Question: Dear Tutor, Please solve the below mentioned question and provide answers along with proper workings and explanations (pls do not use excel format or excel

Dear Tutor,

Please solve the below mentioned question and provide answers along with proper workings and explanations

(pls do not use excel format or excel formulas to answers the below questions)

THANKS!!

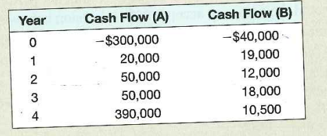

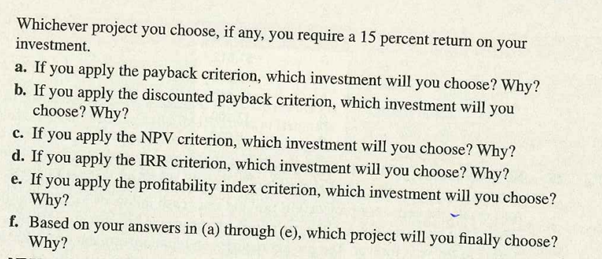

Q1)COMPARING INVESTMENT CRITERIA: Consider the following two mutually exclusive projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts