Question: Der Fliegende Dackel AG ( Aktiengesellschaft ) , an express dog food delivery service based in Frankfurt an der Oder, is considering changing its capital

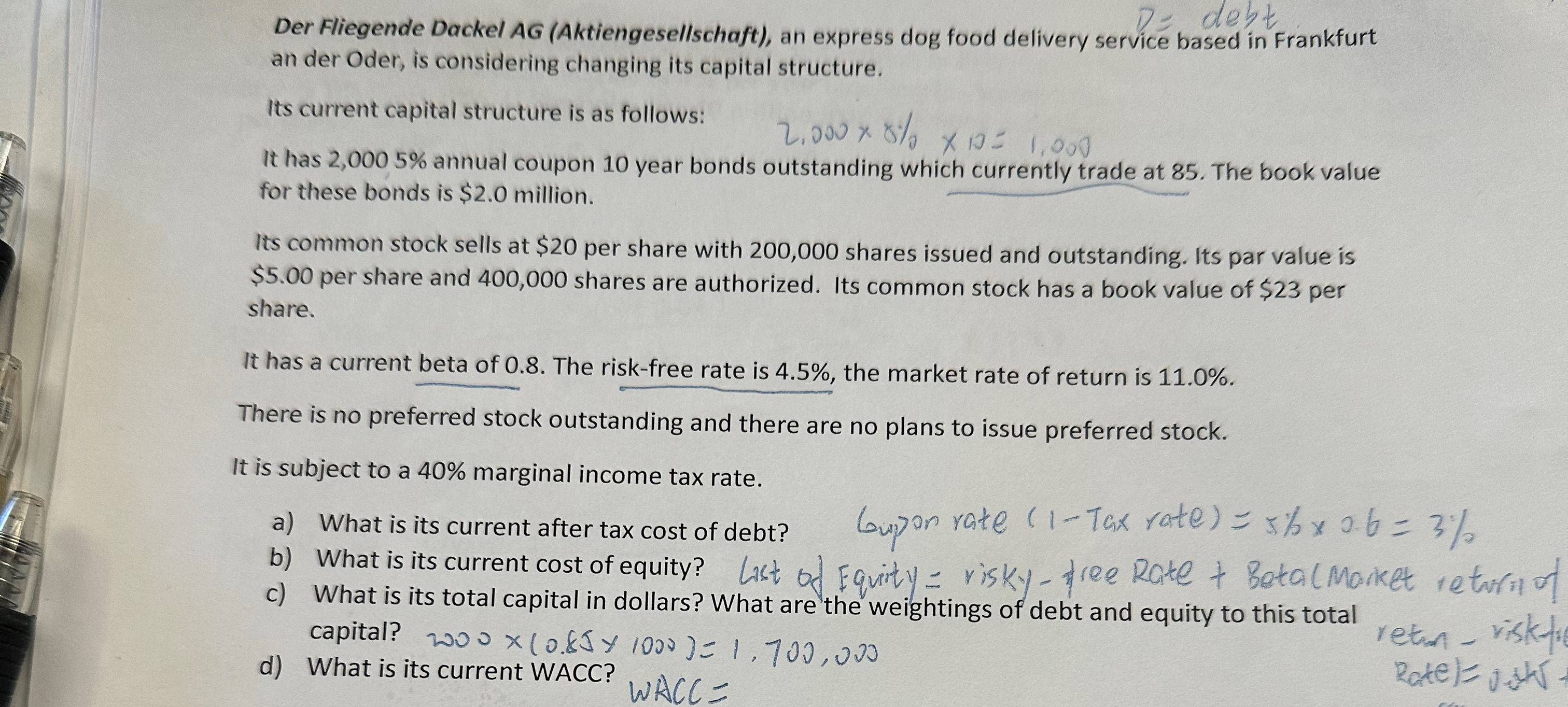

Der Fliegende Dackel AG Aktiengesellschaft an express dog food delivery service based in Frankfurt an der Oder, is considering changing its capital structure.

Its current capital structure is as follows:

It has annual coupon year bonds outstanding which currently trade at The book value for these bonds is $ million.

Its common stock sells at $ per share with shares issued and outstanding. Its par value is $ per share and shares are authorized. Its common stock has a book value of $ per share.

It has a current beta of The riskfree rate is the market rate of return is

There is no preferred stock outstanding and there are no plans to issue preferred stock.

It is subject to a marginal income tax rate.

a What is its current after tax cost of debt?

Gipon rate Tax rate

b What is its current cost of equity? List of Equity visky ree Rate BetalMarket retarn of

c What is its total capital in dollars? What are the weightings of debt and equity to this total capital? y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock