Question: Question1 Prepare the acquisition analysis Question2 Prepare the journal entries in red Ltd to record the acquisition at 1 July 2020 (A) Red Ltd acquired

Question1 Prepare the acquisition analysis

Question2 Prepare the journal entries in red Ltd to record the acquisition at 1 July 2020

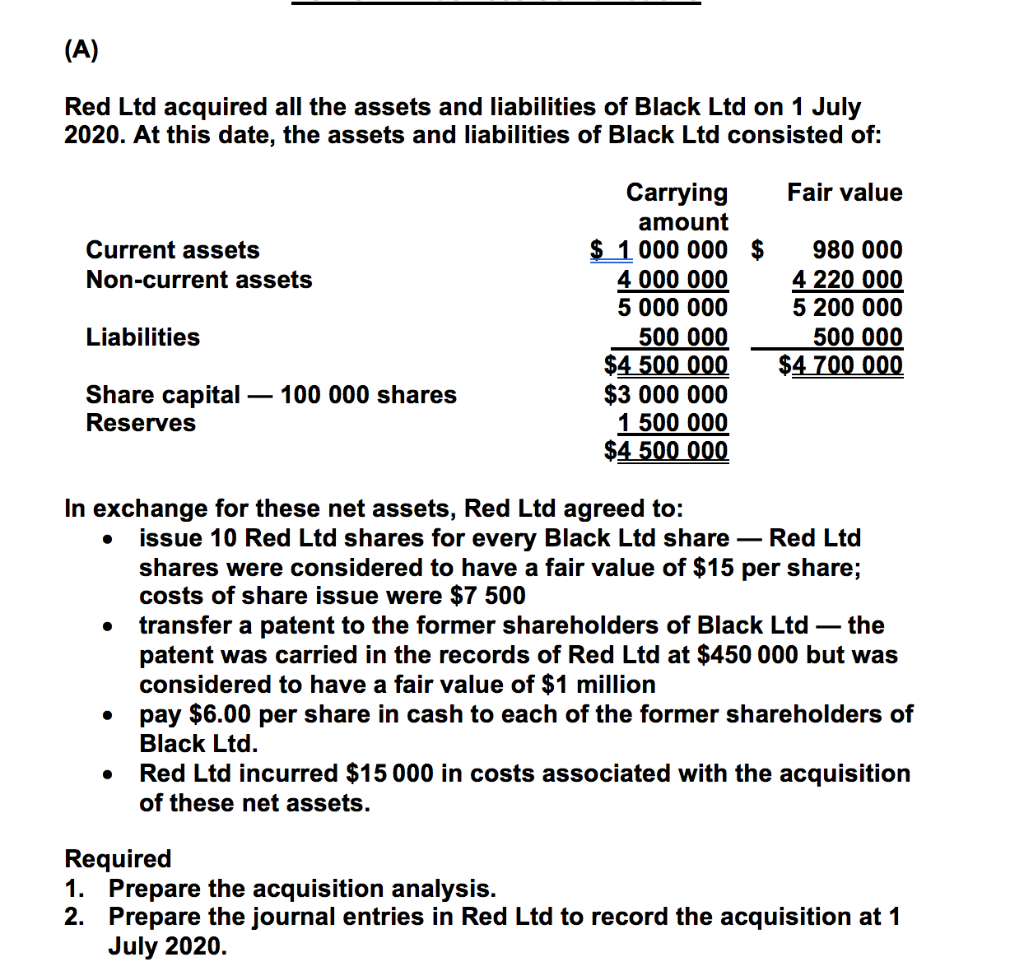

(A) Red Ltd acquired all the assets and liabilities of Black Ltd on 1 July 2020. At this date, the assets and liabilities of Black Ltd consisted of: Fair value Current assets Non-current assets Carrying amount $ 1 000 000 $ 4 000 000 5 000 000 500 000 $4 500 000 $3 000 000 1 500 000 $4 500 000 980 000 4 220 000 5 200 000 500 000 $4 700 000 Liabilities Share capital 100 000 shares Reserves In exchange for these net assets, Red Ltd agreed to: issue 10 Red Ltd shares for every Black Ltd share Red Ltd shares were considered to have a fair value of $15 per share; costs of share issue were $7 500 transfer a patent to the former shareholders of Black Ltd the patent was carried in the records of Red Ltd at $450 000 but was considered to have a fair value of $1 million pay $6.00 per share in cash to each of the former shareholders of Black Ltd. Red Ltd incurred $15 000 in costs associated with the acquisition of these net assets. Required 1. Prepare the acquisition analysis. 2. Prepare the journal entries in Red Ltd to record the acquisition at 1 July 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts