Question: Please help to solve this question, thanks! Question 2 Answer all parts of this question. a) Suppose a firm announces positive earnings growth in the

Please help to solve this question, thanks!

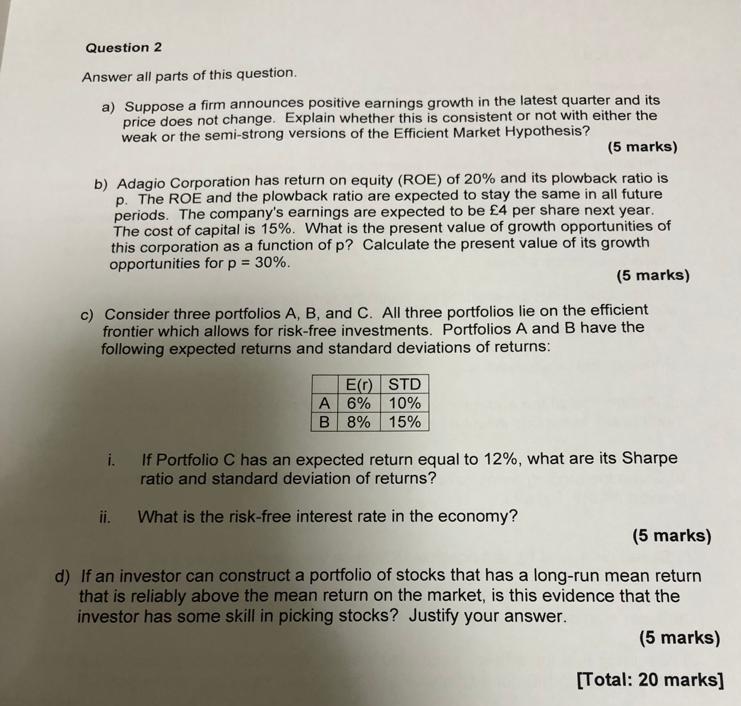

Question 2 Answer all parts of this question. a) Suppose a firm announces positive earnings growth in the latest quarter and its price does not change. Explain whether this is consistent or not with either the weak or the semi-strong versions of the Efficient Market Hypothesis? (5 marks) b) Adagio Corporation has return on equity (ROE) of 20% and its plowback ratio is p. The ROE and the plowback ratio are expected to stay the same in all future periods. The company's earnings are expected to be 4 per share next year. The cost of capital is 15%. What is the present value of growth opportunities of this corporation as a function of p? Calculate the present value of its growth opportunities for p = 30%. (5 marks) c) Consider three portfolios A, B, and C. All three portfolios lie on the efficient frontier which allows for risk-free investments. Portfolios A and B have the following expected returns and standard deviations of returns: EO STD A 6% 10% B 8% 15% i. If Portfolio C has an expected return equal to 12%, what are its Sharpe ratio and standard deviation of returns? ii. What is the risk-free interest rate in the economy? (5 marks) d) If an investor can construct a portfolio of stocks that has a long-run mean return that is reliably above the mean return on the market, is this evidence that the investor has some skill in picking stocks? Justify your answer. (5 marks) [Total: 20 marks] Question 2 Answer all parts of this question. a) Suppose a firm announces positive earnings growth in the latest quarter and its price does not change. Explain whether this is consistent or not with either the weak or the semi-strong versions of the Efficient Market Hypothesis? (5 marks) b) Adagio Corporation has return on equity (ROE) of 20% and its plowback ratio is p. The ROE and the plowback ratio are expected to stay the same in all future periods. The company's earnings are expected to be 4 per share next year. The cost of capital is 15%. What is the present value of growth opportunities of this corporation as a function of p? Calculate the present value of its growth opportunities for p = 30%. (5 marks) c) Consider three portfolios A, B, and C. All three portfolios lie on the efficient frontier which allows for risk-free investments. Portfolios A and B have the following expected returns and standard deviations of returns: EO STD A 6% 10% B 8% 15% i. If Portfolio C has an expected return equal to 12%, what are its Sharpe ratio and standard deviation of returns? ii. What is the risk-free interest rate in the economy? (5 marks) d) If an investor can construct a portfolio of stocks that has a long-run mean return that is reliably above the mean return on the market, is this evidence that the investor has some skill in picking stocks? Justify your answer. (5 marks) [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts