Question: = Deferred perpetuity is a perpetuity with its first payment starting at some point of time in the future. If the deferred perpetuity starts

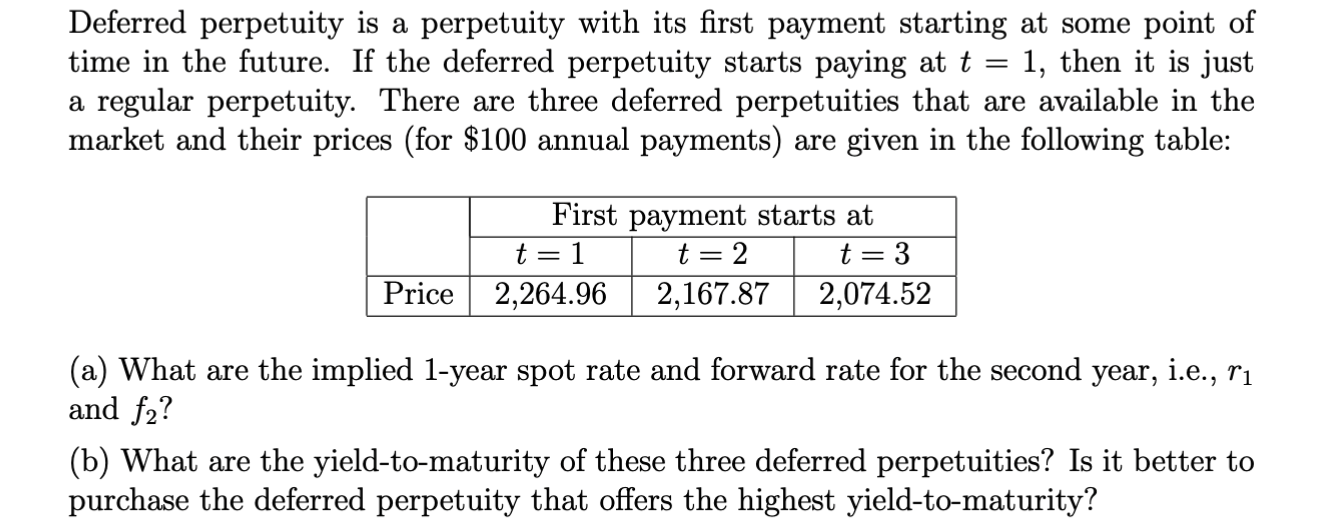

= Deferred perpetuity is a perpetuity with its first payment starting at some point of time in the future. If the deferred perpetuity starts paying at t 1, then it is just a regular perpetuity. There are three deferred perpetuities that are available in the market and their prices (for $100 annual payments) are given in the following table: Price First payment starts at t = 2 2,167.87 t = 1 2,264.96 t = 3 2,074.52 r1 (a) What are the implied 1-year spot rate and forward rate for the second year, i.e., and f? (b) What are the yield-to-maturity of these three deferred perpetuities? Is it better to purchase the deferred perpetuity that offers the highest yield-to-maturity?

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

To determine the implied 1year spot rate r and the forward rate for the second year f2 we can use th... View full answer

Get step-by-step solutions from verified subject matter experts