Question: Denny Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. cost $450,000 and would have a ten-year the new

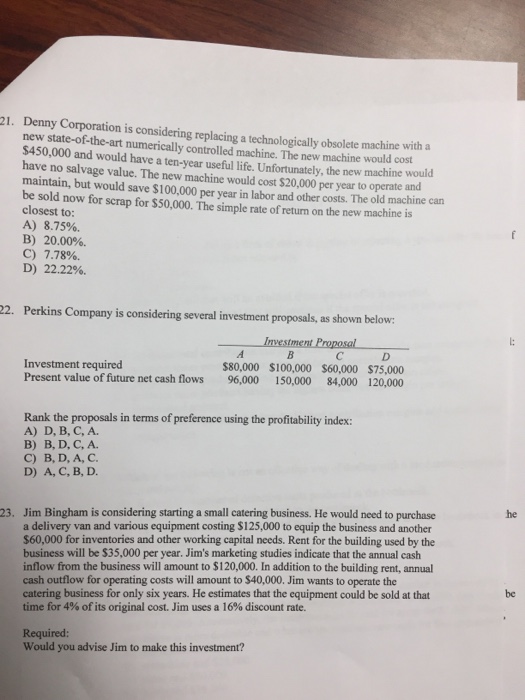

21. Denny Corporation is considering replacing a technologically obsolete machine with a new $450,000 and would have a controlled machine. The new machine would cost have no salvage ten-year useful life. the new machine would value. The new machine would cost $20,000 per year to operate and maintain, but would save $100,000 per year in labor and other costs. The old machine can be sold now for scrap for s50,000. The simple rate of return on the new machine is closest to A) 8.75%. B) 20.00%. C) 7.78%. D) 22.22%. 22. Perkins Company is considering several investment proposals, as shown below: Investment Proposal Investment required $80,000 $100,000 $60,000 $75,000 Present value of future net cash flows 96,000 150,000 84,000 120,000 Rank the proposals in terms of preference using the profitability index: A) D, B, C, A. B) B, D, C, A. C B, D, A, C D) A, C, B, D. 23. Jim Bingham is considering starting a small catering business. He would need to purchase a delivery van and various equipment costing S125,000 to equip the business and another $60,000 for inventories and other working capital needs. Rent for the building used by the business will be S35,000 per year. Jim's marketing studies indicate that the annual cash inflow from the business will amount to $120,000. In addition to the building rent, annual cash outflow for operating costs will amount to S40,000. Jim wants to operate the catering business for only six years. He estimates that the equipment could be sold at that time for 4% of its original cost. Jim uses a 16% discount rate. Required: Would you advise Jim to make this investment? he

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts