Question: Question 1: Bond Valuation (20 marks) (a) IKO Ent Ltd is planning to issue 7-year bonds with semi-annual coupon payments. The market interest rate for

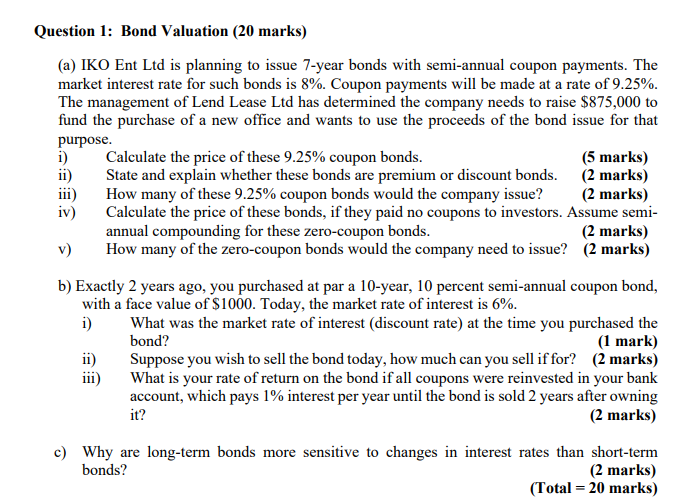

Question 1: Bond Valuation (20 marks) (a) IKO Ent Ltd is planning to issue 7-year bonds with semi-annual coupon payments. The market interest rate for such bonds is 8%. Coupon payments will be made at a rate of 9.25%. The management of Lend Lease Ltd has determined the company needs to raise $875,000 to fund the purchase of a new office and wants to use the proceeds of the bond issue for that purpose. i) Calculate the price of these 9.25% coupon bonds. (5 marks) ii) State and explain whether these bonds are premium or discount bonds. (2 marks) iii) How many of these 9.25% coupon bonds would the company issue? (2 marks) iv) Calculate the price of these bonds, if they paid no coupons to investors. Assume semi- annual compounding for these zero-coupon bonds. (2 marks) v) How many of the zero-coupon bonds would the company need to issue? (2 marks) b) Exactly 2 years ago, you purchased at par a 10-year, 10 percent semi-annual coupon bond, with a face value of $1000. Today, the market rate of interest is 6%. i) What was the market rate of interest (discount rate) at the time you purchased the bond? (1 mark) ii) Suppose you wish to sell the bond today, how much can you sell if for? (2 marks) iii) What is your rate of return on the bond if all coupons were reinvested in your bank account, which pays 1% interest per year until the bond is sold 2 years after owning (2 marks) it? c) Why are long-term bonds more sensitive to changes in interest rates than short-term bonds? (2 marks) (Total = 20 marks) Question 1: Bond Valuation (20 marks) (a) IKO Ent Ltd is planning to issue 7-year bonds with semi-annual coupon payments. The market interest rate for such bonds is 8%. Coupon payments will be made at a rate of 9.25%. The management of Lend Lease Ltd has determined the company needs to raise $875,000 to fund the purchase of a new office and wants to use the proceeds of the bond issue for that purpose. i) Calculate the price of these 9.25% coupon bonds. (5 marks) ii) State and explain whether these bonds are premium or discount bonds. (2 marks) iii) How many of these 9.25% coupon bonds would the company issue? (2 marks) iv) Calculate the price of these bonds, if they paid no coupons to investors. Assume semi- annual compounding for these zero-coupon bonds. (2 marks) v) How many of the zero-coupon bonds would the company need to issue? (2 marks) b) Exactly 2 years ago, you purchased at par a 10-year, 10 percent semi-annual coupon bond, with a face value of $1000. Today, the market rate of interest is 6%. i) What was the market rate of interest (discount rate) at the time you purchased the bond? (1 mark) ii) Suppose you wish to sell the bond today, how much can you sell if for? (2 marks) iii) What is your rate of return on the bond if all coupons were reinvested in your bank account, which pays 1% interest per year until the bond is sold 2 years after owning (2 marks) it? c) Why are long-term bonds more sensitive to changes in interest rates than short-term bonds? (2 marks) (Total = 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts