Question: Decision Process for a Large Development Firm A large development firm is considering bidding on a contract for a new office building complex. The figure

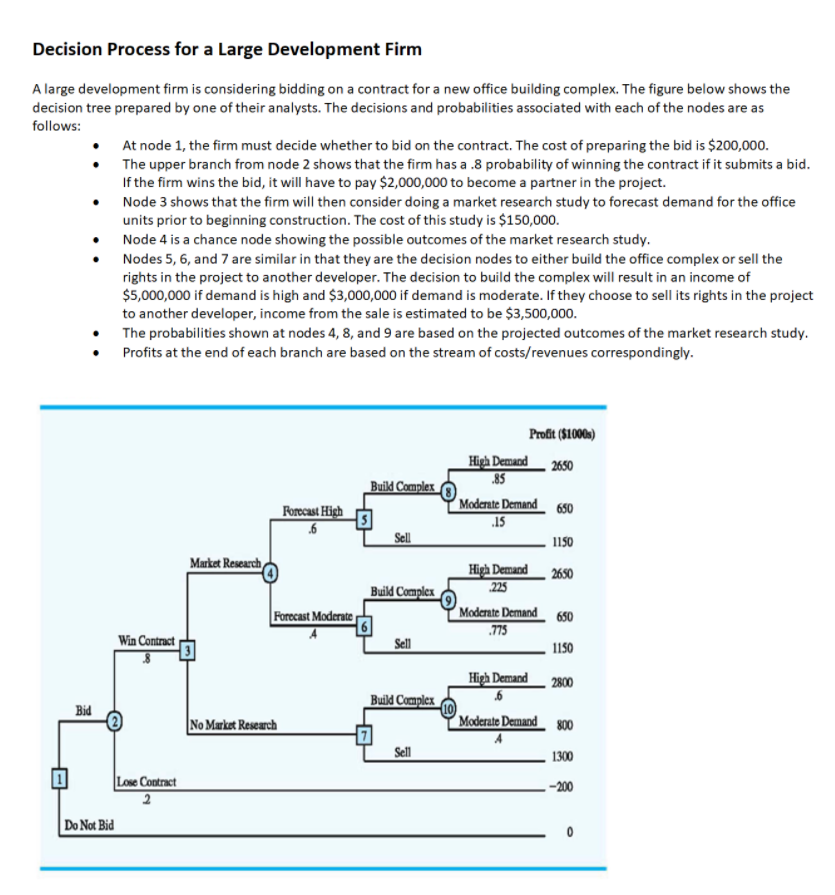

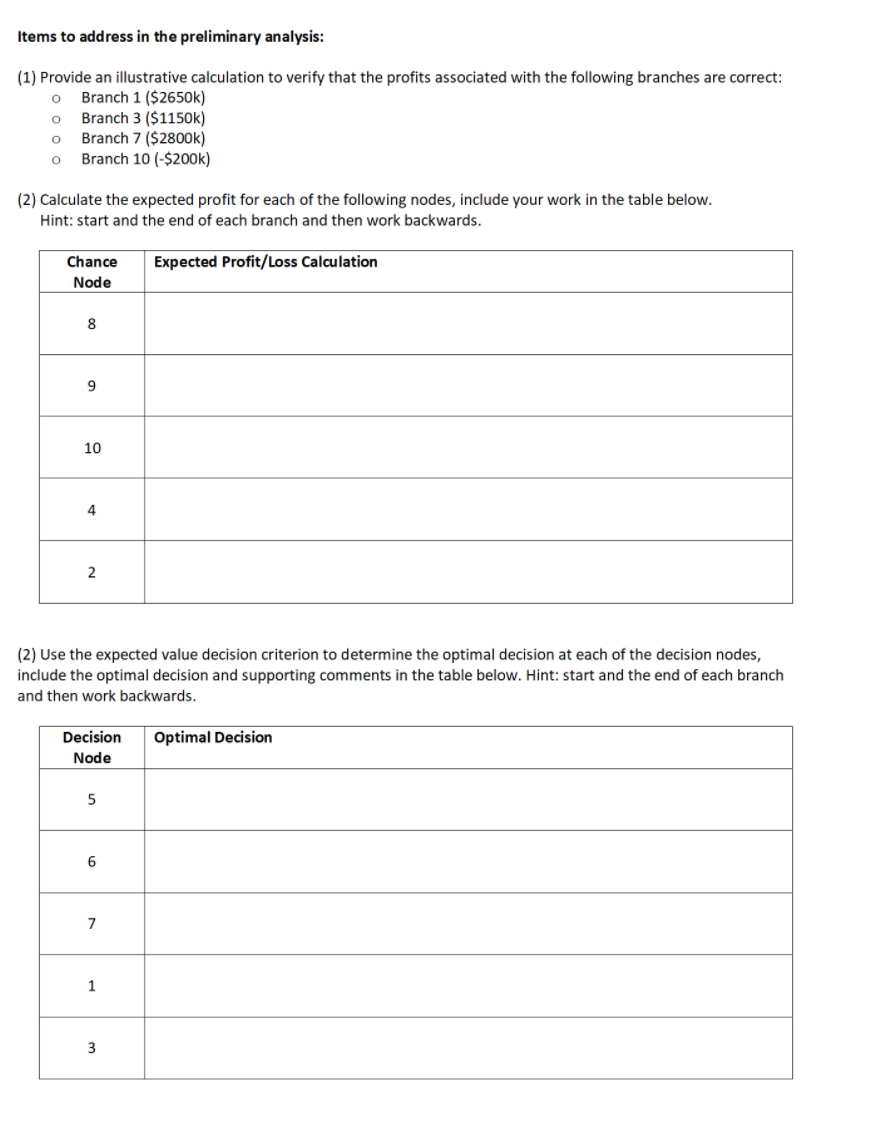

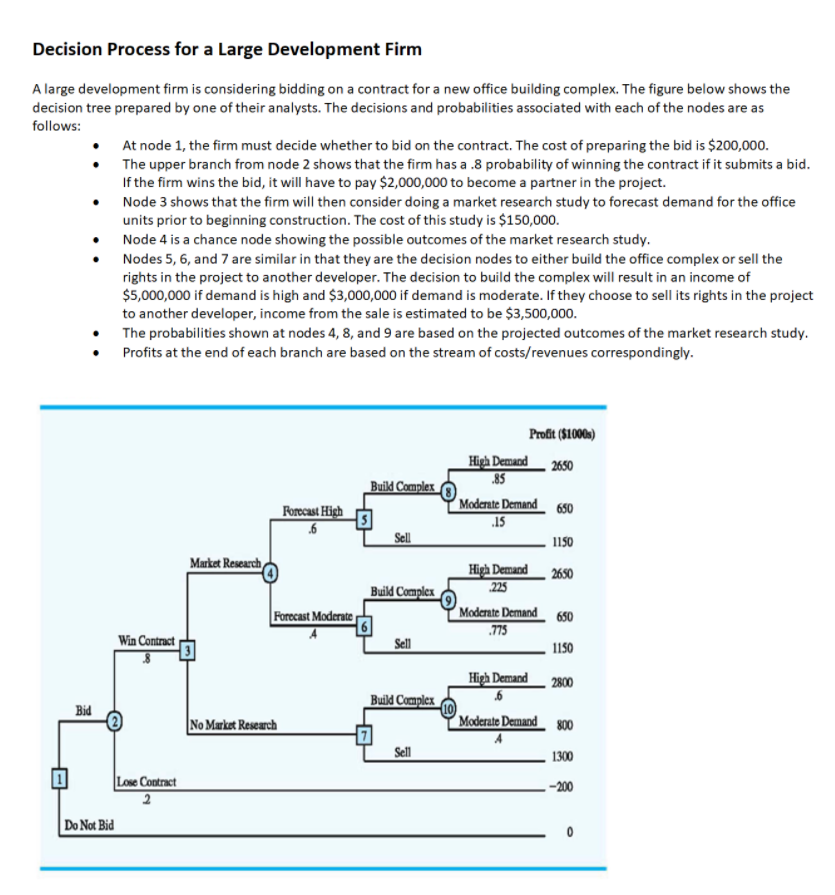

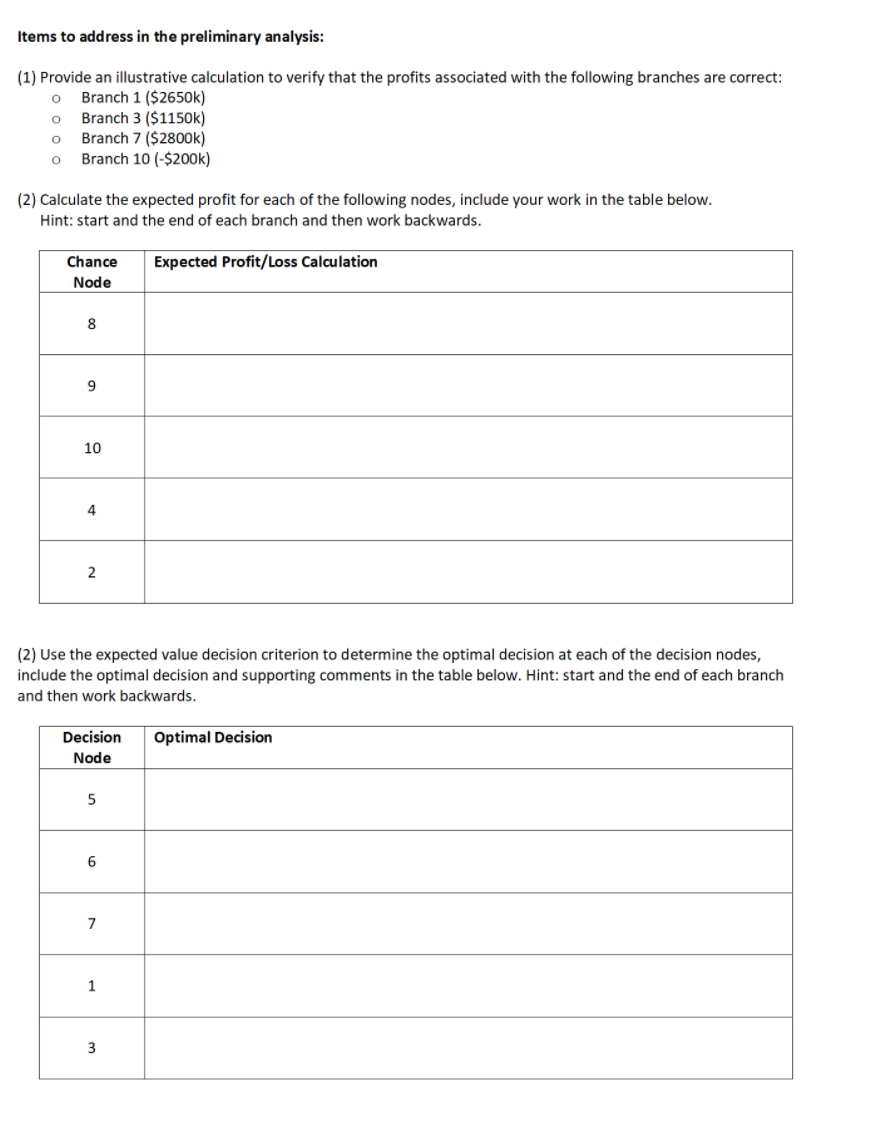

Decision Process for a Large Development Firm A large development firm is considering bidding on a contract for a new office building complex. The figure below shows the decision tree prepared by one of their analysts. The decisions and probabilities associated with each of the nodes are as follows: At node 1, the firm must decide whether to bid on the contract. The cost of preparing the bid is $200,000. The upper branch from node 2 shows that the firm has a .8 probability of winning the contract if it submits a bid. If the firm wins the bid, it will have to pay $2,000,000 to become a partner in the project. Node 3 shows that the firm will then consider doing a market research study to forecast demand for the office units prior to beginning construction. The cost of this study is $150,000. Node 4 is a chance node showing the possible outcomes of the market research study. Nodes 5, 6, and 7 are similar in that they are the decision nodes to either build the office complex or sell the rights in the project to another developer. The decision to build the complex will result in an income of $5,000,000 if demand is high and $3,000,000 if demand is moderate. If they choose to sell its rights in the project to another developer, income from the sale is estimated to be $3,500,000. The probabilities shown at nodes 4, 8, and 9 are based on the projected outcomes of the market research study. Profits at the end of each branch are based on the stream of costs/revenues correspondingly. Build Complex Porecast High Sell Market Research Profit ($1000s) High Demand 2650 .85 Moderate Demand 650 .15 1150 High Demand 2650 .225 Moderate Demand 650 .775 1150 High Demand .6 Moderate Demand 800 Build Complex Forecast Moderate Win Contract 8 Sell 2800 Build Complex Bid No Market Research Sell 1300 .-200 Lose Contract 2 Do Not Bid 0 Items to address in the preliminary analysis: O (1) Provide an illustrative calculation to verify that the profits associated with the following branches are correct: Branch 1 ($2650k) Branch 3 ($1150k) Branch 7 ($2800k) Branch 10 (-$200k) 0 o O (2) Calculate the expected profit for each of the following nodes, include your work in the table below. Hint: start and the end of each branch and then work backwards. Expected Profit/Loss Calculation Chance Node 8 9 10 4 2 (2) Use the expected value decision criterion to determine the optimal decision at each of the decision nodes, include the optimal decision and supporting comments in the table below. Hint: start and the end of each branch and then work backwards. Decision Node Optimal Decision 5 6 7 1 3 3