Question: Define Monetary Policy Tell how the Fed was created Draw the pyramid Define all of the parts of the pyramid, tell # of members and

Define Monetary Policy

Tell how the Fed was created

Draw the pyramid

Define all of the parts of the pyramid, tell # of members and term limits if given for each.

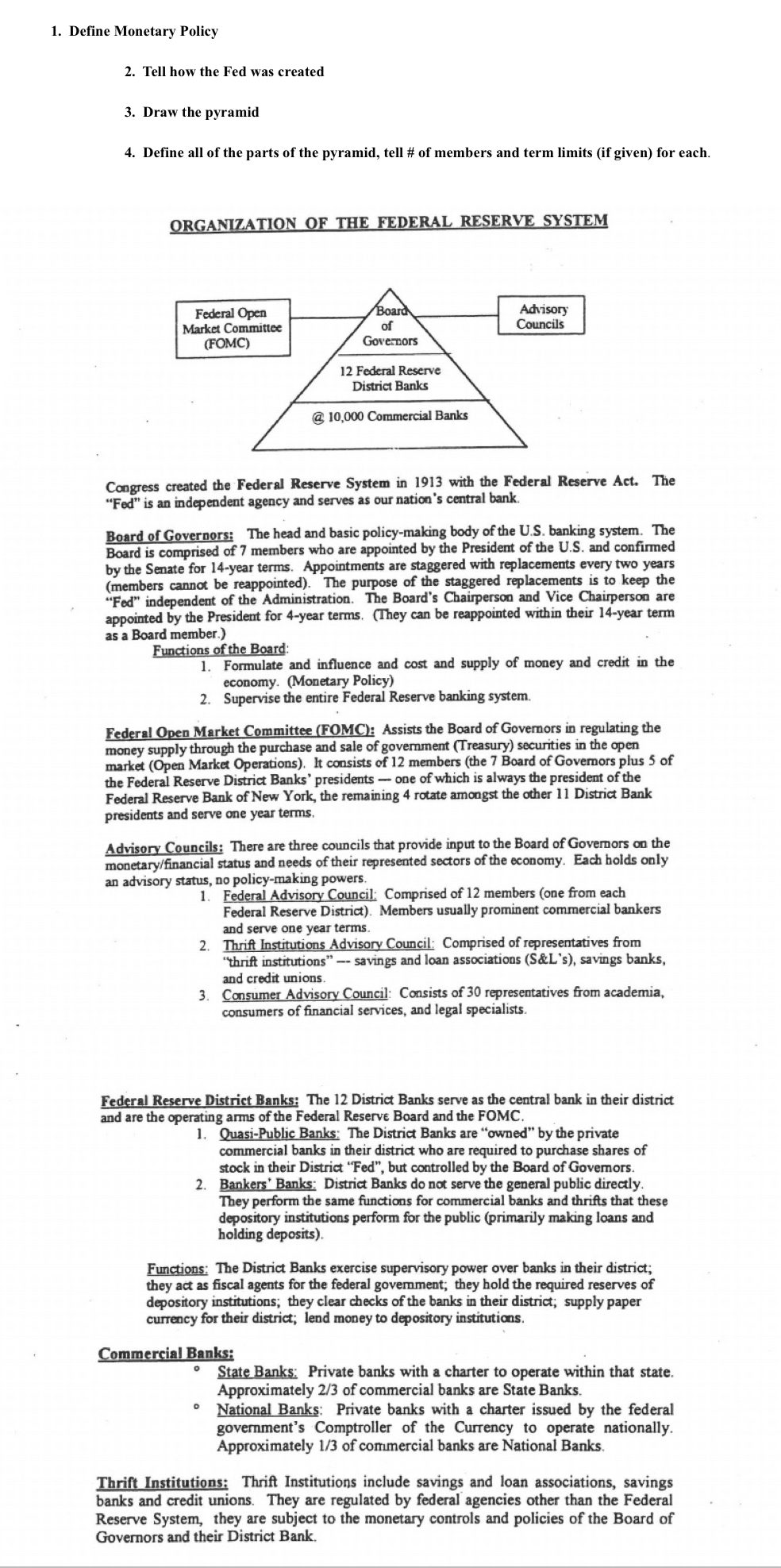

ORGANIZATION OF THE FEDERAL RESERVE SYSTEM

Congress created the Federal Reserve System in with the Federal Reserve Act. The "Fed" is an independent agency and serves as our nation's central bank.

Board of Governors: The head and basic policymaking body of the US banking system. The Board is comprised of members who are appointed by the President of the US and confirmed by the Senate for year terms. Appointments are staggered with replacements every two years members cannot be reappointed The purpose of the staggered replacements is to keep the "Fed" independent of the Administration. The Board's Chairperson and Vice Chairperson are appointed by the President for year terms. They can be reappointed within their year term as a Board member.

Functions of the Board:

Formulate and influence and cost and supply of money and credit in the economy. Monetary Policy

Supervise the entire Federal Reserve banking system.

Federal Open Market Committee FOMC: Assists the Board of Governors in regulating the money supply through the purchase and sale of govemment Treasury securities in the open market Open Market Operations It consists of members the Board of Govemors plus of the Federal Reserve District Banks' presidents one of which is always the president of the Federal Reserve Bank of New York, the remaining rotate amongst the other District Bank presidents and serve one year terms.

Advisory Councils: There are three councils that provide input to the Board of Governors on the monetaryfinancial status and needs of their represented sectors of the economy. Each holds only an advisory status, no policymaking powers.

Federal Advisory Council: Comprised of members one from each Federal Reserve District Members usually prominent commercial bankers and serve one year terms.

Thrift Institutions Advisory Council: Comprised of representatives from "thrift institutions" savings and loan associations S&Ls savings banks, and credit unions.

Consumer Advisory Council: Consists of representatives from academia, consumers of financial services, and legal specialists.

Federal Reserve District Banks: The District Banks serve as the central bank in their district and are the operating arms of the Federal Reserve Board and the FOMC.

QuasiPublic Banks: The District Banks are "owned" by the private commercial banks in their district who are required to purchase shares of stock in their District "Fed", but controlled by the Board of Govemors.

Bankers' Banks: District Banks do not serve the general public directly. They perform the same functions for commercial banks and thrifts that these depository institutions perform for the public primarily making loans and holding deposits

Functions: The District Banks exercise supervisory power over banks in their district; they act as fiscal agents for the federal govemment; they hold the required reserves of depository institutions; they clear checks of the banks in their district; supply paper currency for their district; lend money to depository institutions.

Commercial Banks:

State Banks: Private banks with a charter to operate within that state. Approximately of commercial banks are State Banks.

National Banks: Private banks with a charter issued by the federal government's Comptroller of the Currency to operate nationally. Approximately of commercial banks are National Banks.

Thrift Institutions: Thrift Institutions include savings and loan associations, savings banks and credit unions. They are regulated by federal agencies other than the Federal Reserve System, they are subject to the monetary controls and policies of the Board of Governors and their District Bank.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock