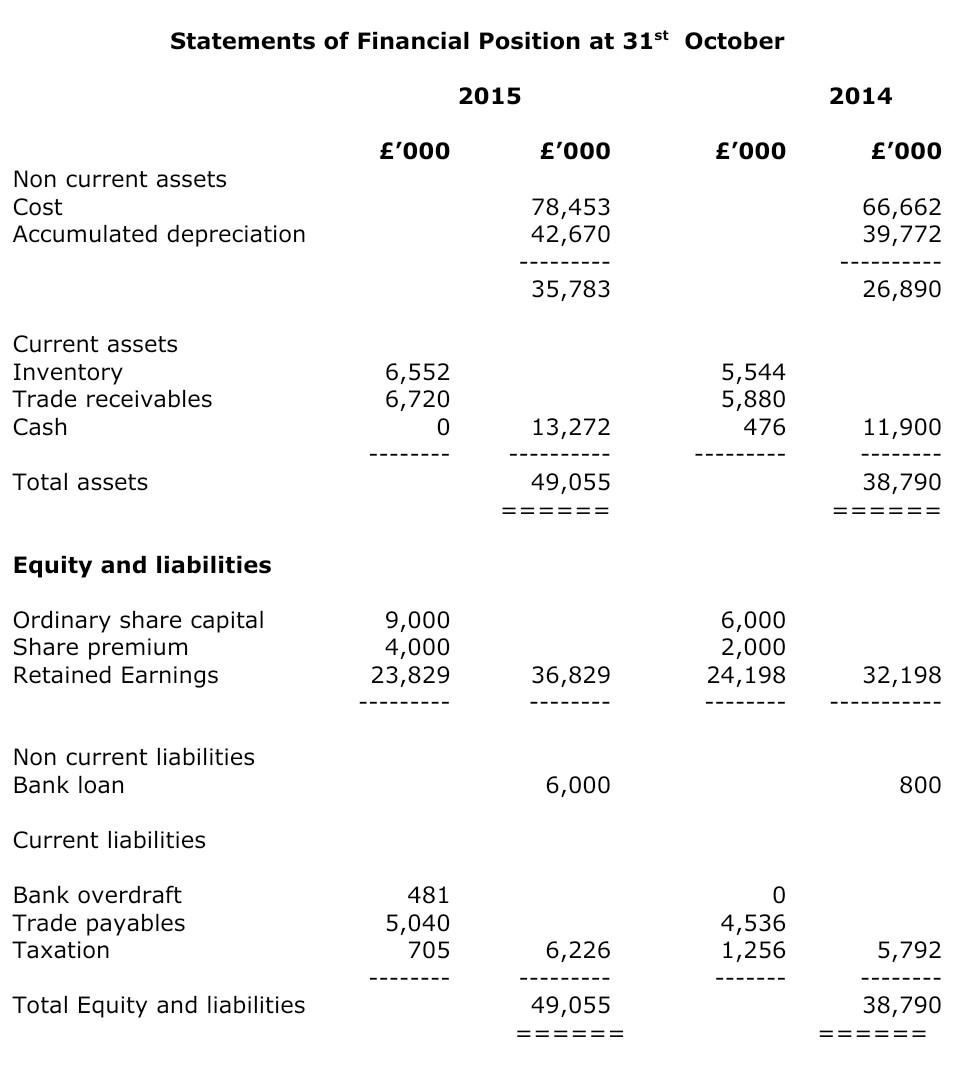

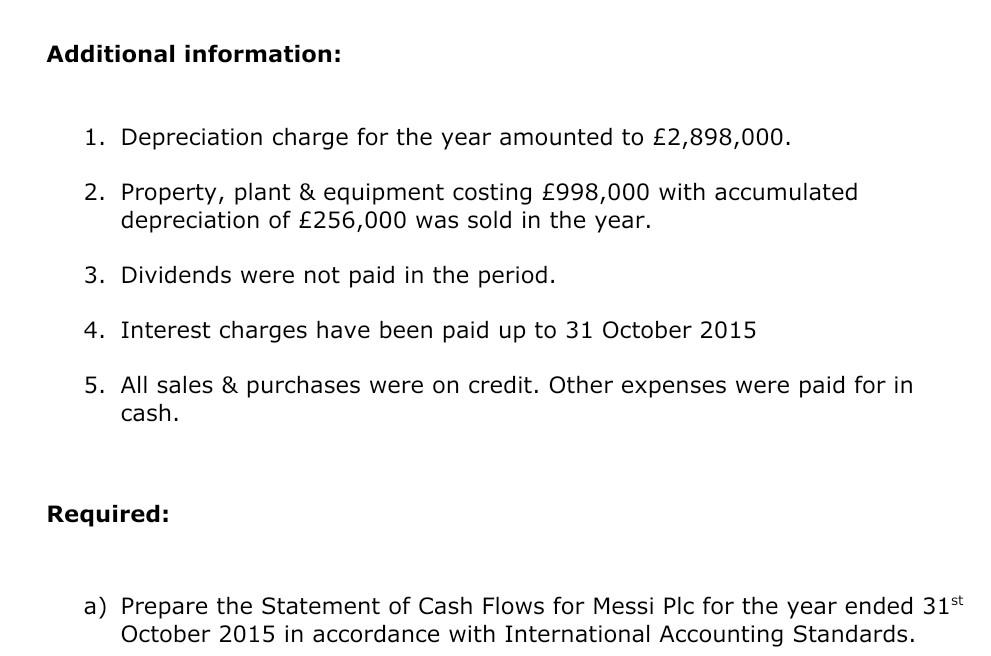

Question 2 The following are the financial statements of Messi Plc for the years ended 31 October 2014 and 2015: Statement of Profit & Loss for the year ended 31 October 2015 '000 Revenue Cost of sales 84,000 50,400 Gross profit 33,600 Gain on disposal of PPE Distribution costs Administration expenses 756 18,480 15,120 Profit from operations 756 Finance cost 420 Profit before tax Tax 336 705 Loss for the period (369) Statements of Financial Position at 31st October 2015 2014 '000 '000 '000 '000 Non current assets Cost Accumulated depreciation 78,453 42,670 66,662 39,772 35,783 26,890 Current assets Inventory Trade receivables Cash 6,552 6,720 0 5,544 5,880 476 13,272 11,900 Total assets 49,055 38,790 ====== ====== Equity and liabilities Ordinary share capital Share premium Retained Earnings 9,000 4,000 23,829 6,000 2,000 24,198 36,829 32,198 Non current liabilities Bank loan 6,000 800 Current liabilities Bank overdraft Trade payables Taxation 481 5,040 705 0 4,536 1,256 6,226 5,792 Total Equity and liabilities 49,055 38,790 Additional information: 1. Depreciation charge for the year amounted to 2,898,000. 2. Property, plant & equipment costing 998,000 with accumulated depreciation of 256,000 was sold in the year. 3. Dividends were not paid in the period. 4. Interest charges have been paid up to 31 October 2015 5. All sales & purchases were on credit. Other expenses were paid for in cash. Required: a) Prepare the Statement of Cash Flows for Messi Plc for the year ended 31st October 2015 in accordance with International Accounting Standards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts