Question: Dear tutor Please help me to answer and understand the follow problem PF Focus Inc. (hereafter, PFI) is considering the impact that an improvement to

Dear tutor

Please help me to answer and understand the follow problem

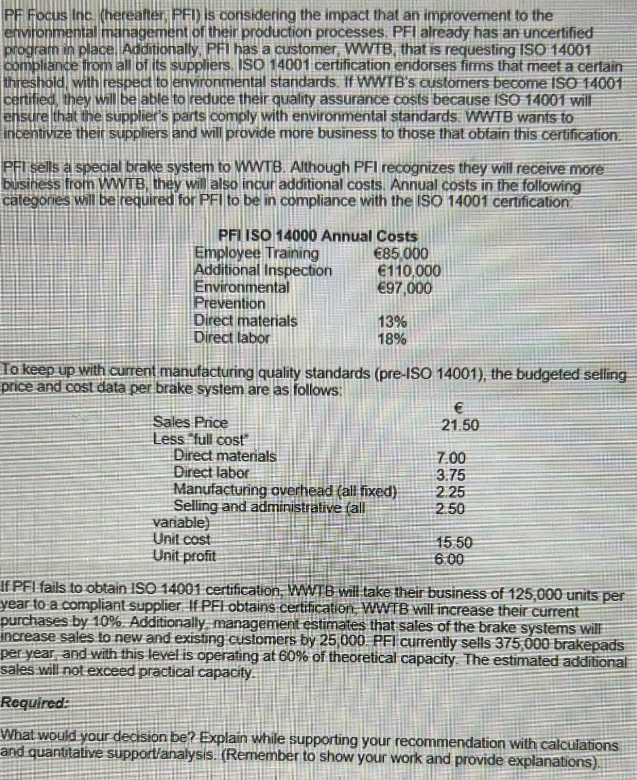

PF Focus Inc. (hereafter, PFI) is considering the impact that an improvement to the environmental management of their production processes. PFI already has an uncertified program in place. Additionally, PFI has a customer, WWTB, that is requesting ISO 14001 compliance from all of its suppliers. ISO 14001 certification endorses firms that meet a certain threshold, with respect to environmental standards. If WWTB's customers become ISO 14001 certified, they will be able to reduce their quality assurance costs because ISO 14001 will ensure that the supplier's parts comply with environmental standards. WWTB wants to incentivize their suppliers and will provide more business to those that obtain this certification. PFlisells a special brake system to WWTB. Although PFI recognizes they will receive more business from WWTB, they will also incur additional costs. Annual costs in the following categories will be required for PFI to be in compliance with the ISO 14001 certification PFI ISO 14000 Annual Costs Employee Training E85 000 Additional Inspection (110,000 Environmental 697,000 Prevention Direct materials 13% Direct labor 18% To keep up with current manufacturing quality standards (pre-ISO 14001), the budgeted selling price and cost data per brake system are as follows: E Sales Price 21.50 Less "full cost" Direct materials 7.00 Direct labor 3.75 Manufacturing overhead (all fixed) 2.25 Selling and administrative fall 2.50 variable) Unit cost 15:50 Unit profit 6:00 If PFI fails to obtain ISO 14001 certification, WWTB will take their business of 125,000 units per year to a compliant supplier. If PFI obtains certification, WWTB will increase their current purchases by 10% Additionally, management estimates that sales of the brake systems will increase sales to new and existing customers by 25,000. PFI currently sells 375,000 brakepads per year, and with this level is operating at 60% of theoretical capacity. The estimated additional sales will not exceed practical capacity. Required: What would your decision be? Explain while supporting your recommendation with calculations and quantitative support/analysis. (Remember to show your work and provide explanations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts