Question: Definitions: Bond features (coupons, face value or par value, coupon, coupon rate, maturity, etc.) . Bond valuation: solve for YTM, PV, N and coupons (payments)

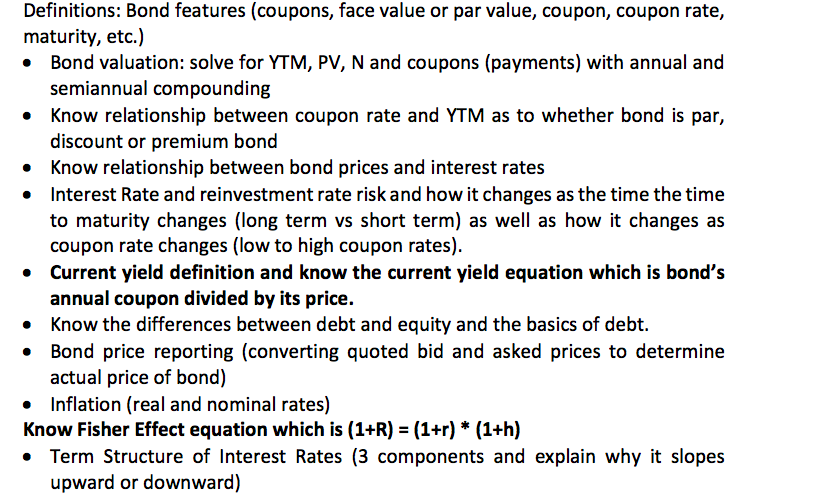

Definitions: Bond features (coupons, face value or par value, coupon, coupon rate, maturity, etc.) . Bond valuation: solve for YTM, PV, N and coupons (payments) with annual and semiannual compounding . Know relationship between coupon rate and YTM as to whether bond is par, discount or premium bond Know relationship between bond prices and interest rates . Interest Rate and reinvestment rate riskand how it changes as the time the time to maturity changes (long term vs short term) as well as how it changes as coupon rate changes (low to high coupon rates) .Current yield definition and know the current yield equation which is bond's annual coupon divided by its price. Know the differences between debt and equity and the basics of debt. Bond price reporting (converting quoted bid and asked prices to determine actual price of bond) . . Inflation (real and nominal rates) Know Fisher Effect equation which is (1+R) (1+r)*(1+h) . Term Structure of Interest Rates (3 components and explain why it slopes upward or downward) Definitions: Bond features (coupons, face value or par value, coupon, coupon rate, maturity, etc.) . Bond valuation: solve for YTM, PV, N and coupons (payments) with annual and semiannual compounding . Know relationship between coupon rate and YTM as to whether bond is par, discount or premium bond Know relationship between bond prices and interest rates . Interest Rate and reinvestment rate riskand how it changes as the time the time to maturity changes (long term vs short term) as well as how it changes as coupon rate changes (low to high coupon rates) .Current yield definition and know the current yield equation which is bond's annual coupon divided by its price. Know the differences between debt and equity and the basics of debt. Bond price reporting (converting quoted bid and asked prices to determine actual price of bond) . . Inflation (real and nominal rates) Know Fisher Effect equation which is (1+R) (1+r)*(1+h) . Term Structure of Interest Rates (3 components and explain why it slopes upward or downward)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts