Question: DEF Ltd started to construct a factory on 1 April 2020; it incurred $40 million and $100 million on 1 April 2020 and 1

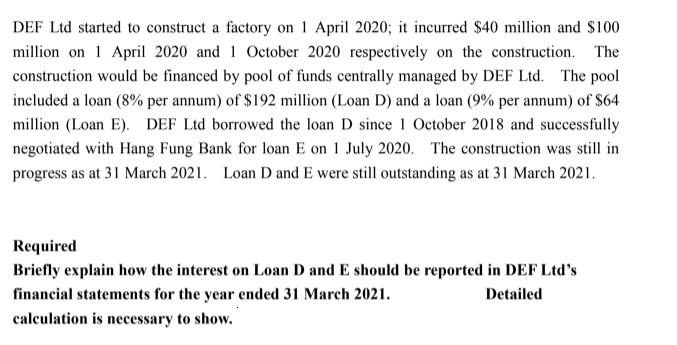

DEF Ltd started to construct a factory on 1 April 2020; it incurred $40 million and $100 million on 1 April 2020 and 1 October 2020 respectively on the construction. The construction would be financed by pool of funds centrally managed by DEF Ltd. The pool included a loan (8% per annum) of $192 million (Loan D) and a loan (9% per annum) of $64 million (Loan E). DEF Ltd borrowed the loan D since 1 October 2018 and successfully negotiated with Hang Fung Bank for loan E on 1 July 2020. The construction was still in progress as at 31 March 2021. Loan D and E were still outstanding as at 31 March 2021. Required Briefly explain how the interest on Loan D and E should be reported in DEF Ltd's financial statements for the year ended 31 March 2021. Detailed calculation is necessary to show.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

A The company had 8 Loan of 192 mn wef 010420 while 9 Loan of 64 mn w... View full answer

Get step-by-step solutions from verified subject matter experts