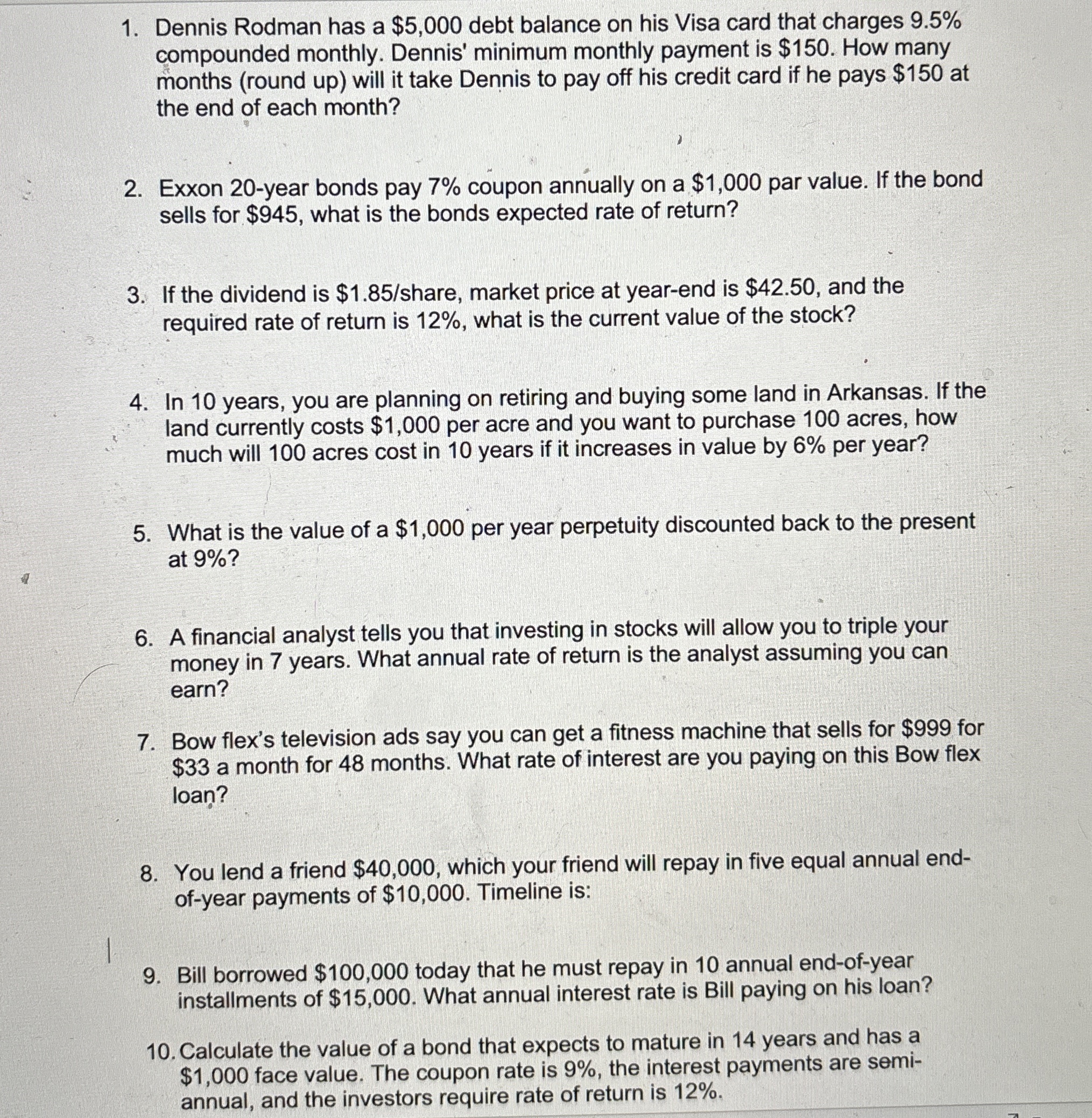

Question: Dennis Rodman has a $ 5 , 0 0 0 debt balance on his Visa card that charges 9 . 5 % compounded monthly. Dennis'

Dennis Rodman has a $ debt balance on his Visa card that charges compounded monthly. Dennis' minimum monthly payment is $ How many months round up will it take Dennis to pay off his credit card if he pays $ at the end of each month?

Exxon year bonds pay coupon annually on a $ par value. If the bond sells for $ what is the bonds expected rate of return?

If the dividend is $share market price at yearend is $ and the required rate of return is what is the current value of the stock?

In years, you are planning on retiring and buying some land in Arkansas. If the land currently costs $ per acre and you want to purchase acres, how much will acres cost in years if it increases in value by per year?

What is the value of a $ per year perpetuity discounted back to the present at

A financial analyst tells you that investing in stocks will allow you to triple your money in years. What annual rate of return is the analyst assuming you can earn?

Bow flex's television ads say you can get a fitness machine that sells for $ for $ a month for months. What rate of interest are you paying on this Bow flex loan?

You lend a friend $ which your friend will repay in five equal annual endofyear payments of $ Timeline is:

Bill borrowed $ today that he must repay in annual endofyear installments of $ What annual interest rate is Bill paying on his loan?

Calculate the value of a bond that expects to mature in years and has a $ face value. The coupon rate is the interest payments are semiannual, and the investors require rate of return is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock