Question: How to answer this question? N 0 P Q R S U XYZ Trucking Limited is a haulage contractor, At 1 May 2018 the company

How to answer this question?

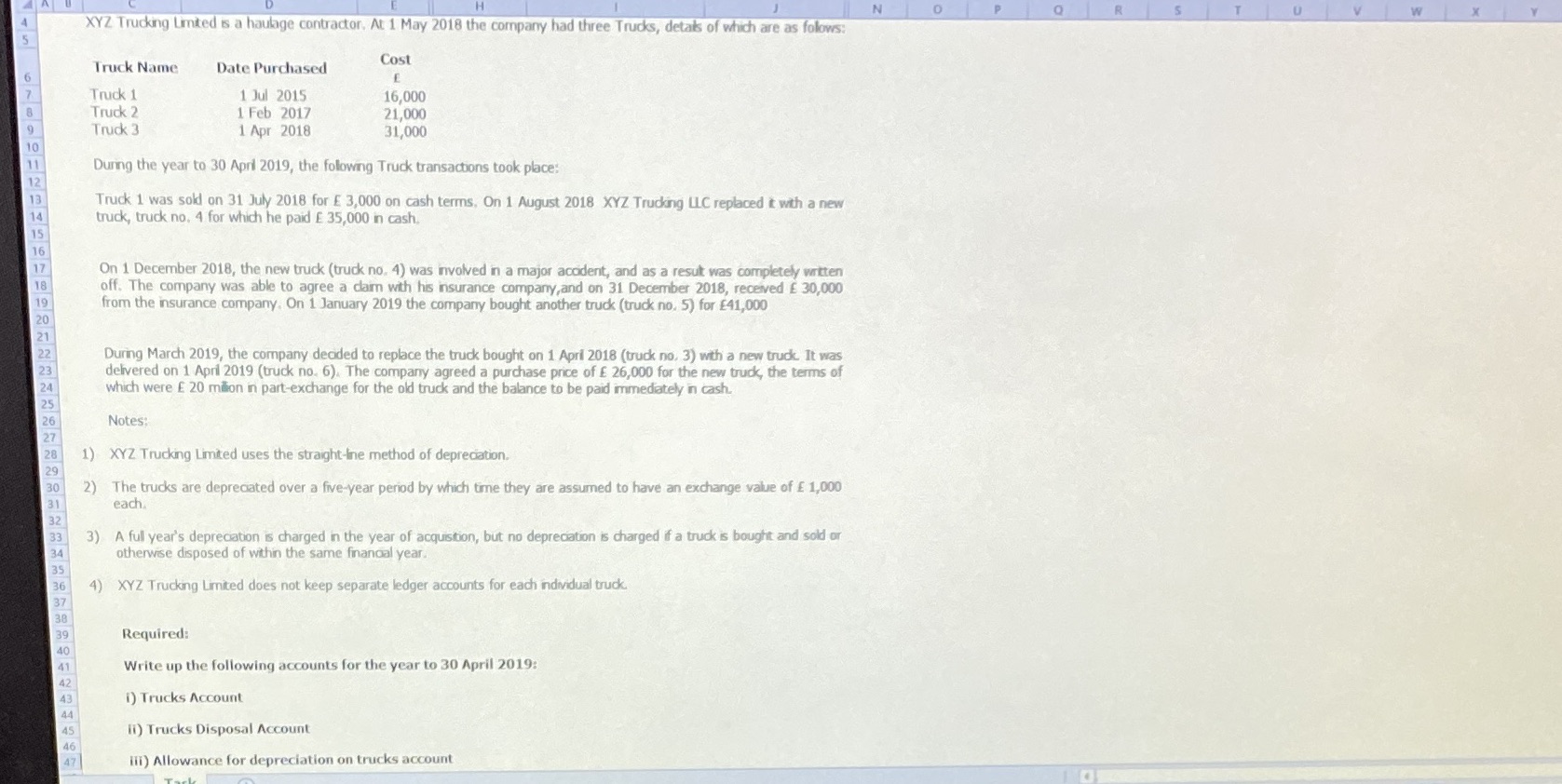

N 0 P Q R S U XYZ Trucking Limited is a haulage contractor, At 1 May 2018 the company had three Trucks, details of which are as folows: Truck Name Date Purchased Cost E Truck 1 1 Jul 2015 16,000 Truck 2 1 Feb 2017 21,000 Truck 3 1 Apr 2018 31,000 During the year to 30 April 2019, the following Truck transactions took place: Truck 1 was sold on 31 July 2018 for E 3,000 on cash terms. On 1 August 2018 XYZ Trucking LLC replaced it with a new truck, truck no. 4 for which he paid E 35,000 in cash. On 1 December 2018, the new truck (truck no. 4) was involved in a major accident, and as a result was completely written off. The company was able to agree a claim with his insurance company, and on 31 December 2018, received E 30,000 from the insurance company. On 1 January 2019 the company bought another truck (truck no. 5) for E41,000 During March 2019, the company decided to replace the truck bought on 1 April 2018 (truck no, 3) with a new truck. It was delivered on 1 April 2019 (truck no. 6). The company agreed a purchase price of E 26,000 for the new truck, the terms of 24 which were E 20 million in part-exchange for the old truck and the balance to be paid immediately in cash. 25 26 Notes: 27 28 XYZ Trucking Limited uses the straight-ine method of depreciation. 29 30 2) The trucks are depreciated over a five-year period by which time they are assumed to have an exchange value of E 1,000 each. 32 3) A full year's depreciation is charged in the year of acquisition, but no depreciation is charged if a truck is bought and sold or otherwise disposed of within the same financial year. 4) XYZ Trucking Limited does not keep separate ledger accounts for each individual truck. Required: 40 41 Write up the following accounts for the year to 30 April 2019: 42 43 1) Trucks Account 44 45 1) Trucks Disposal Account 46 47 ill) Allowance for depreciation on trucks account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts