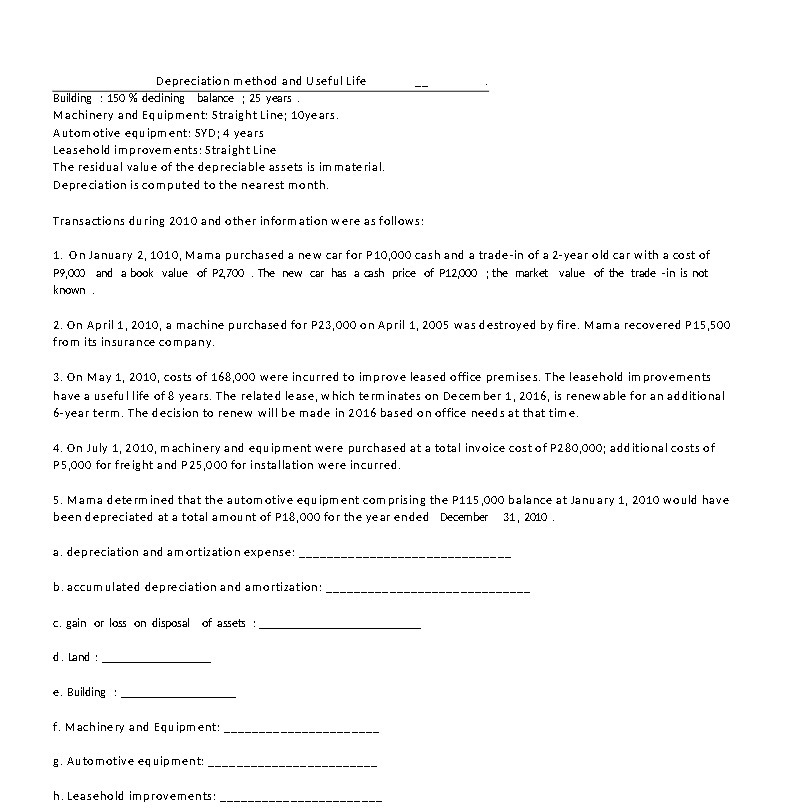

Question: Depreciation method and Useful Life Building : 150 % dedining balance : 25 years Machinery and Equipment: Straight Line; 10years. Automotive equipment: 5YD; 4 years

Depreciation method and Useful Life Building : 150 % dedining balance : 25 years Machinery and Equipment: Straight Line; 10years. Automotive equipment: 5YD; 4 years Leasehold improvements: Straight Line The residual value of the depreciable assets is im material. Depreciation is computed to the nearest month. Transactions during 2010 and other information were as follows: 1. On January 2, 1010, Mama purchased a new car for P10,000 cash and a trade-in of a 2-year old car with a cost of 39000 and a book value of P2700 . The new car has a cash price of P12000 ; the market value of the trade -in is not known . 2. On April 1, 2010, a machine purchased for P23,090 on April 1, 2005 was destroyed by fire. Mama recovered P15,500 from its insurance company. 3. On May 1, 2010, costs of 168,000 were incurred to improve leased office premises. The leasehold improvements have a useful life of & years. The related lease, which terminates on December 1, 2016, is renewable for an additional 6-year term. The decision to renew will be made in 2016 based on office needs at that time. 4. On July 1, 2010, machinery and equipment were purchased at a total invoice cost of P280,000; additional costs of P5,000 for freight and P25,000 for installation were incurred. 5. Mama determined that the automotive equipment comprising the P115,000 balance at January 1, 2010 would have been depreciated at a total amount of P18,000 for the year ended December 31, 2010 a. depreciation and amortization expense: b. accumulated depreciation and amortization: _ c. gain or loss on disposal of assets d. Land : e. Building : f. Machinery and Equipment: E. Automotive equipment: h. Leasehold improvements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts