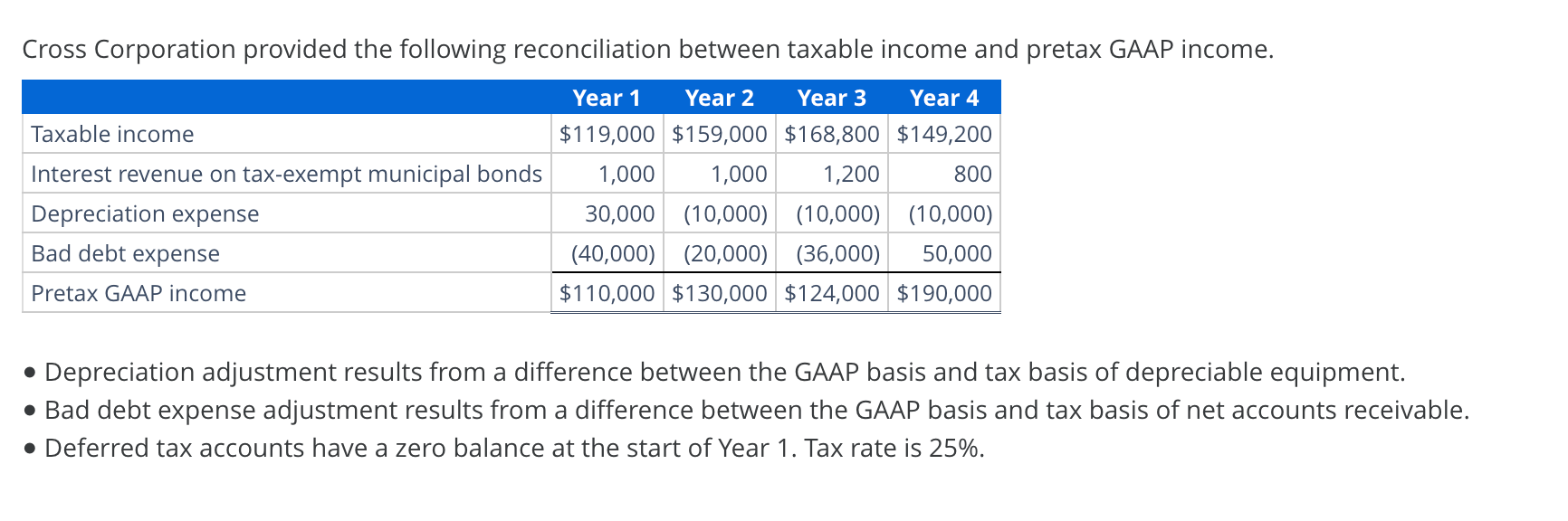

Question: - Depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. - Bad debt expense adjustment results from a

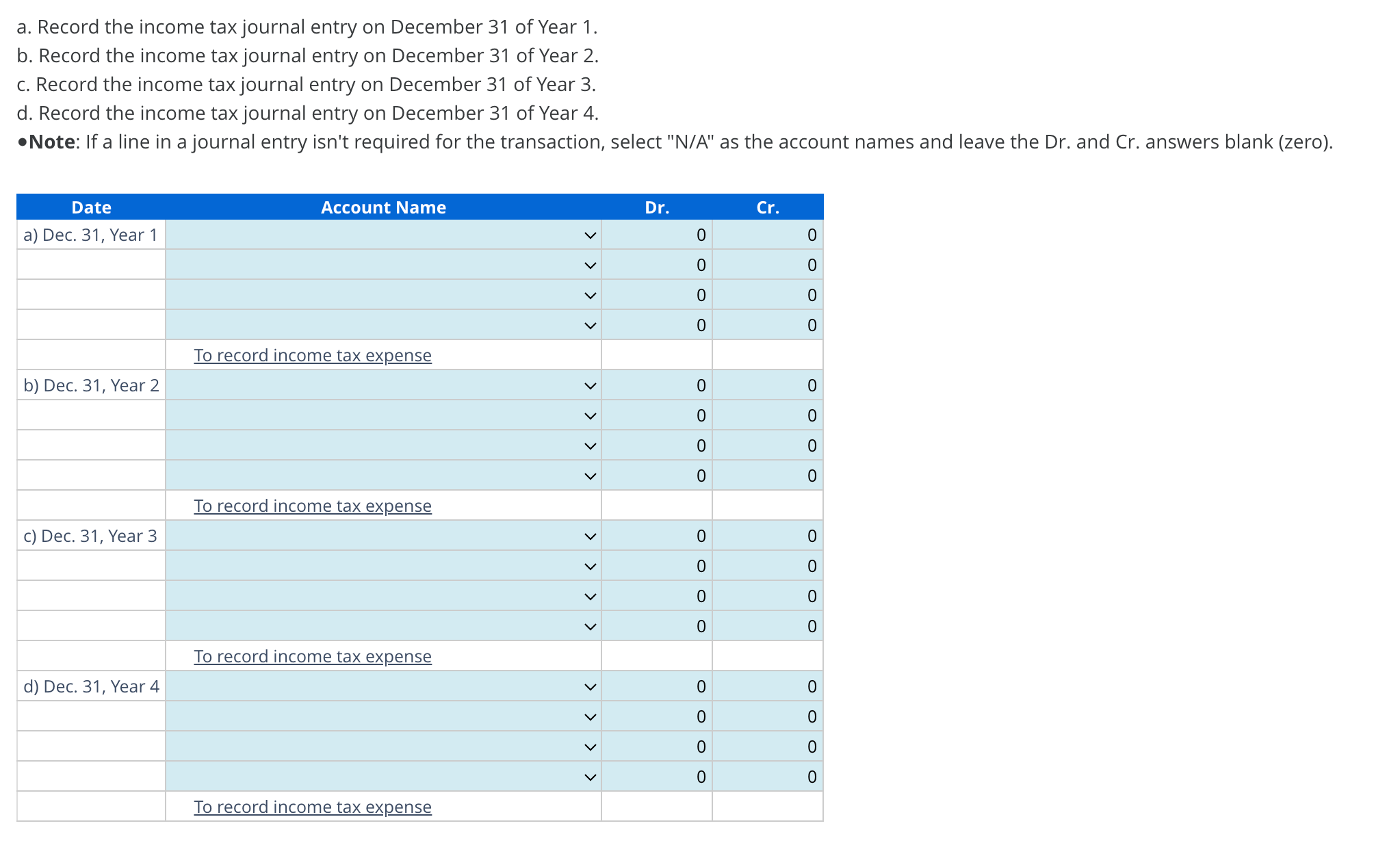

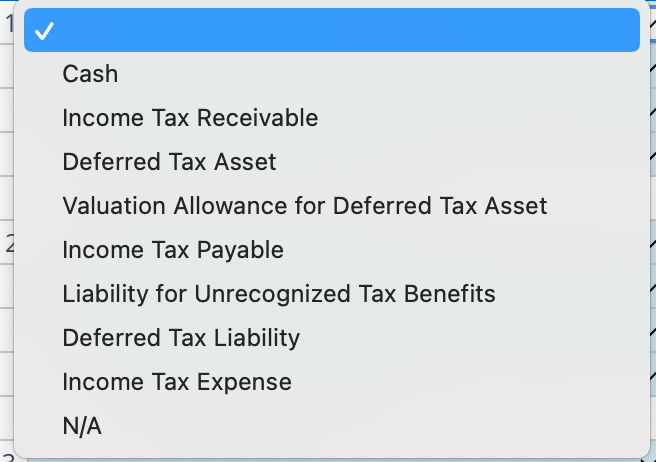

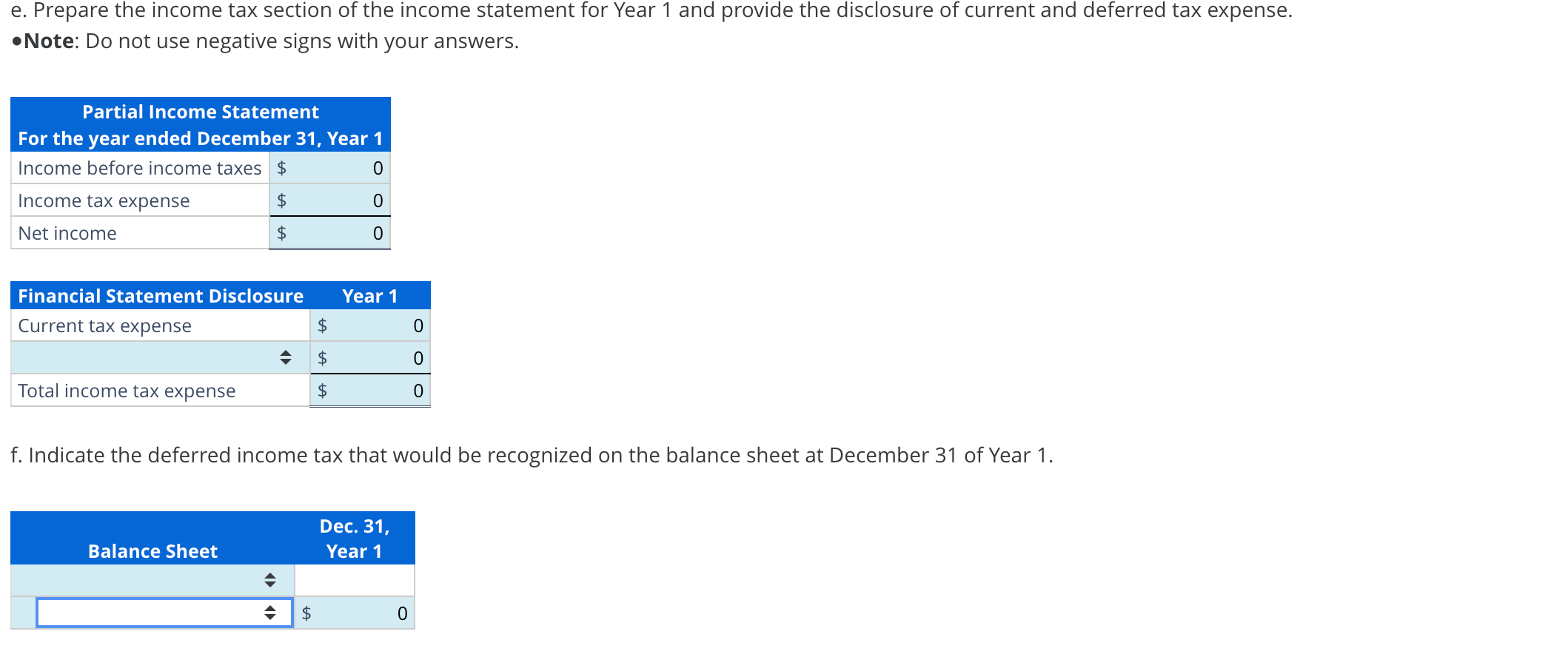

- Depreciation adjustment results from a difference between the GAAP basis and tax basis of depreciable equipment. - Bad debt expense adjustment results from a difference between the GAAP basis and tax basis of net accounts receivable. - Deferred tax accounts have a zero balance at the start of Year 1. Tax rate is 25%. a. Record the income tax journal entry on December 31 of Year 1. b. Record the income tax journal entry on December 31 of Year 2. c. Record the income tax journal entry on December 31 of Year 3. d. Record the income tax journal entry on December 31 of Year 4. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Cash Income Tax Receivable Deferred Tax Asset Valuation Allowance for Deferred Tax Asset Income Tax Payable Liability for Unrecognized Tax Benefits Deferred Tax Liability Income Tax Expense N/A e. Prepare the income tax section of the income statement for Year 1 and provide the disclosure of current and deferred tax expense. - Note: Do not use negative signs with your answers. f. Indicate the deferred income tax that would be recognized on the balance sheet at December 31 of Year 1. Deferred tax asset, net Deferred tax liability, net N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts