Question: Decision and Risk Analysis For a new process, the land was purchased for $ 1 0 million. The fixed capital investment, paid at the end

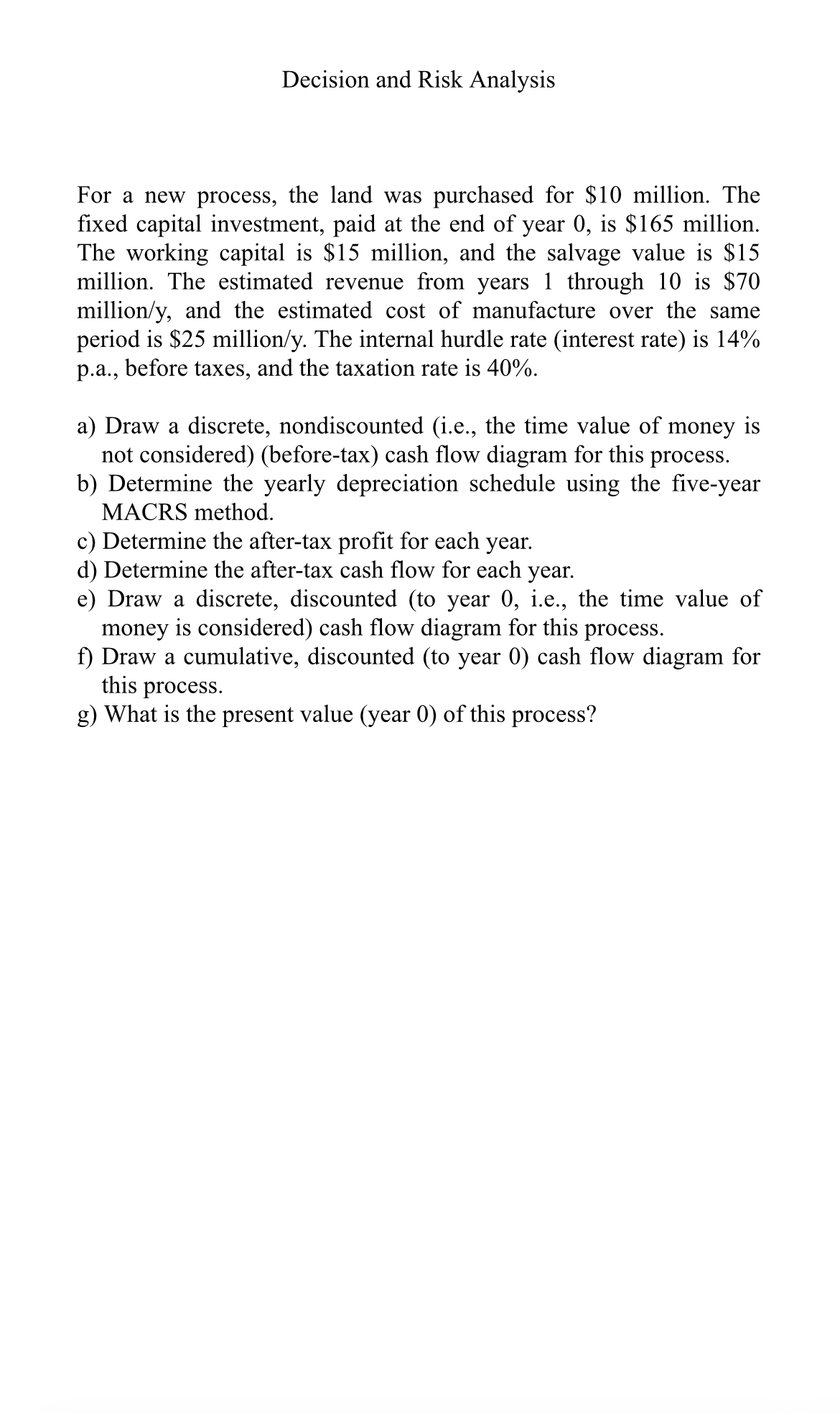

Decision and Risk Analysis

For a new process, the land was purchased for $ million. The fixed capital investment, paid at the end of year is $ million. The working capital is $ million, and the salvage value is $ million. The estimated revenue from years through is $ million and the estimated cost of manufacture over the same period is $ milliony The internal hurdle rate interest rate is pa before taxes, and the taxation rate is

a Draw a discrete, nondiscounted ie the time value of money is not consideredbeforetax cash flow diagram for this process.

b Determine the yearly depreciation schedule using the fiveyear MACRS method.

c Determine the aftertax profit for each year.

d Determine the aftertax cash flow for each year.

e Draw a discrete, discounted to year ie the time value of money is considered cash flow diagram for this process.

f Draw a cumulative, discounted to year cash flow diagram for this process.

g What is the present value year of this process?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock