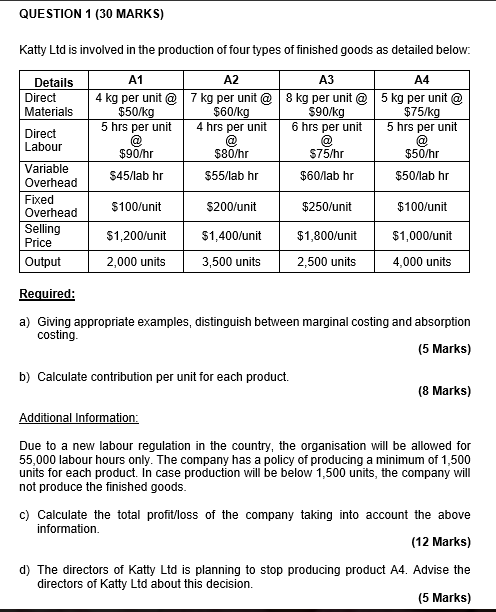

Question: DEC 2018 PAST PAPER QUESTION 1 (30 MARKS) Katty Ltd is involved in the production of four types of finished goods as detailed below: Details

DEC 2018 PAST PAPER

QUESTION 1 (30 MARKS) Katty Ltd is involved in the production of four types of finished goods as detailed below: Details Direct Materials nit@ e kop it @ 5 K9 575K9 Direct Labour A1 A2 A3 A4 4 kg per unit @ 7 kg per unit @ 8 kg per unit @ 5 kg per unit @ $50/kg $60/kg $90/kg 5 hrs per unit 4 hrs per unit 6 hrs per unit 5 hrs per unit @ $90/hr $80/hr $75/hr $50/hr $45/labhr $55/labhr $60/lab hr $50/lab hr $100/unit $200/unit $250/unit $100/unit Variable Overhead Fixed Overhead Selling Price Output $1,800/unit $1,000/unit $1,200/unit 2,000 units $1,400/unit 3,500 units 2,500 units 4,000 units Required: a) Giving appropriate examples, distinguish between marginal costing and absorption costing (5 Marks) b) Calculate contribution per unit for each product. (8 Marks) Additional Information: Due to a new labour regulation in the country, the organisation will be allowed for 55,000 labour hours only. The company has a policy of producing a minimum of 1,500 units for each product. In case production will be below 1,500 units, the company will not produce the finished goods. c) Calculate the total profit/loss of the company taking into account the above information (12 Marks) d) The directors of Katty Ltd is planning to stop producing product A4. Advise the directors of Katty Ltd about this decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts