Question: Dell Computers [1] Dell Computers1 Introduction Dell Computers was founded by Michael Dell in 1984 and has its corporate headquarters in Round Rock, Texas. Michael

Dell Computers[1]

![Dell Computers[1] Dell Computers1 Introduction Dell Computers was founded by Michael Dell](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f8306a5142c_35466f8306a33e36.jpg)

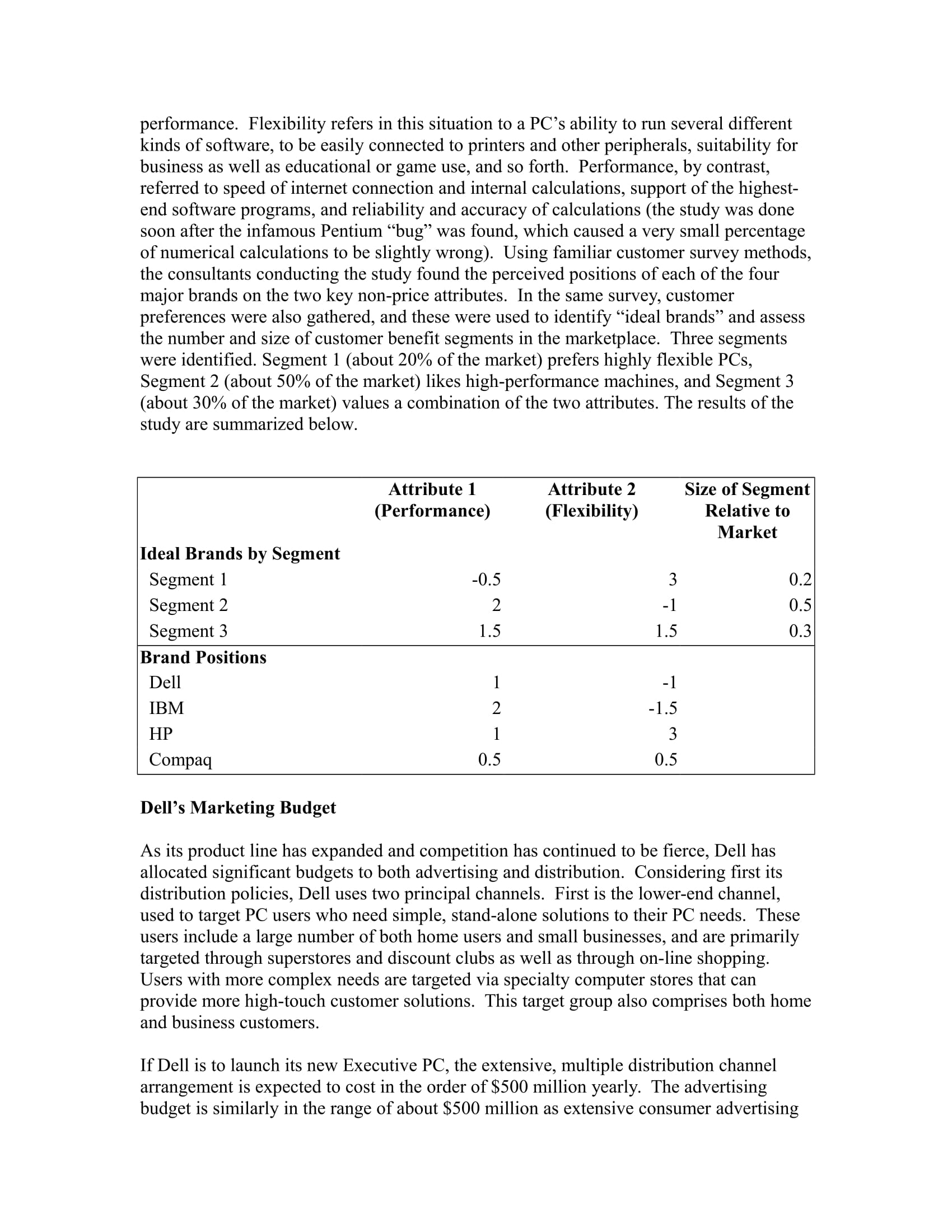

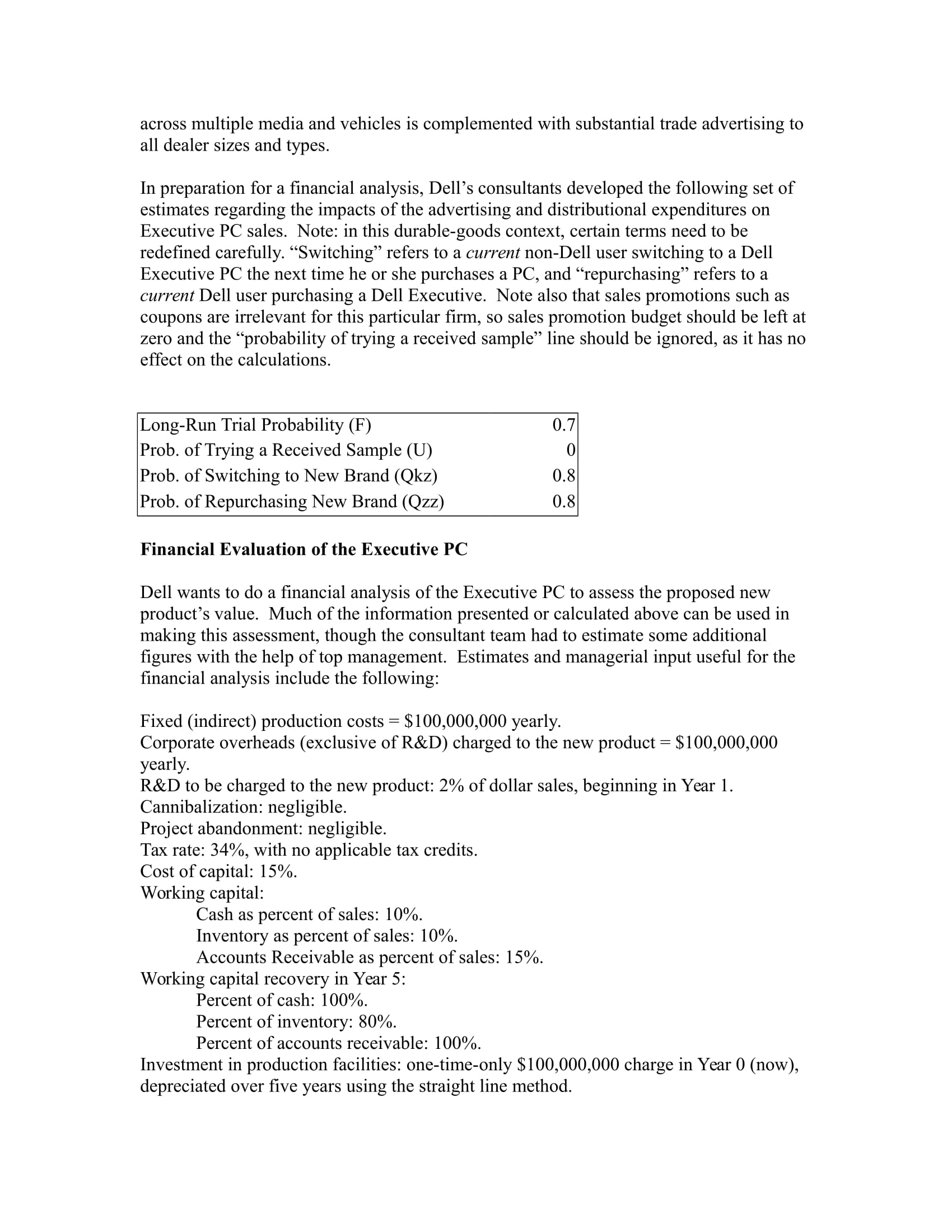

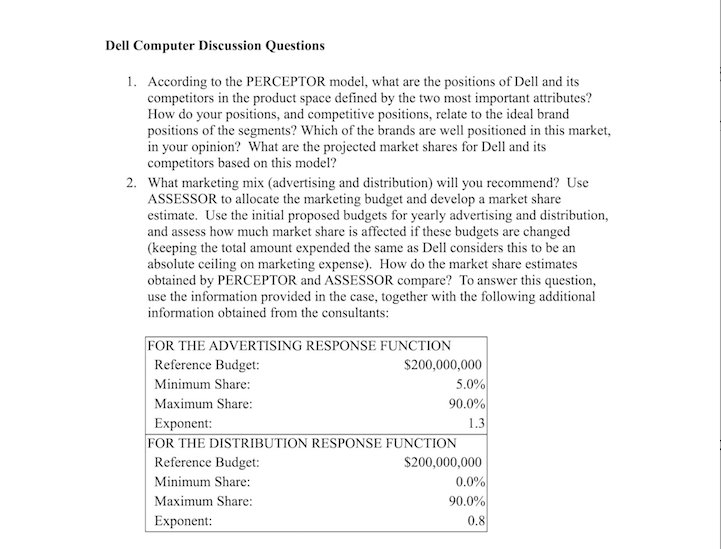

Dell Computers1 Introduction Dell Computers was founded by Michael Dell in 1984 and has its corporate headquarters in Round Rock, Texas. Michael Dell's winning idea was to sell computer systems directly to customers, allowing him and his company to understand customer needs well and therefore to provide the customer with the most appropriate computing solutions. Dell still practices the direct business model, saving time and cost by bypassing retailers and passing on the cost savings to the customer. Dell takes pride in its ability to provide customers with the most up-to-date technology more quickly than its competitors that still rely on slower indirect distribution channels. Dell has a major presence on the intemet, having launched dell.com in 1994. By 1997, Dell was generating $1 million daily in online sales the rst company to achieve this mark. At de11.c0m, customers can put together their own computer system, order it online, and track its ow om manufacturing to shipping. Dell also offers its premier.dell.com Web pages, allowing business and institutional customers to conduct online business. Currently, Dell receives about two billion page requests per quarter, covering 81 country sites, 28 languages and dialects, and in 26 different currencies. The Computer Industry The market for personal computers has been growing rapidly for several years with little end in sight. As of the end of the year 2000, approximately 120 million PCs were sold worldwide. Projections for the next ve years of industry sales are as shown below: Year 2001 2002 2003 2004 2005 Market Size inmillions Competition The PC industry has four major competitors: IBM, Dell, Compaq, and Hewlett-Packard (HP). All four make and sell competitive mid-range performance PCs, with the typical configuration for home or small business use costing approximately $1000. Dell's variable costs per unit total about $800, and it is believed that competitors face a similar variable cost structure. The Executive would be priced competitively, at about the same price level of $1000. A recent study of the home/smallbusiness PC market found that most customers considered two important non-price attributes when selecting a PC, exibility and ' This case was written by Prof. C. Anthony Di Benedetto and is based on public information, including information at www.dell.com. The \"Executive\" is a disguised product name. Market size and market share information is realistic for the leading competitors. Note that there are more than four key players in the computer industry but that some simplifying assumptions were made for the sake of presentation. Positioning information and company/industry nancial information is not based on fact but is meant to illustrate concepts of product positioning, advertising decision-making, and nancial analysis. performance. Flexibility refers in this situation to a PCS ability to run several different kinds of software, to be easily connected to printers and other peripherals, suitability for business as well as educational or game use, and so forth. Performance, by contrast, referred to speed of intemet connection and internal calculations, support of the highest- end software programs, and reliability and accuracy of calculations (the study was done soon after the infamous Pentium \"bug\" was found, which caused a very small percentage of numerical calculations to be slightly wrong). Using familiar customer survey methods, the consultants conducting the study found the perceived positions of each of the four major brands on the two key non-price attributes. In the same survey, customer preferences were also gathered, and these were used to identify \"ideal brands\" and assess the number and size of customer benet segments in the marketplace. Three segments were identied. Segment 1 (about 20% of the market) prefers highly exible PCs, Segment 2 (about 50% of the market) likes high-performance machines, and Segment 3 (about 30% of the market) values a combination of the two attributes. The results of the study are summarized below. Attribute 1 Attribute 2 Size of Segment (Performance) (Flexibility) Relative to Market Ideal Brands by Segment Segment 1 Segment 2 Segment 3 Brand Positions Dell 1 IBM 2 -l .5 HP 1 Compaq 0.5 Dell's Marketing Budget As its product line has expanded and competition has continued to be erce, Dell has allocated signicant budgets to both advertising and distribution. Considering rst its distribution policies, Dell uses two principal channels. First is the lower-end channel, used to target PC users who need simple, stand-alone solutions to their PC needs. These users include a large number of both home users and small businesses, and are primarily targeted through superstores and discount clubs as well as through online shopping. Users with more complex needs are targeted via specialty computer stores that can provide more high-touch customer solutions. This target group also comprises both home and business customers. If Dell is to launch its new Executive PC, the extensive, multiple distribution channel arrangement is expected to cost in the order of $500 million yearly. The advertising budget is similarly in the range of about $500 million as extensive consumer advertising across multiple media and vehicles is complemented with substantial trade advertising to all dealer sizes and types. In preparation for a nancial analysis, Dell's consultants developed the following set of estimates regarding the impacts of the advertising and distributional expenditures on Executive PC sales. Note: in this durable-goods context, certain terms need to be redened carefully. \"Switching\" refers to a current non-Dell user switching to a Dell Executive PC the next time he or she purchases a PC, and \"repurchasing\" refers to a current Dell user purchasing a Dell Executive. Note also that sales promotions such as coupons are irrelevant for this particular rm, so sales promotion budget should be left at zero and the \"probability of trying a received sample\" line should be ignored, as it has no effect on the calculations. Long-Run Trial Probability (F) Prob. of Trying a Received Sample (U) 0 Prob. of Switching to New Brand (ka) 0.8 Prob. of Repurchasing New Brand (sz) 0.8 Financial Evaluation of the Executive PC Dell wants to do a nancial analysis of the Executive PC to assess the proposed new product's value. Much of the information presented or calculated above can be used in making this assessment, though the consultant team had to estimate some additional gures with the help of top management, Estimates and managerial input useful for the nancial analysis include the following: Fixed (indirect) production costs = $100,000,000 yearly. Corporate overheads (exclusive of R&D) charged to the new product = $100,000,000 yearly. R&D to be charged to the new product: 2% of dollar sales, beginning in Year 1. Cannibalization: negligible. Project abandonment: negligible. Tax rate: 34%, with no applicable tax credits. Cost of capital: 15%. Working capital: Cash as percent of sales: 10%. Inventory as percent of sales: 10%. Accounts Receivable as percent of sales: 15%. Working capital recovery in Year 5 : Percent of cash: 100%. Percent of inventory: 80%. Percent of accounts receivable: 100%. Investment in production facilities: one-time-only $100,000,000 charge in Year 0 (now), depreciated over ve years using the straight line method. Dell Computer Discussion Questions 1 . According to the PERCEPTOR model , what are the positions of Well and its* competitors in the product space defined by the two most important attributes! How do your positions , and competitive positions , relate to the ideal brand* positions of the segments ? Which of the brands are well positioned in this market . in your opinion ?" What are the projected market shares for Dell and its competitors based on this model ?" 2 . What marketing mix ( advertising and distribution ; will you recommend ?" USE ASSESSOR to allocate the marketing budget and develop a market share* estimate . Use the initial proposed budgets for yearly advertising and distribution , and assess how much market share is affected if these budgets are changed ( Keeping the total amount expended the same as Dell considers this to be an absolute ceiling on marketing expenses . How do the market share estimates* obtained by PERCEPTOR And ASSESSOR compare ? To answer this question , use the information provided in the case , together with the following additional information obtained from the consultants :" FOR THE ADVERTISING RESPONSE FUNCTION Reference Budget :* $2010.01010. 000 Minimum Share ! 5. 0196 Maximum Share * 90. 01%/} Exponent ! 1 . 3 FOR THE DISTRIBUTION RESPONSE FUNCTION Reference Budget* $200,000, 000 Minimum Share :" Maximum Share * 90. 019/0 Exponent ."

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts