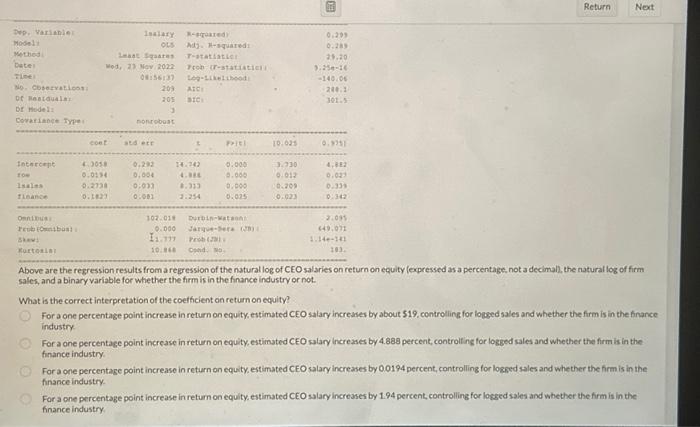

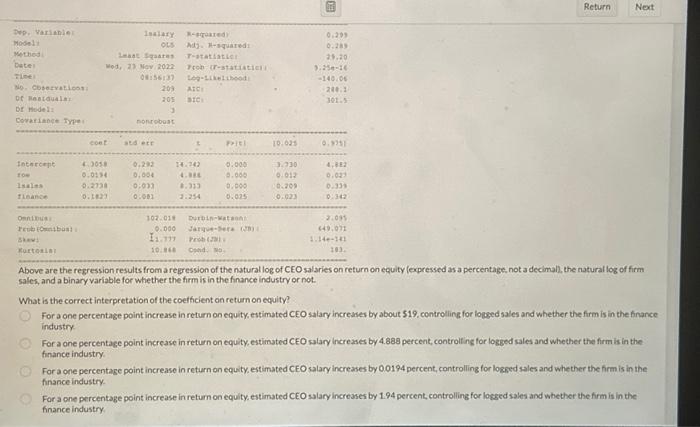

Question: Dep. Variable: Model: Method: Date: Time: No. Observations: Df Residuals: Df Model: Covariance Type: Intercept roe lsales finance Omnibus: Prob (Omnibus): Skew: Kurtosis: lsalary. OLS

Dep. Variable: Model: Method: Date: Time: No. Observations: Df Residuals: Df Model: Covariance Type: Intercept roe lsales finance Omnibus: Prob (Omnibus): Skew: Kurtosis: lsalary. OLS Least Squares Wed, 23 Nov 2022 08:56:37 coef 4.3058 0.0194 0.2738 0.1827 nonrobust std err 209 205 3 0.292 0.004 0.033 0.081 R-squared: Adj. R-squared: F-statistic: Prob (F-statistic): Log-Likelihood: AIC: BIC: 14.742 4.888 8.313 2.254 P>ltl 0.000 0.000 0.000 0.025 102.018 Durbin-Watson: 0.000 Jarque-Bera (JB): 11.777 Prob (JB): Cond. No. 10.868 [0.025 3.730 0.012 0.209 0.023 0.299 0.289 29.20 9.25e-16 -140.06 288.1 301.5 0.975] 4.882 0.027 0.339 0.342 PACOUE 2.095 649.071 1.14e-141 183. Return Next Above are the regression results from a regression of the natural log of CEO salaries on return on equity (expressed as a percentage, not a decimal), the natural log of firm sales, and a binary variable for whether the firm is in the finance industry or not. What is the correct interpretation of the coefficient on return on equity? For a one percentage point increase in return on equity, estimated CEO salary increases by about $19, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 4.888 percent, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 0.0194 percent, controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 1.94 percent, controlling for logged sales and whether the firm is in the finance industry.

Above are the regression results from a regression of the natural log of CEO salaries on return on equity lexpressed as a percentage, not a decimalk, the natural log of firm sales, and a binary variable for whether the firm is in the finance industry or not. What is the correct interpretation of the coefficient on return on equity? For a one percentage point increase in return on equity, estimated CEO salary increases by about 519 , controlling for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 4.888 percent, controlfing for logged sales and whether the firm is in the finance industry. For a one percentage point increase in return on equity, estimated CEO salary increases by 0.0194 percent, controlling for losked sales and whe ther the firm is in ihe finance industry. For a one percentage point increase in return on equily, estimated CEO salaryincreases by 1.94 percent, controlling for logged sales and whether the frrm is in the finance industry