Question: DECIDING IF ADDITIONAL LIFE INSURANCE IS N E E D E D AND , IF SO , APPROPRIATE TYPE. USE WORKSHEET 8.1. Mark Hawkins 45,

DECIDING IF ADDITIONAL LIFE INSURANCE IS N E E D E D AND , IF SO , APPROPRIATE TYPE. USE WORKSHEET 8.1. Mark Hawkins 45, is a recently divorced father of two children, ages 10 and 7. He currently earns $95,000 a year as an operations manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support and $400 a month in alimony to his ex-wife. She currently earns $35,000 a year as a schoolteacher. Mark is now renting an apartment, and the divorce settlement left him with about $100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Marks ex-wife is currently the beneficiary listed on the policy. What advice would you give to Mark? What factors should he consider in deciding whether to buy additional life insurance at this point in his life? If he does need additional life insurance, what type of policy or policies should he buy? Use Worksheet 8.1 to help answer these questions for Mark

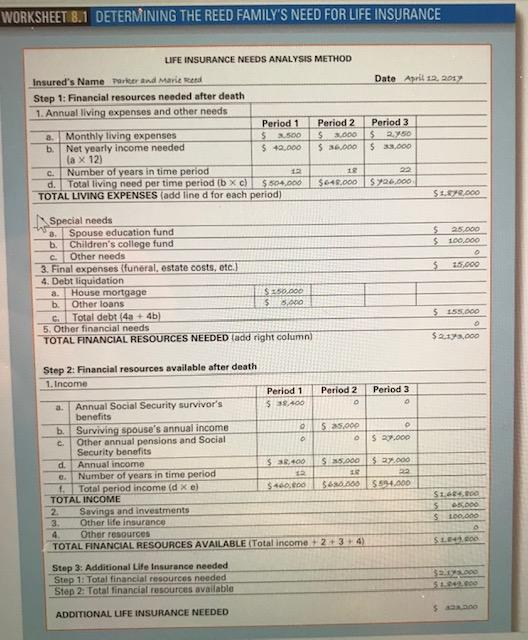

WORKSHEET 8.1 DETERMINING THE REED FAMILY'S NEED FOR LIFE INSURANCE LIFE INSURANCE NEEDS ANALYSIS METHOD Date April 19, 2012 Period 3 $ 2.50 $ 3.000 12 12 26,000 S1.C.DOO Insured's Name Parker and Marie Red Step 1: Financial resources needed after death 1. Annual living expenses and other needs Period 1 Period 2 a. Monthly living expenses 5 500 $ 3.000 b Net yearly income needed $49.000 $36.000 la X 12) Number of years in time period d. Total living need per time period ( bc) $504,000 $646.000 TOTAL LIVING EXPENSES (add line d for each period) Special needs 3. Spouse education fund Children's college fund Other needs 3. Final expenses (funeral, estate costs, etc.) 4. Debt liquidation House mortgage $250.000 b Other loans $ 8.000 C. Total debt (4a + 4b) 5. Other financial needs TOTAL FINANCIAL RESOURCES NEEDED (add right column] $ 25.000 $100,000 5 15.000 $ 55.000 $219.000 Period 3 o $ 27,000 Step 2: Financial resources available after death 1. Income Period 1 Period 2 a. Annual Social Security survivor's $38.400 benefits b. Surviving spouse's annual income 5:25.000 C Other annual pensions and Social O Security benefits d. Annual income $ 3.400 $ 35.000 Number of years in time period 12 Total period income (d xe) $ 400,00 $60.000 TOTAL INCOME 2 Savings and investments 3 Other life insurance 4 Other resources TOTAL FINANCIAL RESOURCES AVAILABLE (Total income +2+3+4) $ 2.000 $ 594.000 S124 5 DOO $ 100.000 SLE Step 3: Additional Life Insurance needed Step 1: Total financial resources needed Step 2. Total financial resources available SEXO 51.42.00 ADDITIONAL LIFE INSURANCE NEEDED WORKSHEET 8.1 DETERMINING THE REED FAMILY'S NEED FOR LIFE INSURANCE LIFE INSURANCE NEEDS ANALYSIS METHOD Date April 19, 2012 Period 3 $ 2.50 $ 3.000 12 12 26,000 S1.C.DOO Insured's Name Parker and Marie Red Step 1: Financial resources needed after death 1. Annual living expenses and other needs Period 1 Period 2 a. Monthly living expenses 5 500 $ 3.000 b Net yearly income needed $49.000 $36.000 la X 12) Number of years in time period d. Total living need per time period ( bc) $504,000 $646.000 TOTAL LIVING EXPENSES (add line d for each period) Special needs 3. Spouse education fund Children's college fund Other needs 3. Final expenses (funeral, estate costs, etc.) 4. Debt liquidation House mortgage $250.000 b Other loans $ 8.000 C. Total debt (4a + 4b) 5. Other financial needs TOTAL FINANCIAL RESOURCES NEEDED (add right column] $ 25.000 $100,000 5 15.000 $ 55.000 $219.000 Period 3 o $ 27,000 Step 2: Financial resources available after death 1. Income Period 1 Period 2 a. Annual Social Security survivor's $38.400 benefits b. Surviving spouse's annual income 5:25.000 C Other annual pensions and Social O Security benefits d. Annual income $ 3.400 $ 35.000 Number of years in time period 12 Total period income (d xe) $ 400,00 $60.000 TOTAL INCOME 2 Savings and investments 3 Other life insurance 4 Other resources TOTAL FINANCIAL RESOURCES AVAILABLE (Total income +2+3+4) $ 2.000 $ 594.000 S124 5 DOO $ 100.000 SLE Step 3: Additional Life Insurance needed Step 1: Total financial resources needed Step 2. Total financial resources available SEXO 51.42.00 ADDITIONAL LIFE INSURANCE NEEDED

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts