Question: Define the following terms: Risk-free rate = Rf Rm = Return on a Publicly Traded Equity Market Risk Premium(MRP) = Rm - Rf Investment Risk

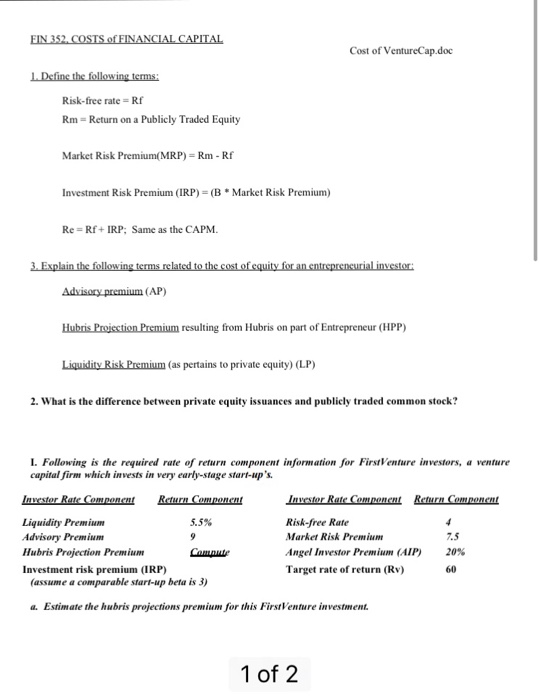

Define the following terms: Risk-free rate = Rf Rm = Return on a Publicly Traded Equity Market Risk Premium(MRP) = Rm - Rf Investment Risk Premium (IRP) = (B^* Market Risk Premium) Re = Rf + IRP; Same as the CAPM. Explain the following terms related to the cost of equity for an entrepreneurial investor: Advisory premium (AP) Hubris Projection Premium resulting from Hubris on part of Entrepreneur (HPP) Liquidity Risk Premium (as pertains to private equity) (LP) What is the difference between private equity issuances and publicly traded common stock? Following is the required rate of return component information for FirstVenture investors, a venture capital firm which invests in very early-stage start-up's. a. Estimate the hubris projections premium for this FirstVenture investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts