Question: Definition and True/False Sample Questions (10 points) 1) A covered call is a call for which... a. The seller covers it with a piece of

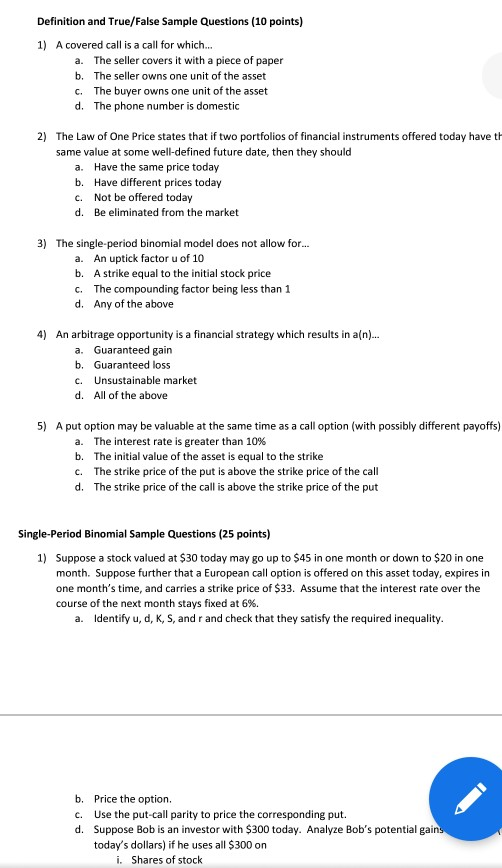

Definition and True/False Sample Questions (10 points) 1) A covered call is a call for which... a. The seller covers it with a piece of paper b. The seller owns one unit of the asset C. The buyer owns one unit of the asset d. The phone number is domestic 2) The Law of One Price states that if two portfolios of financial instruments offered today have th same value at some well-defined future date, then they should a. Have the same price today b. Have different prices today c. Not be offered today d. Be eliminated from the market 3) The single period binomial model does not allow for... a. An uptick factor u of 10 b. A strike equal to the initial stock price C. The compounding factor being less than 1 d. Any of the above 4) An arbitrage opportunity is a financial strategy which results in an)... a. Guaranteed gain b. Guaranteed loss c. Unsustainable market d. All of the above 5) A put option may be valuable at the same time as a call option (with possibly different payoffs) a. The interest rate is greater than 10% b. The initial value of the asset is equal to the strike c. The strike price of the put is above the strike price of the call d. The strike price of the call is above the strike price of the put Single-Period Binomial Sample Questions (25 points) 1) Suppose a stock valued at $30 today may go up to $45 in one month or down to $20 in one month. Suppose further that a European call option is offered on this asset today, expires in one month's time, and carries a strike price of $33. Assume that the interest rate over the course of the next month stays fixed at 6%. a identify u, d, K, S, and r and check that they satisfy the required inequality. b. Price the option. c. Use the put-call parity to price the corresponding put. d. Suppose Bob is an investor with $300 today. Analyze Bob's potential gains today's dollars) if he uses all $300 on i. Shares of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts