Question: Dear Sir, please double check the answer before submitting. Thanks Question: 2 The risk-free rate is 4 per cent. The expected market rate of return

Dear Sir, please double check the answer before submitting. Thanks

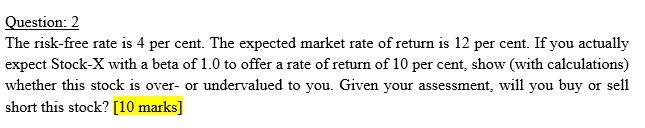

Question: 2 The risk-free rate is 4 per cent. The expected market rate of return is 12 per cent. If you actually expect Stock-X with a beta of 1.0 to offer a rate of return of 10 per cent, show (with calculations) whether this stock is over- or undervalued to you. Given your assessment, will you buy or sell short this stock? [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts