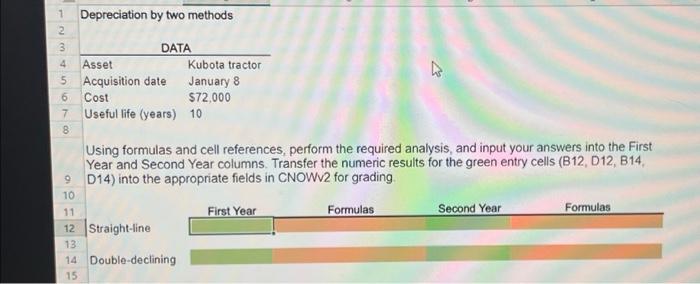

Question: Depreciotion try two metheds Depreciation by two methods Using formulas and cell references, perform the required analysis, and input your answers into the First Year

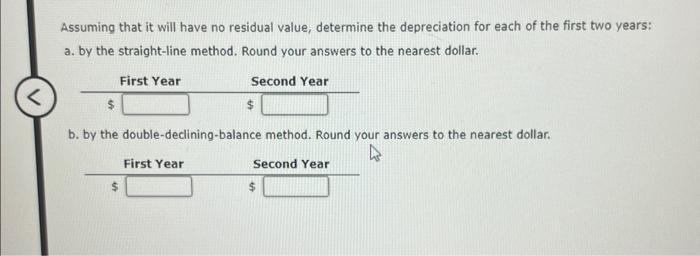

Depreciotion try two metheds Depreciation by two methods Using formulas and cell references, perform the required analysis, and input your answers into the First Year and Second Year columns. Transfer the numeric results for the green entry cells (B12, D12, B14. D14) into the appropriate fields in CNOWv2 for grading Assuming that it will have no residual value, determine the depreciation for each of the first two years: a. by the straight-line method. Round your answers to the nearest dollar. b. by the double-declining-balance method. Round your answers to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts