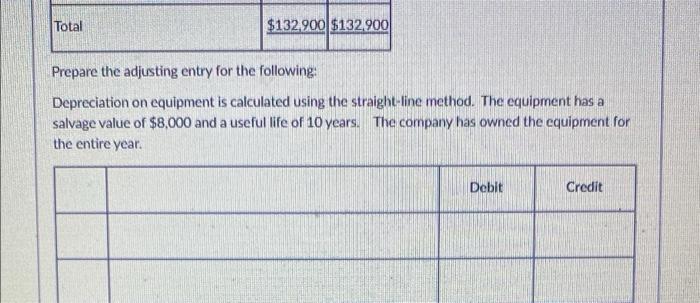

Question: depreciation on equipment is calculated using the straight line method. The equipment has a salvage life of $8000 and a useful life of 10 years.

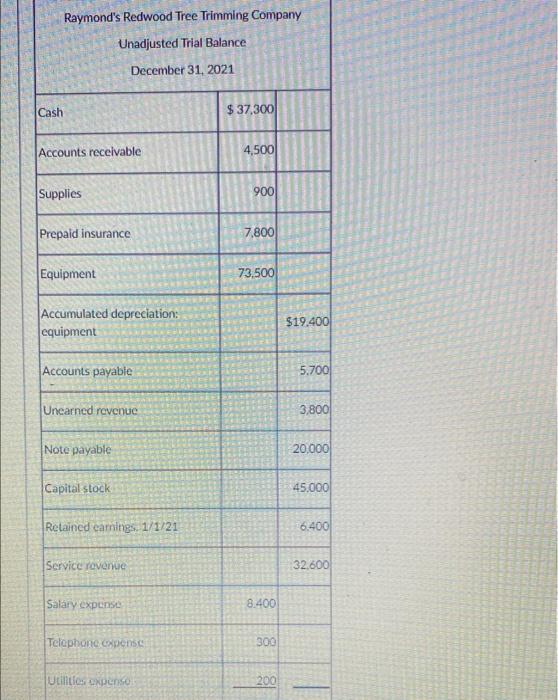

Raymond's Redwood Tree Trimming Company Unadjusted Trial Balance December 31, 2021 Cash Accounts receivable. Supplies Prepaid insurance Equipment Accumulated depreciation: equipment Accounts payable Unearned revenue Note payable Capital stock Retained earnings. 1/1/21 Service revenue Salary expense Telephone expense Utilities expense $37,300 4,500 900 7,800 73,500 8.400 300 200 $19.400 5.700 3,800 20,000 45.000 6.400 32,600 Total $132.900 $132.900 Prepare the adjusting entry for the following: Depreciation on equipment is calculated using the straight-line method. The equipment has a salvage value of $8,000 and a useful life of 10 years. The company has owned the equipment for the entire year. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts